IRS crackdown on wealthy tax dodgers puts industry on alert

The IRS is ramping up collections, examinations and audits of wealthy Americans and their large partnership companies as part of a crackdown that may affect financial advisors' clients.

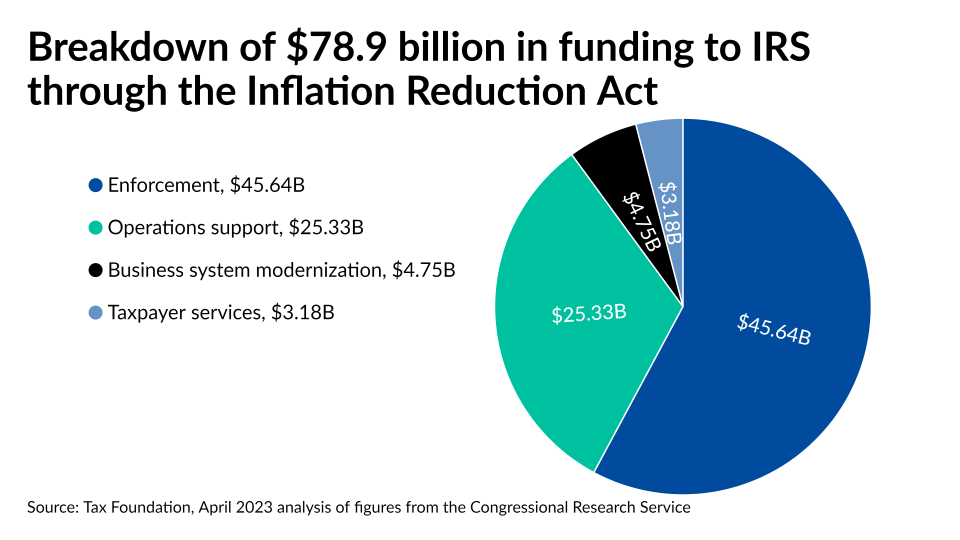

A funding hike of more than $45 billion, or 69%, for enforcement over the next decade thanks to last year's Inflation Reduction Act gives the agency the ability "to ensure the IRS holds our wealthiest filers accountable to pay the full amount of what they owe," Commissioner Danny Werfel said in a statement last week. The agency called the new enforcement a "sweeping effort to restore fairness" to the tax system and "shift attention" to the wealthy from the working class.

Citing "years of underfunding" that "led to the lowest audit rate of wealthy filers in our history," Werfel announced an artificial intelligence-enhanced push to probe 75 partnerships that have an average of more than $10 billion in assets through examinations, to recover hundreds of millions of dollars in unpaid tax debt from 1,600 filers and to contact about 500 other partnerships with more than $10 million in assets and discrepancies on their balance sheets. That latter group could face audits, depending on their response to the letters from the IRS, the agency said.

"Unquestionably, there's always unfairness in the tax system," said Niles Elber, a member in Caplin & Drysdale's Washington, D.C. office who has more than two decades of experience litigating civil and criminal tax cases. "Wealthy people hire lawyers who go in and deal with the Internal Revenue Service on their behalf. When you don't have the resources to do that and the IRS is coming after you, it's very tough to fight back."

An IRS program called the "High Wealth, High Balance Due Taxpayer Field Initiative" will focus collection efforts that were halted and curtailed during the pandemic on millionaires who have more than $250,000 in recognized tax debt. The AI technology is backing an expansion of the IRS's "Large Partnership Compliance" examination sweep by the end of the month. The agency is targeting major partnerships including hedge funds, real estate investment entities, publicly traded companies, large law firms and corporations from other industries. Early next month, the agency will send mailings to large partnerships with millions of dollars in balance-sheet discrepancies that haven't attached the required statements for clarification.

"There is a sea change taking place at the IRS in every aspect of our operations," Werfel said. "Anchored by a deep respect for taxpayer rights, the IRS is deploying new resources towards cutting-edge technology to improve our visibility on where the wealthy shield their income and focus staff attention on the areas of greatest abuse. We will increase our compliance efforts on those posing the greatest risk to our nation's tax system, whether it's the wealthy looking to dodge paying their fair share or promoters aggressively peddling abusive schemes. These steps are critical for the future of the nation's tax system."

In other aspects of the accelerated enforcement, the IRS aims to increase scrutiny of digital assets alongside new potential rules for reporting of cryptocurrency transactions, to audit hundreds of people with foreign accounts averaging over $1.4 million who may not have properly disclosed the assets and to expand probes and criminal investigations of "labor brokers" who are construction contractors paying shell companies that could flow back to themselves. The agency pledged that taxpayers earning less than $400,000 will not face higher audit rates. In addition, it's using "new fairness safeguards" for taxpayers of modest income claiming the Earned Income Tax Credit who have been audited at higher rates in recent years.

High net worth clients and business partnerships — and advisors working with them — "may want to be prepared for more targeted IRS audits," said Colin Walsh, a tax principal and practice leader of Baker Tilly's tax advocacy and controversy services group.

"IRS audits have traditionally been a regimented process under which issues are identified after several meetings and information requests," Walsh said in an email. "With AI, we expect that the IRS will identify issues early in the process, possibly even before the audit, which will be beneficial. Taxpayers and their representatives should prepare accordingly. All of this underscores the need for high-income net worth individuals and partnerships to work with a reputable, experienced and ethical firm when it comes to their taxes."

The technology will give the IRS more ways of comparing a single tax return to hundreds or thousands of similar ones and detecting statistical anomalies, but the AI could also "possibly flag issues that are perfectly explainable and justifiable upon review," Walsh noted.

Stilted negotiations around a potential government shutdown when the current federal funding expires at the end of the month could affect the way that the IRS deploys the technology and the overall program, too, according to Elber. The technology could help the agency "unravel the inner workings of these partnerships," he said, describing their structures as "incredibly opaque" in some cases yet "fairly common" in the tax and wealth management industries alongside other pass-through entities such as LLCs and S-corporations.

"I think it is a bit frightening because I don't know that the technology is advanced enough," Elber said. "Financial advisors are going to work with people who have money. People who have money tend to have these structures."