Iron Mountain Inc (IRM) Reports Record Revenues and Adjusted EBITDA for Q4 and Full Year 2023

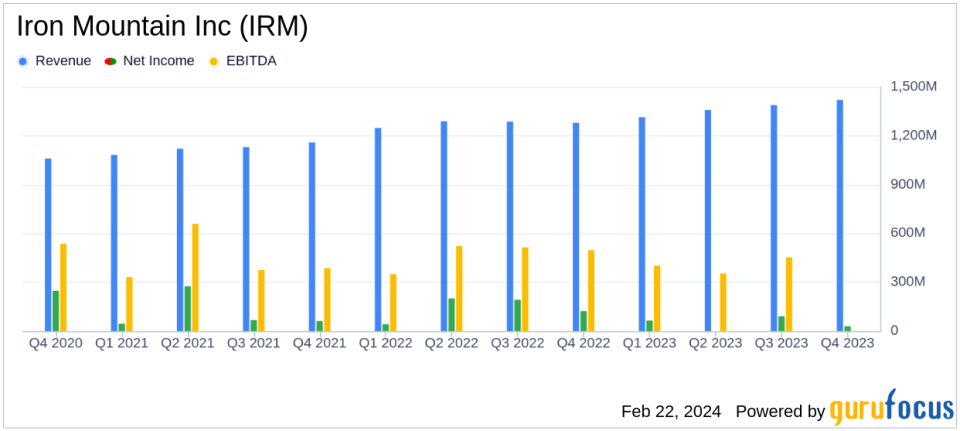

Revenue Growth: Q4 total revenue increased by 11% year-over-year to $1.42 billion; full year revenue up 7% to $5.48 billion.

Net Income: Q4 net income declined to $29 million, a 77% decrease from the previous year; full year net income also fell by 67% to $187 million.

Adjusted EBITDA: Q4 Adjusted EBITDA rose by 11% to $525 million; full year Adjusted EBITDA grew 7% to $1.96 billion.

AFFO: Q4 AFFO increased by 10% to $328 million; full year AFFO up by 5% to $1.21 billion.

Dividend: Declared a quarterly cash dividend of $0.65 per share for Q1 2024, payable on April 4, 2024.

2024 Guidance: Expects revenue growth of 10-12% and Adjusted EBITDA increase of approximately 12%.

On February 22, 2024, Iron Mountain Inc (NYSE:IRM), a global leader in information management services, released its 8-K filing, reporting financial results for the fourth quarter and full year 2023. The company, which operates as a Real Estate Investment Trust (REIT) and primarily serves enterprise clients with its storage and value-added services, achieved record quarterly and full year revenue and Adjusted EBITDA.

Financial Performance and Challenges

IRM's performance in Q4 and the full year of 2023 was marked by significant revenue growth, particularly in storage rental revenue, which saw a 13% increase in Q4 and an 11% increase for the full year. Service revenue also grew by 8% in Q4 and 2% over the full year. Despite these achievements, net income and reported EPS saw a sharp decline, primarily due to higher levels of restructuring and transformation costs, lower gains on asset recycling, and the negative impact from changes in foreign exchange rates.

The company's Adjusted EBITDA margin remained stable at 37.0% for Q4 and 35.8% for the full year. The Adjusted Funds From Operations (AFFO), a key metric for REITs indicating cash flow from operations, increased by 10% in Q4 and 5% for the full year, reflecting the company's strong operational performance and updated calculation excluding amortization of capitalized commissions.

"We are pleased to report outstanding performance in both the fourth quarter and the full year, again resulting in all-time record Revenue and Adjusted EBITDA," said William L. Meaney, President and CEO of Iron Mountain. "We are well positioned to continue our growth trajectory in 2024, which is reflected in our financial guidance for double digit revenue growth."

Balance Sheet and Cash Flow Highlights

IRM's balance sheet as of December 31, 2023, shows an increase in total assets to $17.47 billion, up from $16.14 billion the previous year. The company's long-term debt increased to $11.81 billion, up from $10.48 billion in 2022. Cash and cash equivalents also rose to $222.79 million, compared to $141.79 million at the end of 2022.

The company's cash flow from operations remained robust, supporting its dividend payout and investment in growth initiatives. The declaration of a quarterly cash dividend of $0.65 per share for the first quarter of 2024 is a testament to IRM's commitment to delivering shareholder value.

Looking Ahead

IRM issued strong guidance for 2024, projecting revenue growth of 10-12% and an Adjusted EBITDA increase of approximately 12%. This optimistic outlook is underpinned by the company's strategic growth plan, Project Matterhorn, and the recent acquisition of Regency Technologies, which enhances IRM's leadership in Asset Lifecycle Management.

The company's focus on digital transformation, data centers, and expanding its service offerings positions it well for continued growth in the information management industry. As IRM navigates the challenges ahead, its strong financial foundation and strategic initiatives are expected to drive further success in 2024 and beyond.

For detailed financial tables and a complete analysis of IRM's performance, visit GuruFocus.com for the full earnings report.

Explore the complete 8-K earnings release (here) from Iron Mountain Inc for further details.

This article first appeared on GuruFocus.