iRhythm Technologies Inc Insider Sells Company Shares

Daniel Wilson, EVP, Corp Dev Inv Rel at iRhythm Technologies Inc (NASDAQ:IRTC), executed a sale of 7,218 shares in the company on January 2, 2024, according to a recent SEC Filing. The transaction was carried out at an average price of $103.31 per share, resulting in a total value of $745,674.58.

iRhythm Technologies Inc is a healthcare company that provides ambulatory electrocardiogram (ECG) monitoring for patients at risk for arrhythmias. The company's technology platform, Zio, offers wearable biosensor devices for continuous ECG monitoring, coupled with cloud-based data analytics and machine-learning capabilities.

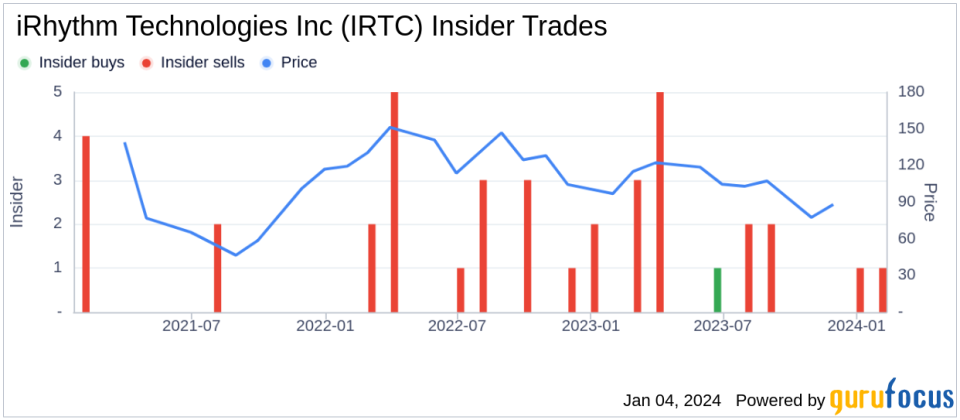

Over the past year, the insider has sold a total of 15,856 shares of iRhythm Technologies Inc and has not made any purchases of the stock. The recent sale by the insider is part of a broader trend observed over the past year, where there has been a total of 1 insider buy and 14 insider sells.

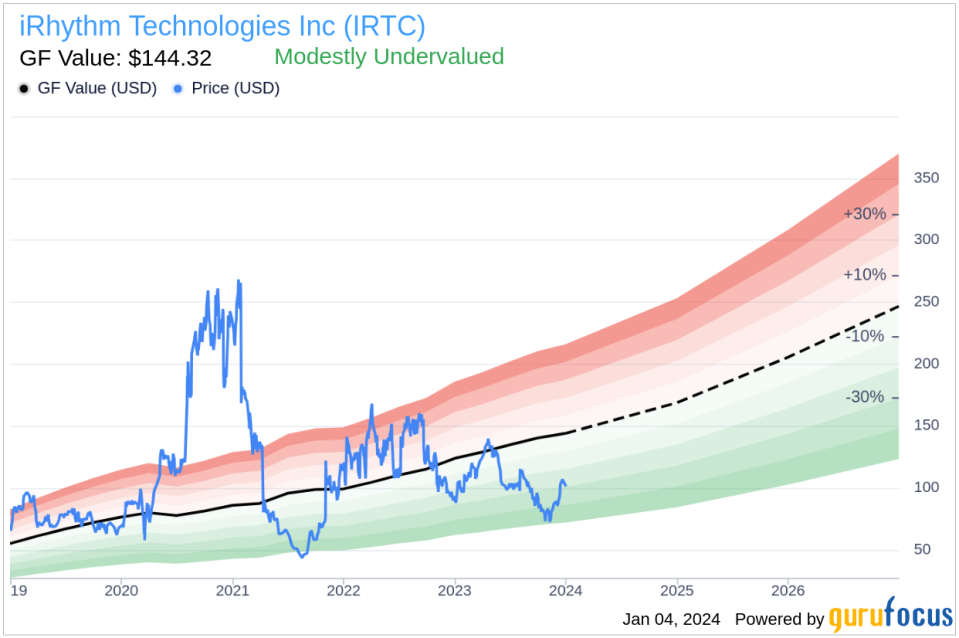

On the valuation front, iRhythm Technologies Inc's shares were trading at $103.31 on the day of the insider's sale, giving the company a market capitalization of $3.169 billion. The stock's price-to-GF-Value ratio stands at 0.72, indicating that it is modestly undervalued according to the GF Value of $144.32.

The GF Value is a proprietary intrinsic value estimate from GuruFocus, which is determined by historical trading multiples, an adjustment factor based on the company's historical returns and growth, and future business performance estimates provided by Morningstar analysts.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.