IQVIA (IQV) Climbs 17% in 3 Months: Here's What to Know

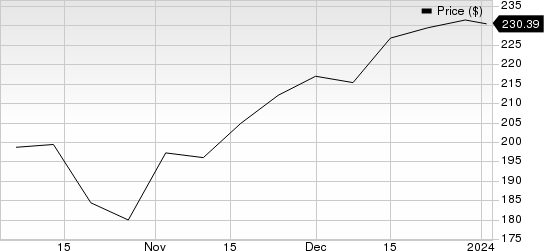

IQVIA Holdings Inc.’s IQV shares have had an impressive run in the past three months. The stock has gained 17.3%, outperforming the 11.2% growth of the Zacks S&P 500 composite.

IQV posted better-than-expected earnings performance in the past four quarters, driven by revenue growth and disciplined cost management. Its earnings surpassed the Zacks Consensus Estimate in all the past four quarters, delivering an average surprise of 1.6%.

IQVIA Holdings Inc. Price

IQVIA Holdings Inc. price | IQVIA Holdings Inc. Quote

The demand environment remains healthy across all its segments, contributing to a 4.9% year-over-year increase in revenues in the third quarter of 2023. The company’s combined offerings of research and development and commercial services have been helping it to develop trusted relationships, resulting in a diversified base of more than 10,000 clients in over 100 countries.

The company has a huge collection of healthcare information that encompasses more than one billion comprehensive, longitudinal, non-identified patient records across sales, prescription and promotional data, electronic medical records, medical claims, genomics and social media. This enormous treasure trove of information is a distinguishing asset and perhaps a big barrier to entry for competitors.

IQVIA has a consistent record of share repurchases. In 2022, 2021 and 2020, the company repurchased shares worth $1.17 billion, $406 million and $447 million, respectively. Such moves not only instill investors’ confidence but also positively impact earnings per share.

Zacks Rank and Stocks to Consider

IQVIA currently carries a Zacks Rank #3 (Hold).

Investors interested in the Zacks Business Services sector can consider the following better-ranked stocks:

Rollins ROL currently carries a Zacks Rank #2 (Buy). For the fourth quarter of 2023, the Zacks Consensus Estimate for earnings is pegged at 20 cents, indicating year-over-year growth of 17.7%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

ROL has an impressive earnings surprise history, beating the consensus mark in three of the four trailing quarters and matching once, the average surprise being 7.2%.

FTI Consulting FCN also carries a Zacks Rank of 2 at present. The consensus mark for fourth-quarter 2023 earnings is pegged at $1.57 per share, indicating 3.3% year-over-year growth.

FCN has an impressive earnings surprise history, beating the consensus mark in three of the four trailing quarters and missing once, the average surprise being 8.5%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

FTI Consulting, Inc. (FCN) : Free Stock Analysis Report

Rollins, Inc. (ROL) : Free Stock Analysis Report

IQVIA Holdings Inc. (IQV) : Free Stock Analysis Report