IQVIA Holdings (IQV): A Modestly Undervalued Gem?

IQVIA Holdings Inc (NYSE:IQV) experienced a minor loss of -1.32% in its daily trading, with a 3-month loss of -0.61%. Despite these setbacks, the company maintains a robust Earnings Per Share (EPS) (EPS) of 5.81. But the question remains: Is IQVIA Holdings modestly undervalued? Through a comprehensive valuation analysis, this article aims to answer that question.

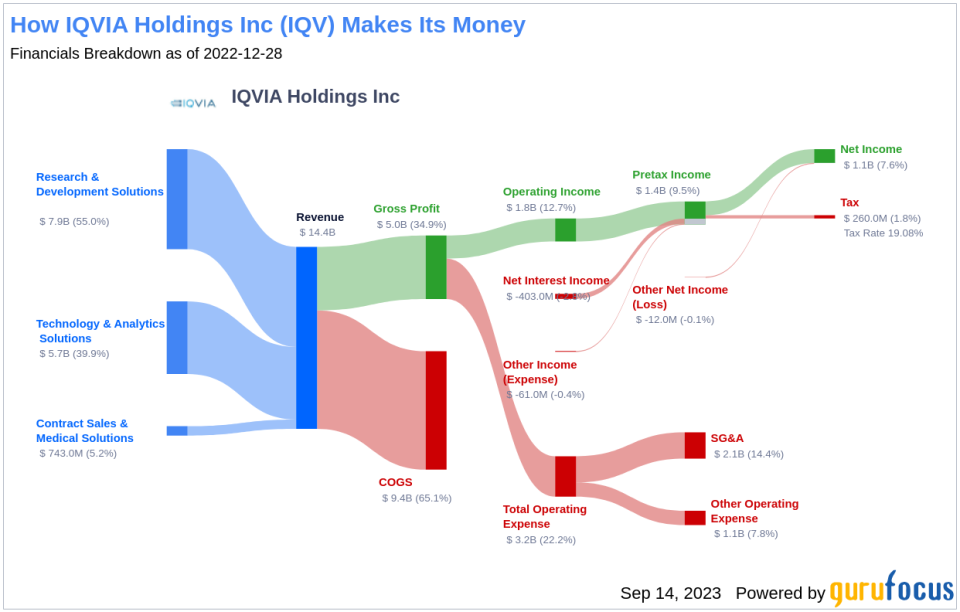

Company Overview

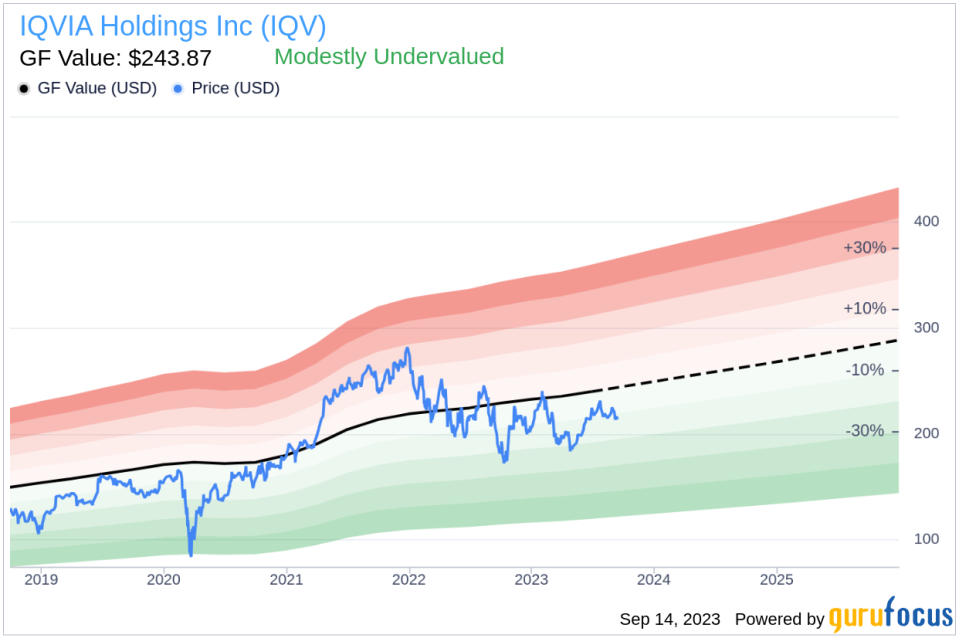

IQVIA Holdings is a global leader in healthcare data and analytics, offering outsourced late-stage clinical trials and technology services to the healthcare industry. The company's current stock price is $213.75, and with a market cap of $39.10 billion, it stands as a significant player in the industry. The GuruFocus Value, an estimate of the stock's fair value, stands at $243.87, indicating that the stock might be modestly undervalued.

