IQVIA Holdings Inc (IQV) Posts Strong Year-Over-Year Growth in Q4 and Full-Year 2023 Earnings

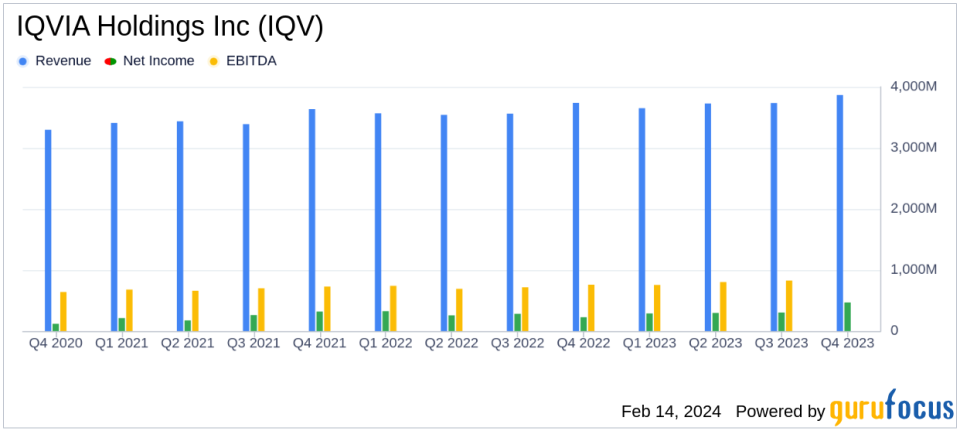

Revenue: Q4 revenue of $3,868 million and full-year revenue of $14,984 million.

Net Income: GAAP Net Income of $469 million in Q4, a 106.6% increase year-over-year.

Earnings Per Share: GAAP Diluted EPS of $2.54 for Q4, reflecting a 111.7% increase year-over-year.

Adjusted EBITDA: $966 million for Q4, marking a 5.0% increase from the previous year.

R&D Solutions: Bookings of over $2.8 billion in Q4 with a book-to-bill ratio of 1.31x.

2024 Guidance: Revenue projected to be between $15,400 million and $15,650 million.

Share Repurchase: $229 million of common stock repurchased in Q4, totaling $992 million for the year.

On February 14, 2024, IQVIA Holdings Inc (NYSE:IQV), a leading global provider of advanced analytics, technology solutions, and clinical research services to the life sciences industry, announced its financial results for the fourth quarter and full year of 2023. The company released its 8-K filing, showcasing a strong performance despite a challenging macroeconomic environment.

IQVIA, which emerged from the 2016 merger of Quintiles and IMS Health, operates primarily through its Research & Development segment, offering outsourced clinical trials and a technology and analytics segment that provides healthcare data and analytics services. The company also maintains a smaller contract sales business.

Financial Performance and Challenges

IQVIA reported a revenue increase of 3.5% to $3,868 million for Q4 and a 4.0% increase to $14,984 million for the full year, compared to the previous year. The R&D Solutions segment showed robust growth with a 9.2% year-over-year increase in contracted backlog, now standing at $29.7 billion. This growth is significant as it indicates a strong demand for IQVIA's services in the life sciences sector, which is critical for the company's long-term sustainability.

Despite the positive revenue trends, the company faced challenges, including client caution and lower spending levels in the Technology & Analytics Solutions (TAS) segment. However, the R&D Solutions segment continued to exhibit strong clinical demand with a book-to-bill ratio of 1.31x for the quarter.

Financial Achievements and Importance

IQVIA's financial achievements, including a significant increase in GAAP Net Income and Diluted Earnings per Share, underscore the company's ability to capitalize on its market position and operational efficiency. The impressive growth in net income, which more than doubled to $469 million in Q4, highlights the company's profitability and ability to generate shareholder value.

Adjusted EBITDA, a key metric for evaluating a company's operating performance, rose to $966 million for the quarter, a 5.0% increase year-over-year. This growth in profitability is particularly important for IQVIA as it continues to invest in technology and expand its global footprint in the competitive Medical Diagnostics & Research industry.

Financial Position and Outlook

As of December 31, 2023, IQVIA reported a strong financial position with cash and cash equivalents of $1,376 million and a net debt of $12,297 million. The company's Net Leverage Ratio was 3.45x trailing twelve-month Adjusted EBITDA. The company also demonstrated strong cash flow management with an Operating Cash Flow of $747 million and Free Cash Flow of $568 million for Q4.

For the full year of 2024, IQVIA anticipates revenue to be between $15,400 million and $15,650 million, with Adjusted EBITDA expected to be between $3,700 million and $3,800 million, and Adjusted Diluted Earnings per Share projected to be between $10.95 and $11.25.

Chairman and CEO Ari Bousbib commented on the results, stating,

The IQVIA team delivered solid 2023 results in a challenging macro environment,"

and expressed confidence in the company's fundamentals and market outlook.

IQVIA's performance reflects its resilience and strategic positioning in the life sciences industry, offering valuable insights for investors and stakeholders. The company's ability to navigate a complex global market while delivering growth and profitability makes it a noteworthy entity for value investors and potential GuruFocus.com members.

For more detailed financial information and the full earnings report, please refer to IQVIA's 8-K filing.

Contacts for further information include IQVIA Investor Relations, Nick Childs (nicholas.childs@iqvia.com), +1.973.316.3828.

Explore the complete 8-K earnings release (here) from IQVIA Holdings Inc for further details.

This article first appeared on GuruFocus.