Ironwood Pharmaceuticals (IRWD): A Hidden Gem or a Potential Risk? An In-Depth Look at Its Valuation

Ironwood Pharmaceuticals Inc (NASDAQ:IRWD) has seen a daily gain of 1.35%, although it has experienced a 3-month loss of -9.58%. The company reported a Loss Per Share of 6.04. The question that arises is whether the stock is modestly undervalued or not. This article aims to provide a comprehensive analysis of Ironwood Pharmaceuticals' valuation. We encourage you to read on for a deeper understanding of the company's financial health and future prospects.

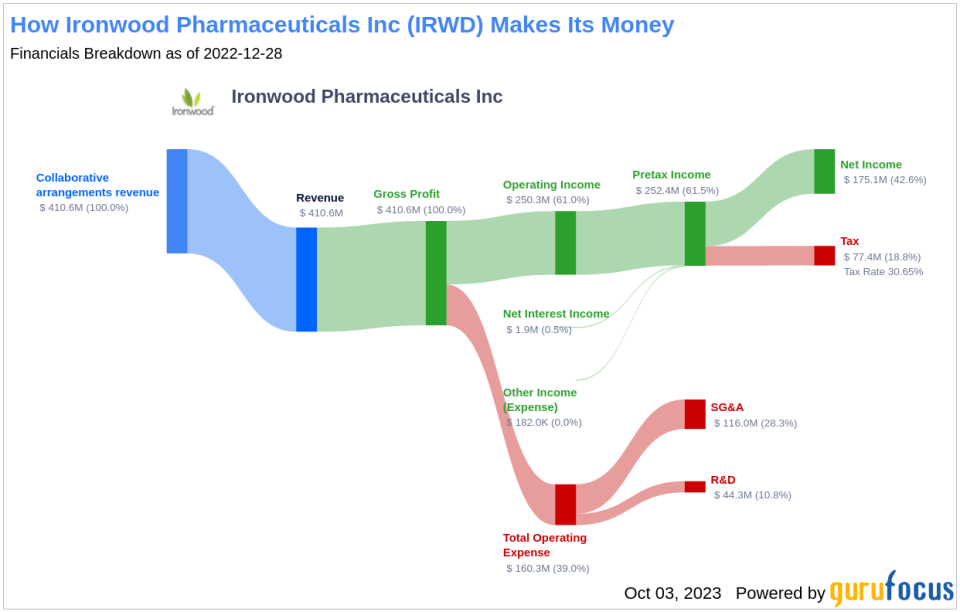

Company Overview

Ironwood Pharmaceuticals, a specialty and generic drug manufacturing company, operates a human therapeutics segment. The company focuses on advancing innovative product opportunities in areas of large unmet need, including irritable bowel syndrome with constipation, chronic idiopathic constipation, hyperuricemia associated with uncontrolled gout, uncontrolled gastroesophageal reflux disease, and vascular and fibrotic diseases. It considers collaborative licenses, commercial agreements, and acquisition investments as potential components of its operational growth strategy for expanding its research, development, manufacturing, and marketing capabilities.

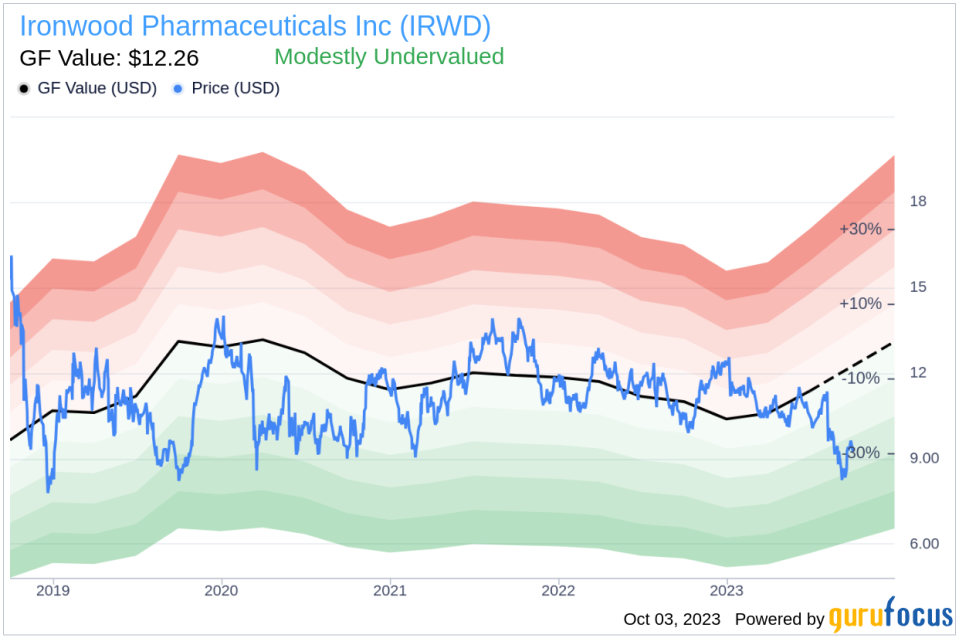

Currently, Ironwood Pharmaceuticals (NASDAQ:IRWD) is trading at $9.37 per share, while its GF Value, an estimation of fair value, stands at $12.26. This comparison suggests that the stock might be modestly undervalued. Let's explore this valuation more deeply, integrating financial assessment with essential company details.

