IQVIA (IQV) Gains From Global IT Framework, Liquidity Low

IQVIA Holdings Inc. IQV has had an impressive run over the past six months. The stock has gained 21.7%, outperforming the 13.6% rally of the industry it belongs to and the 12.7% rise of the Zacks S&P 500 composite.

IQV reported mixed fourth-quarter 2023 results, wherein earnings and revenues surpassed the Zacks Consensus Estimate. Earnings (excluding 11 cents from non-recurring items) were $2.65 per share, beating the Zacks Consensus Estimate by 3.1% and increasing 4.3% from the year-ago reported figure. Total revenues of $3.87 billion surpassed the consensus estimate by 2.2% and rose 3.5% from the year-ago reported figure.

How is IQVIA Doing?

The company’s stronghold on the life science space and market positioning is led by its robust capabilities. It leverages the strong healthcare-specific global IT framework, clinical development capabilities, driven by analytics, and a growing ecosystem of real-world solutions. This has led IQV’s growth and retain relationships with healthcare stakeholders. The company has a trusted and diversified client base of more than 10,000 in above 100 countries, to which it offers research and development, and commercial services.

The addressable market size of IQVIA is more than $330 billion. This market encompasses outsourced research and development, real-world evidence and connected health, and technology-enabled clinical and commercial operations markets. It aims to capitalize on the market using different strategies that include innovation and improving its services by using its data, analytical and technological expertise in specific domains.

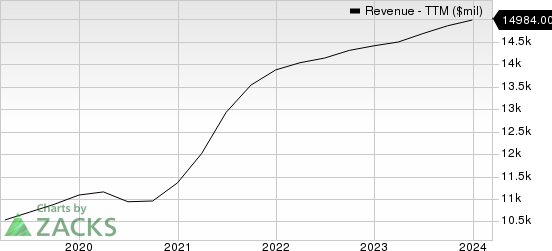

IQVIA Holdings Inc. Revenue (TTM)

IQVIA Holdings Inc. revenue-ttm | IQVIA Holdings Inc. Quote

IQVIA has a consistent record of share repurchases. In 2023, 2022 and 2021, the company repurchased shares worth $992 million, $1.17 billion and $406 million, respectively. This strategy has not only improved investors’ confidence but also driven the company’s earnings per share. Partly due to these positives, its shares have gained 21.7%% over the past six months.

IQVIA is observing an increase in its operating expenses. Total operating expenses increased 1% year over year in 2023. Hence, this could squeeze profits in the upcoming years. Its current ratio at the end of fourth-quarter 2023 was pegged at 0.86, lower than the year-ago quarter's 0.89. A current ratio of less than 1 often indicates that the company may have problems paying off its short-term obligations and the risk of default is high.

Zacks Rank and Stocks to Consider

IQVIAcurrently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader Zacks Business Services sector are Barrett Business Services BBSI and Jamf JAMF.

Barrett Business Services (BBSI) currently carries a Zacks Rank of 2 (Buy). BBSI has a long-term earnings growth expectation of 14%.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

BBSI delivered a trailing four-quarter earnings surprise of 77.7%, on average.

Jamf (JAMF) carries a Zacks Rank of 2 at present. JAMF has a long-term earnings growth expectation of 22.5%.

JAMF delivered a trailing four-quarter earnings surprise of 49.4%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Barrett Business Services, Inc. (BBSI) : Free Stock Analysis Report

IQVIA Holdings Inc. (IQV) : Free Stock Analysis Report

Jamf Holding Corp. (JAMF) : Free Stock Analysis Report