Iridium's (IRDM) Certus Helps to Advance Aviation Connectivity

Iridium Communications IRDM has unveiled its latest offering — the Iridium Certus aviation commercial service. This service ensures a secure cockpit domain with reliable voice and data capabilities. This marks a significant achievement as it brings Iridium Connected aviation solutions to commercial transport aircraft, business aviation and Uncrewed Aircraft Systems.

Iridium Certus utilizes L-band satellite frequencies, which are particularly well-suited for cockpit communications. It complements existing in-flight connectivity (IFC) systems in commercial transport passenger cabins and can serve as the primary service for small-to-mid-size business jet cabins. Additionally, it offers advantages over HF/VHF for electronic flight bags, flight-critical data, and passenger communications during oceanic flights.

Iridium is introducing a variety of multi-tier Iridium Certus solutions that work seamlessly with other IFC systems on board aircraft. Several Iridium Value Added Manufacturers and Value-Added Resellers are providing different Iridium Certus 100 and Iridium Certus 700 solutions. Also, safety certifications and flight trials are expected to commence by the end of 2023, and approvals are anticipated in 2024.

Iridium Communications Inc Price and Consensus

Iridium Communications Inc price-consensus-chart | Iridium Communications Inc Quote

Iridium provides weather-resilient L-band connectivity and global coverage compared to geostationary systems by leveraging its Low-Earth-Orbit satellite network. The flexibility of Iridium Certus service allows users to scale device SWaP requirements, catering to various mission needs and offering different price points and versatility for different aircraft types and operational requirements.

The success of Iridium Certus technology in maritime and land applications has paved the way for its integration into aviation. Overall, the aviation industry can now benefit from a robust suite of Iridium Certus solutions, supporting Uncrewed Aerial Vehicles/Urban Air Mobility, business jet cabin connectivity, and paving the way for future flight deck applications.

Iridium is the only satellite communications company that offers dedicated commercial global voice and data communications. The company continues to invest heavily in research and development to launch advanced satellite communications services.

In May, the company achieved an important milestone in its efforts to enhance the reliability and redundancy of its satellite constellation. The company has successfully launched and deployed five spare satellites, bringing the total number of backup Iridium satellites in orbit to 14.

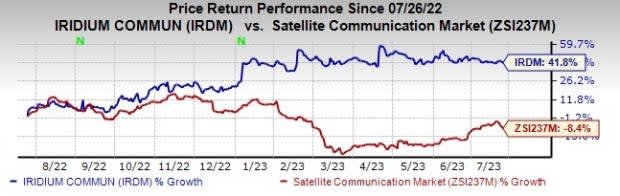

Iridium currently has a Zacks Rank #2 (Buy). Shares of the company have gained 41.8% in the past year against the sub-industry’s decline of 8.4%.

Image Source: Zacks Investment Research

Other Stocks to Consider

Some other top-ranked stocks in the broader technology space are InterDigital IDCC, Badger Meter BMI and Woodward WWD. InterDigital and Badger Meter presently sport a Zacks Rank #1 (Strong Buy), while Woodward currently carries a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for InterDigital’s 2023 earnings per share (EPS) has increased 62.6% in the past 60 days to $8.08. The company’s long-term earnings growth rate is 13.9%.

InterDigital’s earnings beat estimates in all the trailing four quarters, delivering an average surprise of 170.9%. Shares of IDCC have rallied 52% in the past year.

The Zacks Consensus Estimate for Badger Meter’s 2023 EPS has increased 1.1% in the past 60 days to $2.72.

Badger Meter’s earnings beat the Zacks Consensus Estimate in all the last four quarters, the average being 5.3%. Shares of BMI have surged 81.3% in the past year.

The Zacks Consensus Estimate for Woodward’s fiscal 2023 EPS has increased 0.3% in the past 60 days to $3.59.

WWD’s long-term earnings growth rate is 13.5%. Shares of WWD have gained 12% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Badger Meter, Inc. (BMI) : Free Stock Analysis Report

InterDigital, Inc. (IDCC) : Free Stock Analysis Report

Iridium Communications Inc (IRDM) : Free Stock Analysis Report

Woodward, Inc. (WWD) : Free Stock Analysis Report