IQVIA Holdings' (IQV) Q2 Earnings Beat Estimates, Decline Y/Y

IQVIA Holdings Inc. IQV reported solid second-quarter 2023 results, wherein earnings and revenues surpassed the Zacks Consensus Estimate.

Adjusted earnings per share (excluding 84 cents from non-recurring items) of $2.43 beat the Zacks Consensus Estimate by 2.5% but declined marginally on a year-over-year basis. Total revenues of $3,728 million also outpaced the Zacks Consensus Estimate marginally. The top line increased 5.3% year over year on a reported basis and 5.5% on a constant-currency basis.

Segmental Revenues

Revenues from Technology & Analytics Solutions amounted to $1,456 million. The metric rose 3.4% on both reported basis and at constant currency.

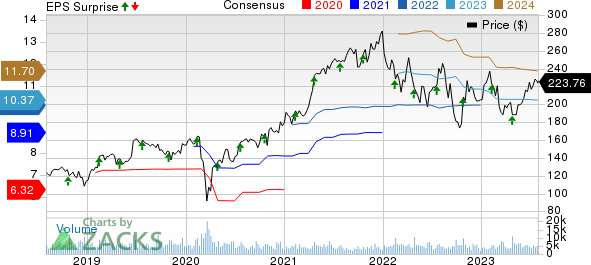

IQVIA Holdings Inc. Price, Consensus and EPS Surprise

IQVIA Holdings Inc. price-consensus-eps-surprise-chart | IQVIA Holdings Inc. Quote

Research & Development Solutions’ revenues of $2,096 million increased 7.5% on a reported basis and 7.6% on a constant-currency basis.

Revenues from Contract Sales & Medical Solutions totaled $176 million, down 3.8% on a reported basis and was flat at constant currency.

Operating Performance

Adjusted EBITDA was $864 million, up 8% year over year.

Balance Sheet and Cash Flow

IQVIA exited second-quarter 2023 with cash and cash equivalents of $1,382 million compared with $1,494 million at the end of the prior quarter. Long-term debt (less current portion) was $11,833 million compared with $12,433 million at the prior-quarter end.

IQV generated $402 million of cash from operating activities in the reported quarter while capital expenditure was $160 million. Free cash flow was $242 million.

In the second quarter of 2023, IQV repurchased shares worth $490 million. As of Jun 30, 2023, IQVIA had $736 million of share repurchase authorization available.

Q3 Guidance

For the third quarter of 2023, IQV expects revenues to be between $3,760 million and $3,810 million, indicating growth of 5.6-7.0% on a reported basis and 3.9-5.3% at constant currency. The Zacks Consensus Estimate is pegged at $3.70 billion, lower than management’s expectation.

IQV anticipates adjusted EBITDA in the range of $880-$895 million, suggesting a rise of 8.1-10.0%.

Adjusted earnings per share are expected to be between $2.39 and $2.49, implying a decline of 3.6% to an improvement of 0.4% on a reported basis. The Zacks Consensus Estimate is pegged at $2.37, lower than the company’s anticipation.

2023 Guidance

IQVIA expects revenues to be between $15,050 million and $15,175 million (prior view: $15.15 billion and $15.40 billion), hinting at a jump of 4.4-5.3% on a reported basis and 4.1-5% at constant currency (earlier guidance: 5.1-6.9% on a reported basis and 4.7-6.5% at constant currency). The Zacks Consensus Estimate is pegged at $15.24 billion, higher than the company’s projection.

Adjusted earnings per share are estimated to be between $10.2 and $10.45 (up 0.4-2.9%) (prior view: $10.26 and $10.56). The midpoint of the updated guidance ($10.325) is below the Zacks Consensus Estimate of $10.37.

Adjusted EBITDA is anticipated to be between $3.6 billion and $3.635 billion (prior view: $3.625 billion and $3.695 billion).

Currently, IQVIA carries a Zacks Rank #4 (Sell). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Earnings Snapshot

Interpublic Group of Companies IPG second-quarter 2023 earnings surpassed the Zacks Consensus Estimate while revenues missed. Adjusted earnings (considering 6 cents from non-recurring items) of 74 cents per share beat the consensus estimate by 23.3%. The bottom line declined 17.5% on a year-over-year basis.

Net revenues of $2.33 billion missed the consensus estimate by 2.9% and decreased 14.9% on a year-over-year basis. Total revenues of $2.67 billion decreased 2.6% year over year.

Equifax EFX reported mixed second-quarter 2023 results, wherein earnings beat the Zacks Consensus Estimate but revenues lagged. Adjusted earnings (excluding 59 cents from non-recurring items) of $1.71 per share outpaced the consensus mark by 2.4%. The bottom line dipped 18.2% from the year-ago figure.

Total revenues of $1.32 billion fell short of the consensus estimate by 0.4% while matching the year-ago figure on a reported basis. The top line gained 1% on a local-currency basis.

ManpowerGroup MAN reported lower-than-expected second-quarter 2023 results. Adjusted earnings of $1.58 per share lagged the Zacks Consensus Estimate by 1.9% and plunged 32.2% year over year owing to restructuring costs and Argentina-related non-cash currency translation losses.

Revenues of $4.9 billion missed the consensus mark by 0.6% and decreased 4.3% year over year on a reported basis. The top line fell 3% on a constant-currency basis.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ManpowerGroup Inc. (MAN) : Free Stock Analysis Report

Interpublic Group of Companies, Inc. (The) (IPG) : Free Stock Analysis Report

Equifax, Inc. (EFX) : Free Stock Analysis Report

IQVIA Holdings Inc. (IQV) : Free Stock Analysis Report