Iron Mountain Inc CEO William Meaney Sells Over $1.3 Million in Company Stock

Iron Mountain Inc (NYSE:IRM), a global leader in storage and information management services, has recently witnessed a significant insider sell by its President and CEO, William Meaney. On December 13, 2023, Meaney sold 21,014 shares of Iron Mountain Inc at an average price of $66.32 per share, amounting to a total transaction value of approximately $1,393,728. This move has caught the attention of investors and market analysts, prompting a closer look into the implications of such insider activity.

Who is William Meaney?

William Meaney is the President and CEO of Iron Mountain Inc, a position he has held since 2013. With a background in the aviation industry and a former CEO of The Zuellig Group, Meaney has brought a wealth of experience to Iron Mountain. Under his leadership, the company has expanded its services globally and has made significant strides in digital transformation, positioning Iron Mountain as a key player in both physical and digital information management.

Iron Mountain Inc's Business Description

Iron Mountain Inc is a company that specializes in records management, data backup and recovery, document management, and secure shredding. The firm operates a vast network of storage facilities around the world, safeguarding assets for organizations in more than 50 countries. Iron Mountain's services cater to a wide range of industries, including financial services, healthcare, legal, and government entities, ensuring compliance with regulatory requirements and providing solutions for data privacy and security.

Analysis of Insider Buy/Sell and Relationship with Stock Price

Insider transactions can provide valuable insights into a company's health and future prospects. Over the past year, William Meaney has sold a total of 407,707 shares and has not made any purchases. This pattern of selling without corresponding buys could signal Meaney's belief that the stock may be fully valued or that he is diversifying his personal assets. However, without additional context, it's challenging to determine the exact motivation behind these sales.

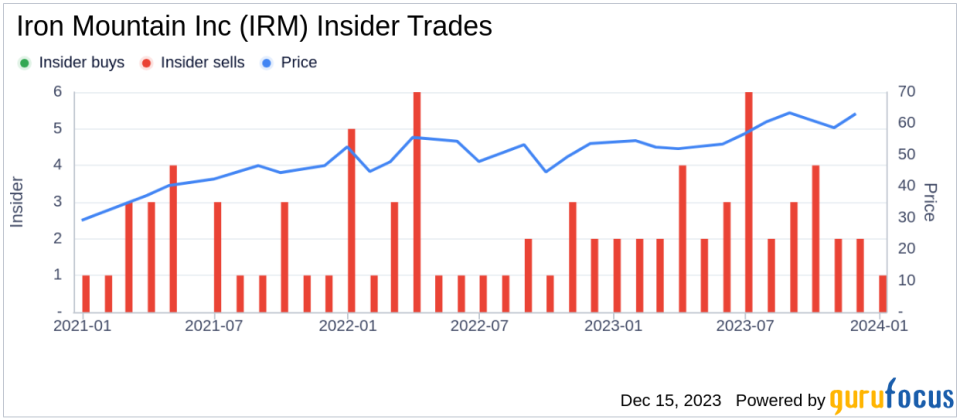

The insider transaction history for Iron Mountain Inc shows a trend of more insider selling than buying over the past year, with 35 insider sells and no insider buys. This trend could be interpreted as a lack of confidence among insiders about the company's future stock price appreciation.

On the day of Meaney's recent sell, Iron Mountain Inc shares were trading at $66.32, giving the company a market cap of $19.99 billion. The price-earnings ratio of 72.82 is significantly higher than the industry median of 17.38 and above the company's historical median, suggesting that the stock may be overvalued compared to its peers and its own trading history.

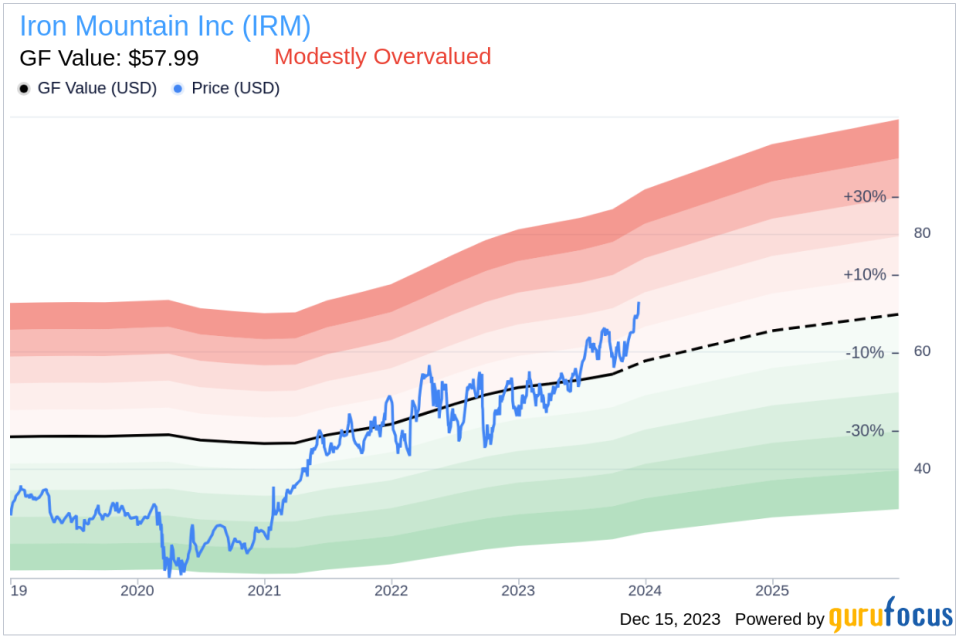

With a price of $66.32 and a GuruFocus Value of $57.99, Iron Mountain Inc has a price-to-GF-Value ratio of 1.14, indicating that the stock is modestly overvalued based on its GF Value. The GF Value is an intrinsic value estimate that considers historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates from Morningstar analysts.

The insider trend image above reflects the recent insider selling activity, which could be a point of concern for potential investors. The absence of insider buying may suggest that insiders do not perceive the stock as undervalued at current levels, despite the company's solid business fundamentals.

The GF Value image provides a visual representation of the stock's valuation relative to its intrinsic value. The current price-to-GF-Value ratio above 1 indicates that the stock is trading at a premium to its estimated fair value, which could limit the upside potential for investors buying at current prices.

Conclusion

William Meaney's recent insider sell of Iron Mountain Inc shares may raise questions among investors about the stock's valuation and future prospects. While insider selling alone is not a definitive indicator of a stock's direction, the combination of a high price-earnings ratio, a modestly overvalued GF Value rating, and a trend of more insider selling than buying could suggest that the stock's current price already reflects much of its potential. Investors should consider these factors alongside the company's overall financial health, market position, and growth strategies when making investment decisions.

As always, it's important to conduct thorough research and consider a wide range of factors before making any investment. Insider transactions are just one piece of the puzzle, and they should be weighed against other financial metrics and market analyses.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.