iRhythm Technologies Inc (IRTC) Reports Growth Amidst Challenges in Q4 and Full Year 2023

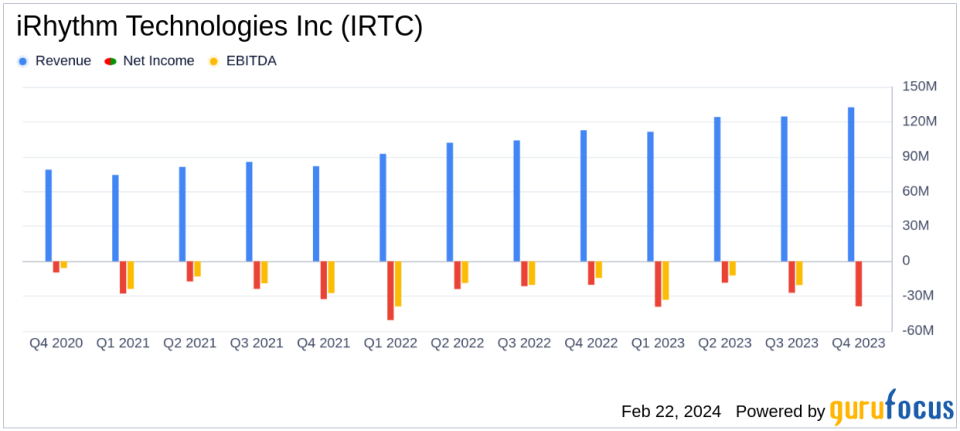

Revenue Growth: Q4 revenue increased by 17.7% year-over-year to $132.5 million, and full-year revenue rose by 19.9% to $492.7 million.

Gross Margin: Q4 gross margin decreased to 66.0%, a 390 basis point decline from the previous year, while full-year gross margin also saw a decrease.

Net Loss: Q4 net loss widened to $38.7 million, and full-year net loss increased to $123.4 million.

Adjusted EBITDA: Q4 adjusted EBITDA improved by $1.3 million, while full-year adjusted EBITDA showed a $6.4 million improvement.

Cash Position: Cash, cash equivalents, and marketable securities stood at $133.8 million at the end of 2023, a decrease from the previous quarter.

Operational Highlights: Significant progress in new account openings and Zio monitor transitions, with 67% of registrations for the newest generation monitor.

2024 Guidance: Revenue projected to grow to approximately $575 million to $585 million with gross margin expected to range from 68% to 69%.

On February 22, 2024, iRhythm Technologies Inc (NASDAQ:IRTC) released its 8-K filing, announcing financial results for the fourth quarter and full year ended December 31, 2023. The company, known for its innovative Zio servicea platform that combines wearable biosensing technology with data analytics and machine-learningreported a significant increase in patient registrations and revenue growth, despite facing challenges that led to wider net losses.

Financial Performance and Challenges

iRhythm Technologies Inc (NASDAQ:IRTC) experienced robust growth in patient registrations, which increased by over 22% in the fourth quarter compared to the same period in the previous year. This growth translated into a 17.7% increase in revenue for the quarter, reaching $132.5 million. For the full year, revenue climbed to $492.7 million, marking a 19.9% increase from 2022. However, the company's gross margin contracted both in the fourth quarter and the full year, primarily due to higher headcount-related costs and expenses associated with the commercial launch of the Zio monitor.

The company's net loss for the fourth quarter expanded to $38.7 million, an $18.5 million increase from the fourth quarter of 2022. The full-year net loss also grew to $123.4 million, a $7.3 million increase from the previous year. Despite these losses, iRhythm Technologies Inc (NASDAQ:IRTC) reported an improved adjusted EBITDA of $2.4 million for the quarter and a reduced full-year adjusted EBITDA loss of $4.9 million, reflecting the company's focus on operational discipline.

Operational Highlights and Future Outlook

IRTC achieved its second-highest quarter of new account openings for Zio long-term continuous monitoring in the United States during Q4, with a record number of new account onboarding throughout 2023. The transition to the newest generation Zio monitor is progressing well, with 67% of registrations now for the latest device. The company's President and CEO, Quentin Blackford, highlighted the transformational year for iRhythm, emphasizing the 20% revenue growth, record new account onboarding, and significant product launches.

Looking ahead to 2024, iRhythm Technologies Inc (NASDAQ:IRTC) expects to continue its growth trajectory, with revenue projected to reach between $575 million to $585 million. The company anticipates an improvement in gross margin, ranging from 68% to 69%, and an adjusted EBITDA margin of approximately 3% to 4% of revenues.

Financial Statements and Metrics

IRTC's balance sheet reflects a solid financial position with $133.8 million in cash, cash equivalents, and marketable securities as of December 31, 2023. The company's operating expenses for the fourth quarter were $126.6 million, influenced by an impairment charge and increased legal, regulatory, and consulting fees. For the full year, operating expenses amounted to $457.0 million, a 15.6% increase from 2022, mainly due to headcount expansion to support product development and business growth.

"This past year was truly transformational for iRhythm as we made significant strides to advance our mission in our core U.S. market while advancing multiple initiatives that set us up for future growth," said Quentin Blackford, iRhythms President and CEO.

The company's performance in 2023, despite the widened net losses, demonstrates a strong commitment to growth and market expansion. The increased focus on operational efficiency and the strategic initiatives underway position iRhythm Technologies Inc (NASDAQ:IRTC) favorably for continued success in the digital healthcare space.

Explore the complete 8-K earnings release (here) from iRhythm Technologies Inc for further details.

This article first appeared on GuruFocus.