iPower (IPW) Posts Wider-Than-Expected Q4 Loss, Sales Beat

iPower Inc. IPW reported fourth-quarter fiscal 2023 results, wherein the top line beat the Zacks Consensus Estimate and increased year over year. However, the company reported a wider-than-expected loss.

iPower Inc. Price, Consensus and EPS Surprise

iPower Inc. price-consensus-eps-surprise-chart | iPower Inc. Quote

Quarter in Details

iPower posted a loss of 10 cents per share in the fiscal fourth quarter, wider than the Zacks Consensus Estimate of a loss of 3 cents per share and the loss of 5 cents per share reported in the year-ago period.

Net sales were $23.4 million, up 6% year over year. Also, the top line beat the Zacks Consensus Estimate of $22 million. This increase was attributed to greater product sales to the company’s largest channel partner and strong demand for iPower’s non-hydroponic product portfolio.

Gross profit of $9.1 million was flat with the year-ago quarter. Also, the gross margin contracted 250 basis points to 38.7% from the prior-year period. The decline in the gross margin mainly resulted from the increased cost of goods sold tied to inventory that had previously experienced elevated freight charges, along with normal variations in the product and channel mix.

Operating expenses increased 13.2% to $12 million in the fourth quarter of fiscal 2023. Also, the operating margin increased 330 basis points from the prior-year period to 51.3%. The rise in operating margin was partly due to increased expenses associated with selling, fulfillment and marketing, which were incurred in conjunction with the sale of inventory built up in the prior quarters.

Image Source: Zacks Investment Research

Other Financial Details

iPower ended the quarter with cash and cash equivalents of $3.7 million. As of Jun 30, 2023, net debt was down 43% to $8.1 million from $14.2 million as of Jun 30, 2022. Total stockholders' equity was $20.9 million at the end of the quarter under review.

Outlook

Fiscal 2023 was the third straight year when iPower registered double-digit revenue growth, owing to stellar and consistent demand for its in-house products, which constituted more than 90% of the total revenues. Additionally, iPower continued to diversify its product offerings beyond hydroponics, with non-hydroponic products making up more than 75% of sales in fiscal 2023.

Throughout the past year, management focused on addressing the challenge of high-cost inventory build-up from previous periods, which had been hurting the gross margin lately. Encouragingly, the company has successfully reduced excess inventory levels and foresees a gross margin improvement in fiscal 2024. With a more streamlined and efficient supply chain, normalized inventory levels, and sustained demand for products, the company remains confident in attaining growth and profitability goals.

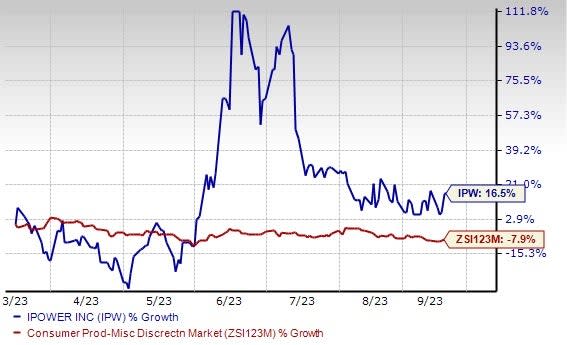

Shares of this Zacks Rank #3 (Hold) company have railed 16.5% in the past six months against the industry's decline of 7.9%.

Stocks to Consider

Below, we have highlighted three better-ranked stocks, namely Sprouts Farmers Market, Inc. SFM, Walmart Inc. WMT and Ross Stores Inc. ROST.

Sprouts Farmers Market operates in a highly fragmented grocery store industry. SFM currently has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

The company has an expected EPS growth rate of 9.3% for three to five years. The Zacks Consensus Estimate for Sprouts Farmers Market’s 2023 earnings and sales indicates growth of 14.6% and 5.7%, respectively, from the previous year’s reported figures. SFM has a trailing four-quarter average earnings surprise of 14.3%.

Walmart has evolved from being a traditional brick-and-mortar retailer into an omnichannel player. WMT presently carries a Zacks Rank #2. It has an expected EPS growth rate of 6.6% for three to five years.

The Zacks Consensus Estimate for Walmart’s fiscal 2023 earnings and sales indicates growth of 2.2% and 9.2%, respectively, from the previous year’s reported figures. WMT has a trailing four-quarter average earnings surprise of 11.6%.

Ross Stores operates as an off-price retailer of apparel and home accessories. ROST currently carries a Zacks Rank #2. It has an expected EPS growth rate of 11.6% for three to five years.

The Zacks Consensus Estimate for Ross Stores’ fiscal 2023 earnings and sales indicates growth of 19.4% and 8.1%, respectively, from the previous year’s reported figures. ROST has a trailing four-quarter average earnings surprise of 11.4%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Walmart Inc. (WMT) : Free Stock Analysis Report

Ross Stores, Inc. (ROST) : Free Stock Analysis Report

Sprouts Farmers Market, Inc. (SFM) : Free Stock Analysis Report

iPower Inc. (IPW) : Free Stock Analysis Report