iRadimed Corp (IRMD) Reports Record Revenues and Robust Earnings Growth in Q4 and Full-Year 2023

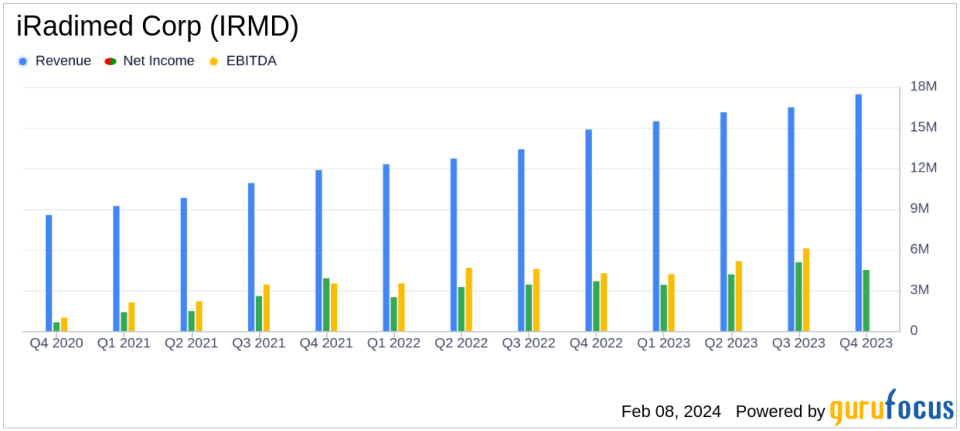

Revenue Growth: Q4 revenue increased by 17.4% year-over-year, with full-year revenue up by 23.1%.

Net Income: Q4 net income rose to $4.5 million, with a full-year net income of $17.2 million, marking significant increases from the previous year.

Earnings Per Share (EPS): GAAP diluted EPS for Q4 was $0.36, and $1.35 for the full year, showing a notable rise from 2022.

Non-GAAP Adjustments: Non-GAAP net income for Q4 was $5.0 million, and $18.9 million for the full year, excluding stock-based compensation expense.

Cash Flow: Operating cash flow for the year was $13.5 million, with a free cash flow of $5.5 million after significant capital expenditures.

Guidance for 2024: iRadimed Corp projects revenue between $72.0 million and $74.0 million and GAAP diluted EPS between $1.37 and $1.47 for the full year.

On February 8, 2024, iRadimed Corp (NASDAQ:IRMD) released its 8-K filing, announcing financial results for the fourth quarter and full year of 2023. The company, known for its innovative MRI-compatible medical devices, reported a year of record revenues and substantial earnings growth.

Company Overview

iRadimed Corp develops, manufactures, and distributes MRI-compatible IV infusion pump systems and patient vital signs monitoring systems, along with related accessories and services. These products are designed to be safe for use during MRI procedures and are sold primarily to hospitals and acute care facilities both in the U.S. and internationally.

Financial Performance and Challenges

The company's performance in the fourth quarter was marked by a 17.4% increase in revenue year-over-year, reaching $17.5 million. This growth was driven by robust sales in both the IV infusion pump product line and the monitoring business. Net income for the quarter also increased to $4.5 million, or $0.36 per diluted share, up from $3.7 million, or $0.29 per diluted share in the fourth quarter of 2022.

For the full year, iRadimed reported a revenue of $65.6 million, a 23.1% increase from the previous year. The net income for the year was $17.2 million, or $1.35 per diluted share, compared to $12.8 million, or $1.02 per diluted share for 2022. These financial achievements underscore the company's ability to grow its market share and maintain profitability in the competitive Medical Devices & Instruments industry.

Despite these strong results, the company faces challenges, including the need to continuously innovate and address the competitive pressures within the medical device sector. Additionally, the company anticipates a cash outlay of approximately $13 million towards the development of a new facility in Orlando, FL, which could impact short-term cash flows.

Key Financial Metrics

Important metrics from the income statement include a gross profit margin of 76.9% for Q4 and 76.5% for the full year, indicating a slight decrease from the previous year. The balance sheet shows a healthy cash and cash equivalents position of $49.8 million as of December 31, 2023. The cash flow statement reflects strong cash flow from operations at $13.5 million for the year.

These metrics are crucial as they demonstrate iRadimed's ability to manage costs effectively, maintain liquidity, and generate cash to fund operations and strategic investments.

It was a banner year for Iradimed, capped by our fourth quarter execution and finishing the year with record revenues driven by robust growth in our IV infusion pump product and continued strength of our monitoring business," said Roger Susi, President and Chief Executive Officer of the Company.

Analysis of Company's Performance

iRadimed's financial performance in 2023 reflects a company that is effectively capitalizing on its unique position in the MRI-compatible medical device market. The introduction of a quarterly dividend in 2024 signals confidence in the company's continued profitability and cash flow generation. However, investors should be mindful of the capital expenditures associated with the new facility and the potential impact on future cash flows.

The company's forward guidance for 2024, with expected revenue growth and stable earnings per share, suggests a positive outlook, although it will be important to monitor how the company manages its growth investments and whether it can sustain its profit margins.

For more detailed information and to stay updated on iRadimed Corp's financial performance, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from iRadimed Corp for further details.

This article first appeared on GuruFocus.