Is Iron Mountain Inc (IRM) Stock Fairly Valued?

Iron Mountain Inc (NYSE:IRM) has seen a daily gain of 2.07% and a 3-month gain of 9.61%. With an Earnings Per Share (EPS) (EPS) of 1.29, the question arises - is the stock fairly valued? This article aims to answer this question by providing a detailed valuation analysis of Iron Mountain. The following sections will delve into the company's operations, financial strength, profitability, and growth, offering valuable insights for potential investors.

About Iron Mountain Inc

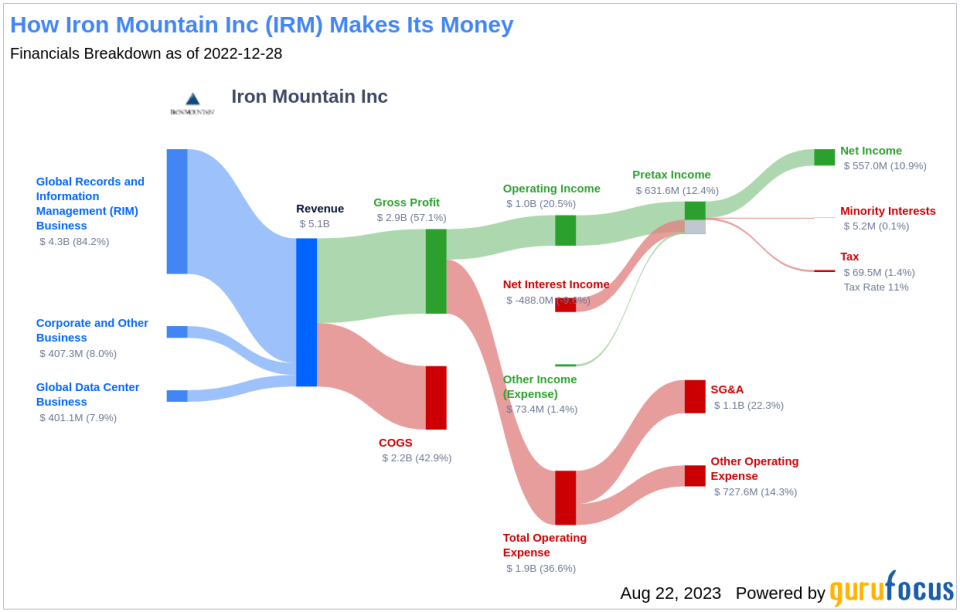

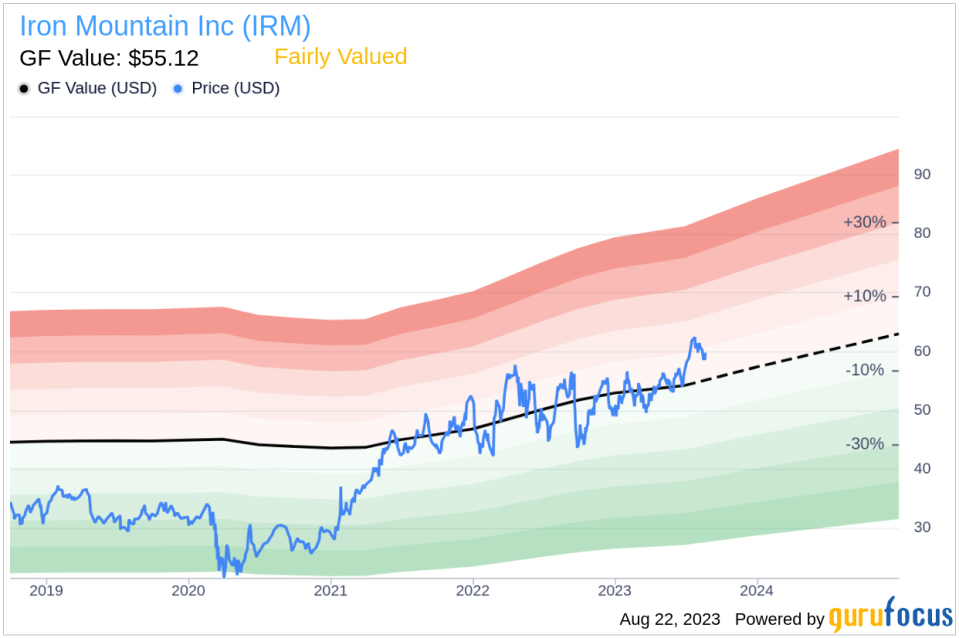

Iron Mountain Inc is a leading provider of record management services, organized as a Real Estate Investment Trust (REIT). The majority of its revenue stems from its storage business, supplemented by value-added services. The company primarily serves enterprise clients in developed markets. Iron Mountain's business segments include Global RIM Business, Global Data Center Business, and Corporate and Other Business. The company's stock price currently stands at $59.78, compared to the GF Value of $55.12, suggesting that the stock is fairly valued.