Understanding GF Value

The GF Value is a proprietary measure that represents the current intrinsic value of a stock. It is derived from a unique method that takes into account historical trading multiples, a GuruFocus adjustment factor based on the company's past returns and growth, and future estimates of business performance. The GF Value Line provides an overview of the fair value at which the stock should ideally be traded.

According to GuruFocus Value calculation, the stock of Ironwood Pharmaceuticals (NASDAQ:IRWD) is believed to be modestly undervalued. The current price of $9.37 per share and the market cap of $1.50 billion suggest that Ironwood Pharmaceuticals stock may be trading below its fair value.

Being relatively undervalued, the long-term return of Ironwood Pharmaceuticals' stock is likely to be higher than its business growth.

Link: These companies may deliver higher future returns at reduced risk.

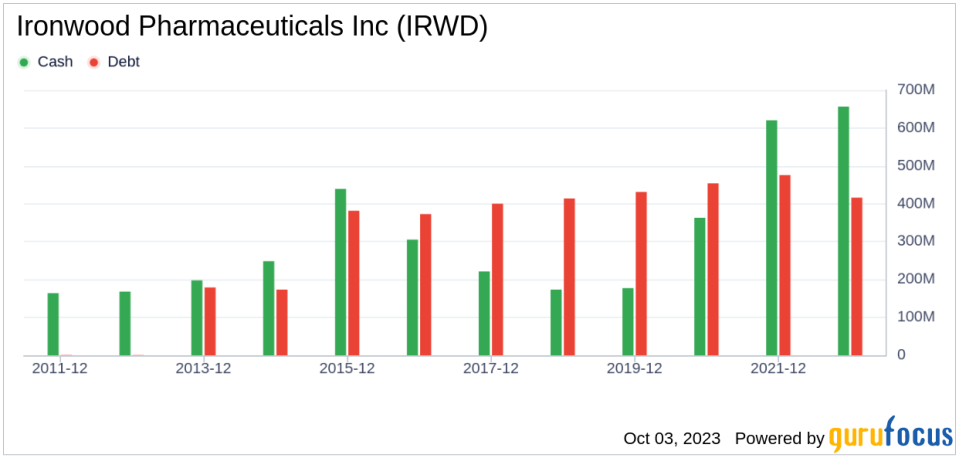

Financial Strength Analysis

Investing in companies with poor financial strength carries a higher risk of permanent loss. A great way to understand a company's financial strength is by looking at its cash-to-debt ratio and interest coverage. Ironwood Pharmaceuticals has a cash-to-debt ratio of 0.22, which is lower than 74.88% of 1039 companies in the Drug Manufacturers industry. The overall financial strength of Ironwood Pharmaceuticals is 2 out of 10, indicating that its financial strength is poor.

Profitability and Growth

Investing in profitable companies, especially those that have demonstrated consistent profitability over the long term, poses less risk. Ironwood Pharmaceuticals has been profitable 4 times over the past 10 years. Over the past twelve months, the company had a revenue of $427.30 million and a Loss Per Share of $6.04. Its operating margin is -204.36%, which ranks worse than 90.59% of 1031 companies in the Drug Manufacturers industry. Overall, GuruFocus ranks the profitability of Ironwood Pharmaceuticals at 3 out of 10, indicating poor profitability.

Growth is one of the most important factors in the valuation of a company. Ironwood Pharmaceuticals's 3-year average revenue growth rate is worse than 80.68% of 916 companies in the Drug Manufacturers industry. However, its 3-year average EBITDA growth rate is 29.4%, which ranks better than 76.42% of 878 companies in the Drug Manufacturers industry.

ROIC vs WACC

Comparing a company's return on invested capital (ROIC) to its weighted cost of capital (WACC) is another way to evaluate its profitability. ROIC measures how well a company generates cash flow relative to the capital it has invested in its business. WACC is the rate that a company is expected to pay on average to all its security holders to finance its assets. If ROIC is higher than WACC, it indicates that the company is creating value for shareholders. Over the past 12 months, Ironwood Pharmaceuticals's ROIC was -206.07, while its WACC came in at 6.65.

Conclusion

Overall, the stock of Ironwood Pharmaceuticals (NASDAQ:IRWD) is believed to be modestly undervalued. The company's financial condition is poor, and its profitability is also poor. However, its growth ranks better than 76.42% of 878 companies in the Drug Manufacturers industry. To learn more about Ironwood Pharmaceuticals stock, you can check out its 30-Year Financials here.

To find out the high-quality companies that may deliver above-average returns, please check out GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.