Ironwood's (IRWD) Q3 Earnings Miss Mark, Linzess Volume Rises

Ironwood Pharmaceuticals, Inc. IRWD reported adjusted earnings of 12 cents per share for third-quarter 2023, missing the Zacks Consensus Estimate of 17 cents. The company had reported adjusted earnings of 28 cents per share in the year-ago quarter.

Total revenues in the reported quarter were $113.7 million, beating the Zacks Consensus Estimate of $113 million. The top line also increased almost 4.6% year over year.

Quarter in Detail

As reported by partner AbbVie Inc. ABBV, Ironwood’s sole marketed product — Linzess (linaclotide) — generated net sales of almost $279 million in the United States, up 7% year over year, driven by prescription growth. Total prescription and new prescription demand for Linzess increased 8% and 16%, respectively, year over year.

Ironwood and AbbVie equally share Linzess’ brand collaboration profits and losses. IRWD’s share of net profit from the sales of Linzess in the United States (included in collaborative revenues) totaled $110.1 million, increasing 5% year over year.

Linzess’ collaborative revenues from U.S. sales marginally missed our model estimate of $110.3 million.

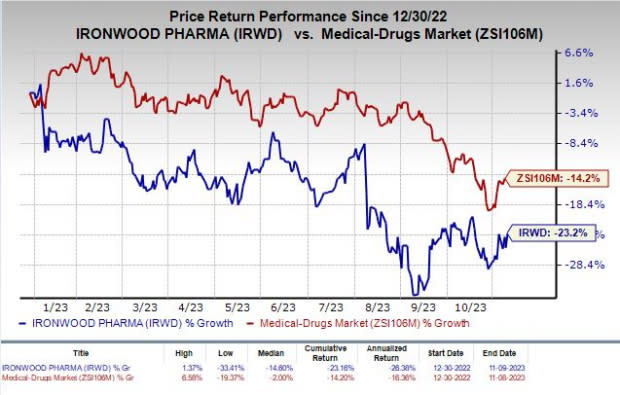

Shares of Ironwood have lost 23.2% so far this year compared with the industry’s decline of 14.2%.

Image Source: Zacks Investment Research

We note that in June 2023, ABBV received FDA approval for Linzess label expansion for treating functional constipation in pediatric patients aged 6-17 years. Following this nod, Linzess became the first and only FDA-approved prescription therapy for functional constipation in pediatric patients.

Ironwood has agreements with two partners — Astellas Pharma and AstraZeneca AZN — related to the development and commercialization of Linzess in Japan and China, respectively.

Both Astellas and AstraZeneca have exclusive rights to develop and market the drug in their respective territories. Astellas and AZN are liable to pay royalties to Ironwood on net Linzess revenues earned in their regions.

Ironwood recorded $3.6 million in royalties and other revenues, up almost 5.9% from the prior-year quarter’s figure.

As of Sep 30, 2023, Ironwood had cash and cash equivalents worth $110.2 million compared with $175.3 million as of Jun 30, 2023.

2023 Guidance

Ironwood maintained its guidance for 2023 provided earlier this year.

The company continues to expect total revenues in the range of $435-$450 million. It also anticipates U.S. sales of Linzess to grow in the band of 6-8%, unchanged from the previous expectation.

The company also expects adjusted EBITDA of approximately ($900 million) for the year. The figure includes a one-time charge of approximately $1.1 billion from the VectivBio acquisition.

Ironwood completed the buyout of Switzerland-based biotech company VectivBio in June for approximately $1.1 billion. VectivBio focuses on the development of treatments for severe and rare gastrointestinal conditions.

With the acquisition of VectivBio, Ironwood acquired rights to develop and commercialize apraglutide. The candidate is being evaluated in the phase III STARS study for treating short-bowel syndrome patients with intestinal failure. Top-line data from the same is expected in March 2024.

Apraglutide is also being evaluated in a phase II proof-of-concept study – STARGAZE – for patients with steroid-refractory gastrointestinal acute Graft versus Host Disease. Data from the study is anticipated by the first quarter of 2024.

This apart, Ironwood is developing two other pipeline candidates, IW-3300 and CNP-104.

A phase II proof-of-concept study is evaluating IW-3300 for the potential treatment of visceral pain conditions, such as interstitial cystitis/bladder pain syndrome and endometriosis.

Meanwhile, Ironwood, in collaboration with COUR Pharmaceuticals, is developing CNP-104 for treating primary biliary cholangitis (PBC). A clinical study is being conducted by COUR Pharmaceuticals to evaluate the safety, tolerability, pharmacodynamic effects and efficacy of CNP-104 in PBC patients. Top-line data from the same is expected in the third quarter of 2024.

Ironwood Pharmaceuticals, Inc. Price, Consensus and EPS Surprise

Ironwood Pharmaceuticals, Inc. price-consensus-eps-surprise-chart | Ironwood Pharmaceuticals, Inc. Quote

Zacks Rank & Stock to Consider

Ironwood currently carries a Zacks Rank #4 (Sell).

A better-ranked stock in the same sector is MEI Pharma, Inc. MEIP, sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, estimates for MEI Pharma’s 2023 loss per share have improved from $6.54 to $4.89. During the same period, loss per share estimates for 2024 have narrowed from $5.14 to $4.02. Year to date, shares of MEIP have rallied 44.9%.

Earnings of MEI Pharma beat estimates in three of the trailing four quarters and met the same on the other occasion. On average, MEIP came up with a four-quarter earnings surprise of 53.58%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AstraZeneca PLC (AZN) : Free Stock Analysis Report

Ironwood Pharmaceuticals, Inc. (IRWD) : Free Stock Analysis Report

AbbVie Inc. (ABBV) : Free Stock Analysis Report

MEI Pharma, Inc. (MEIP) : Free Stock Analysis Report