Understanding GF Value

The GF Value is a unique measure of a stock's intrinsic value, calculated based on historical trading multiples, a GuruFocus adjustment factor based on past performance and growth, and future business performance estimates. The GF Value Line provides an overview of the stock's fair trading value. If the stock price is significantly above the GF Value Line, it is considered overvalued and its future return is likely to be poor. Conversely, if the stock price is significantly below the GF Value Line, the stock is undervalued and its future return is likely to be higher.

The stock of Iron Mountain appears to be fairly valued based on GuruFocus' valuation method. This suggests that the long-term return of its stock is likely to be close to the rate of its business growth.

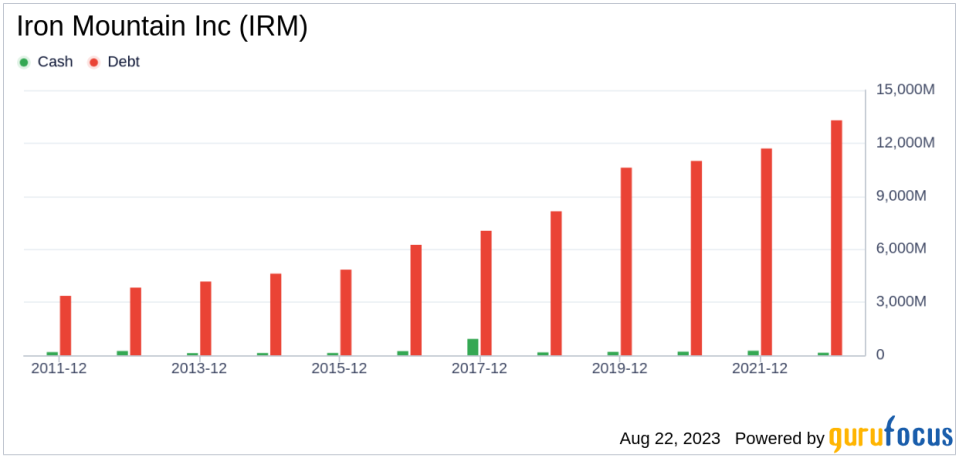

Financial Strength

Investing in companies with poor financial strength carries a higher risk of permanent capital loss. Therefore, it's crucial to carefully review a company's financial strength before deciding to buy its stock. Iron Mountain's cash-to-debt ratio of 0.01 is worse than 86.57% of the companies in the REITs industry, indicating poor financial strength.

Profitability and Growth

Consistent profitability over the long term reduces risk for investors. Iron Mountain has been profitable 10 out of the past 10 years, indicating fair profitability. The company's 3-year average annual revenue growth of 5.6% is better than 71.79% of the companies in the REITs industry, suggesting good growth.

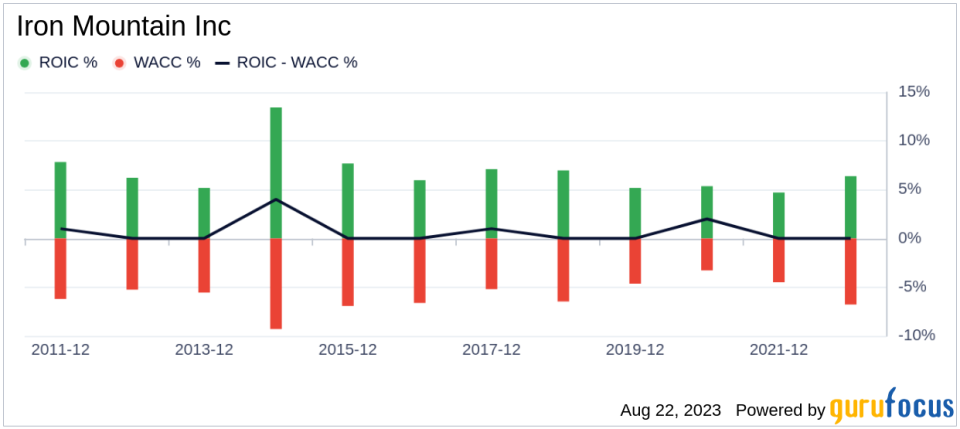

ROIC vs WACC

Comparing a company's return on invested capital (ROIC) to its weighted cost of capital (WACC) is another way to evaluate its profitability. If the ROIC is higher than the WACC, it indicates that the company is creating value for shareholders. Over the past 12 months, Iron Mountain's ROIC was 6.16, while its WACC came in at 7.39.

Conclusion

Overall, Iron Mountain's stock appears to be fairly valued. Despite its poor financial condition, the company has shown fair profitability and good growth. To learn more about Iron Mountain stock, you can check out its 30-Year Financials here.

To find out high-quality companies that may deliver above-average returns, please check out GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.