Iridium (IRDM) Gains 23% YTD: Will the Uptrend Continue?

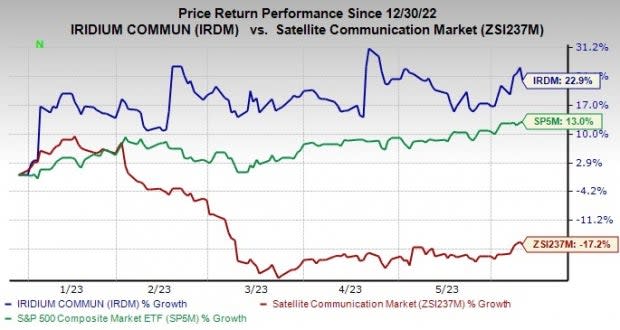

Iridium Communications IRDM is a leading satellite communications company that offers dedicated commercial global voice and data communications. It is witnessing strong momentum this year with shares soaring 22.9% year to date against the sub-industry’s decline of 17.2%. It has also outperformed the benchmark S&P 500’s gain of 13% year to date.

Let’s discuss the reasons for IRDM’s outperformance and analyze whether the stock can keep the momentum going.

Factors Attributable to Price Increase

Iridium’s solid subscriber base and strategic relationship with government organizations are driving higher revenues. Its satellite constellation consists of several active satellites in low Earth orbit to provide global voice and data communications coverage. It uses an L-band frequency which is resilient to extreme weather conditions.

Image Source: Zacks Investment Research

Being the sole provider of mobile voice and data satellite communications network, it benefits from a highly lucrative recurring service revenue base. The company has witnessed a steady subscriber growth and mobile penetration backed by an efficient operating model. It is focused on augmenting both commercial and government service revenues to leverage its fixed-cost infrastructure. As of Mar 31, IRDM had 2,051,000 billable subscribers, up 15% compared with 1,781,000 at the end of the prior-year quarter.

In the last reported quarter, total service revenues rose 10% year over year to $139.3 million, owing to strong recurring revenues from a growing subscriber base. Iridium expects commercial service revenues to benefit from growth in IoT, ongoing activations and solid uptake of the company’s broadband services. For 2023, management expects total service revenue growth between 9% and 11%.

IRDM aims to tap the consumer-oriented satellite segment by launching new satellite direct-to-device capabilities. Also, the company's collaboration with Qualcomm for satellite messaging and emergency services in smartphones is an additional tailwind.

Iridium expects the voice and data business to gain from increasing demand for newer services like Push-to-Talk and Iridium GO! Services.

A Look at Headwinds

Weakness in global macroeconomic conditions could compel customers to lower spending, which may not bode well for satellite and communications companies like Iridium.

Volatile supply-chain dynamics, component shortages and rising inflation could lead to higher costs and increased lead time, which are major concerns. Leveraged balance sheet and stiff competition remain concerning.

Zacks Rank & Stocks to Consider

Notably, Iridium currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader technology space are Dropbox DBX, Badger Meter BMI and Blackbaud BLKB. Dropbox currently sports a Zacks Rank #1 (Strong Buy) while Badger Meter and Blackbaud carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Dropbox’s 2023 earnings has increased 10.1% in the past 60 days to $1.85 per share. The long-term earnings growth rate is anticipated to be 12.3%.

Dropbox’s earnings beat the Zacks Consensus Estimate in the last four quarters, the average being 10.4%. Shares of DBX have gained 15.9% in the past year.

The Zacks Consensus Estimate for Badger Meter’s 2023 earnings has increased 4.7% in the past 60 days to $2.69 per share.

Badger Meter’s earnings beat the Zacks Consensus Estimate in all the last four quarters, the average being 5.3%. Shares of BMI have soared 102.9% in the past year.

The Zacks Consensus Estimate for Blackbaud’s 2023 earnings has increased 9.3% in the past 60 days to $3.75 per share.

Blackbaud’s earnings beat the Zacks Consensus Estimate in the last four quarters, the average surprise being 10.4%. Shares of BLKB have improved 31.1% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Badger Meter, Inc. (BMI) : Free Stock Analysis Report

Blackbaud, Inc. (BLKB) : Free Stock Analysis Report

Iridium Communications Inc (IRDM) : Free Stock Analysis Report

Dropbox, Inc. (DBX) : Free Stock Analysis Report