Understanding the GF Value

The GF Value is a proprietary measure that calculates the intrinsic value of a stock. It takes into account historical trading multiples, a GuruFocus adjustment factor based on past performance and growth, and future business performance estimates. If the stock price is significantly above the GF Value Line, it is overvalued, and its future return is likely to be poor. Conversely, if it is significantly below the GF Value Line, its future return will likely be higher.

At its current price of $213.75 per share, IQVIA Holdings has a market cap of $39.10 billion. Based on the GuruFocus Value calculation, the stock is believed to be modestly undervalued. As a result, the long-term return of its stock is likely to be higher than its business growth.

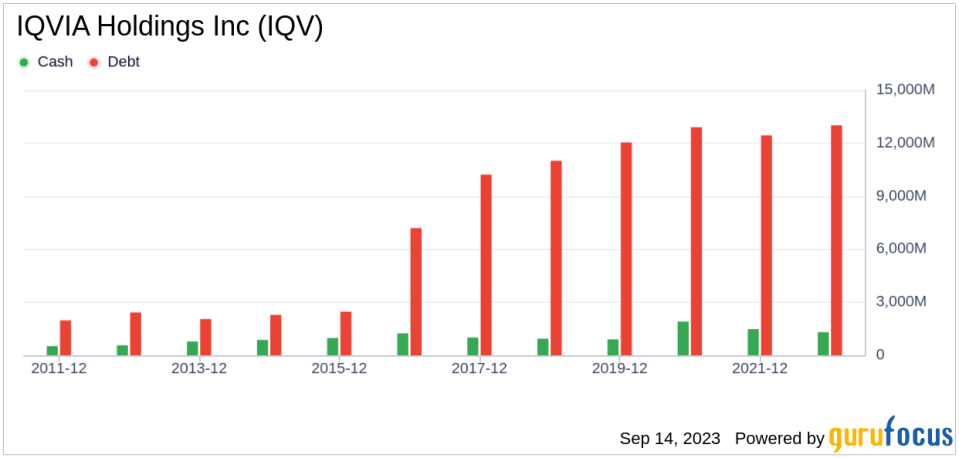

Financial Strength Analysis

Checking the financial strength of a company before investing is crucial to avoid the risk of permanent loss. IQVIA Holdings has a cash-to-debt ratio of 0.11, which is lower than 88.65% of 229 companies in the Medical Diagnostics & Research industry. This indicates that the financial strength of IQVIA Holdings is relatively poor.

Profitability and Growth

Investing in profitable companies carries less risk. IQVIA Holdings has been profitable 10 years over the past 10 years, with revenues of $14.70 billion and an EPS of $5.81 in the past 12 months. Its operating margin of 12.94% is better than 72.57% of 226 companies in the Medical Diagnostics & Research industry, indicating strong profitability.

Company growth also plays a significant role in its valuation. IQVIA Holdings has an average annual revenue growth of 10.8%, ranking better than 50.73% of 205 companies in the industry. Its 3-year average EBITDA growth is 15%, ranking better than 55.26% of 190 companies in the industry.

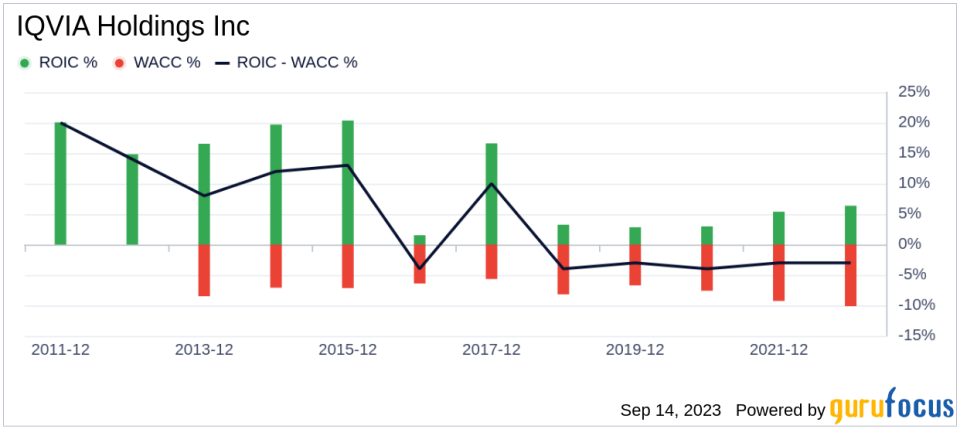

ROIC vs WACC

Another way to evaluate a company's profitability is to compare its return on invested capital (ROIC) to its weighted cost of capital (WACC). IQVIA Holdings's ROIC was 6.67, while its WACC came in at 9.68 over the past 12 months. This comparison can be seen in the image below:

Conclusion

In conclusion, the stock of IQVIA Holdings is believed to be modestly undervalued. Despite its poor financial strength, its profitability is strong, and its growth ranks better than 55.26% of 190 companies in the Medical Diagnostics & Research industry. To learn more about IQVIA Holdings stock, you can check out its 30-Year Financials here.

To find out the high-quality companies that may deliver above-average returns, please check out the GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.