Who Qualifies For the Child and Dependent Care Credit?

Hiring someone to care for your loved one so you can continue working is a common practice in the U.S. If a child, spouse or other household member requires care and you can’t provide the care without quitting your job, you’re not alone. A financial advisor can help you optimize your tax strategy to meet your household needs and financial goals. Depending on your eligibility, you may be eligible to claim a tax credit to defray the expenses associated with that care.

Check out our income tax calculator.

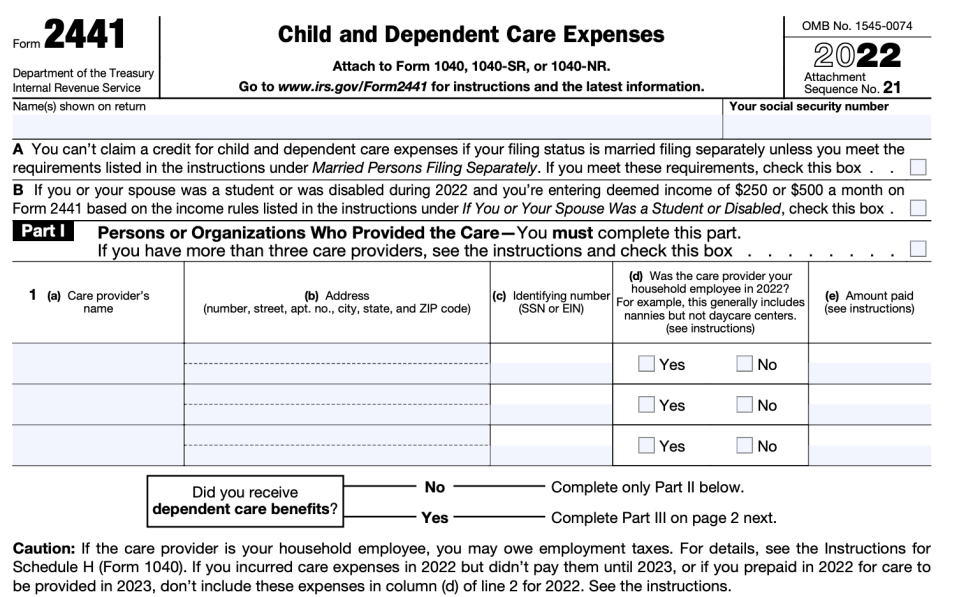

IRS Form 2441: Child and Dependent Care Expenses

IRS Form 2441, Child and Dependent Care Expenses, is a two-page tax form that will take some time and concentration to fill out correctly. In previous years, the resulting credit likely wouldn’t pay you back for all your care expenses, either, since it was capped at $3,000 for the care of one person and $6,000 for the care of two or more people. However, for tax year 2021, the credit was worth $8,000 if you had one qualifying person and $16,000 if you have two or more qualifying persons. The increased value of the credit was the result of the American Rescue Plan Act of 2021, passed in response to the COVID-19 pandemic. For tax year 2022, the credit has reverted back to $3,000 (a maximum credit of $1,050) for one child or dependent and $6,000 (for a maximum credit of $2,100) for the care of two or more.

Who Qualifies for the Child and Dependent Care Credit?

To qualify for the Child and Dependent Care Tax Credit you must meet certain eligibility requirements. Most importantly, you must have paid someone else to provide care so that you could work or look for work.

The care you paid for must have been for a dependent child under age 13 or for a spouse or other household member who is physically or mentally incapable of self-care. If you’re filing single, you must have earned income to claim the tax credit, income that you’re reporting on your Form 1040. If you’re married and filing jointly, you and your spouse must both have earned income, unless one of you was a full-time student or has a disability. With a few exceptions (such as for separated spouses), couples who are married and filing separately can’t claim the tax credit.

The care expenses for which you’re claiming the tax credit must have been paid to someone outside of the household. You can’t use the credit for money you paid to your spouse, to the parent of the household member in need of care, to a dependent of yours or to a child who will not be age 19 or older by the end of the year (even if that child isn’t your dependent). The first step when filling out Form 2441 is to identify the caregiver or caregivers you paid. Remember that if one or more of those caregivers worked in your home you may be liable for nanny taxes on behalf of your household employees.

How to Fill Out Form 2441

Part I

The point of Form 2441 is to prove to the IRS that you’re eligible for the Child and Dependent Care Tax Credit, to indicate the eligible care costs you incurred during the tax year and to declare your income. In Part I, you’ll write the name(s) or the person or people who provided the care you paid for. For each caregiver you list, you’ll also write the address, Social Security number (or Employer Identification number) and the amount you paid.

Once you’ve filled out Part I you have two choices. If you received dependent care benefits, head to Part III before completing Part II. If you didn’t receive dependent care benefits, go straight to Part II.

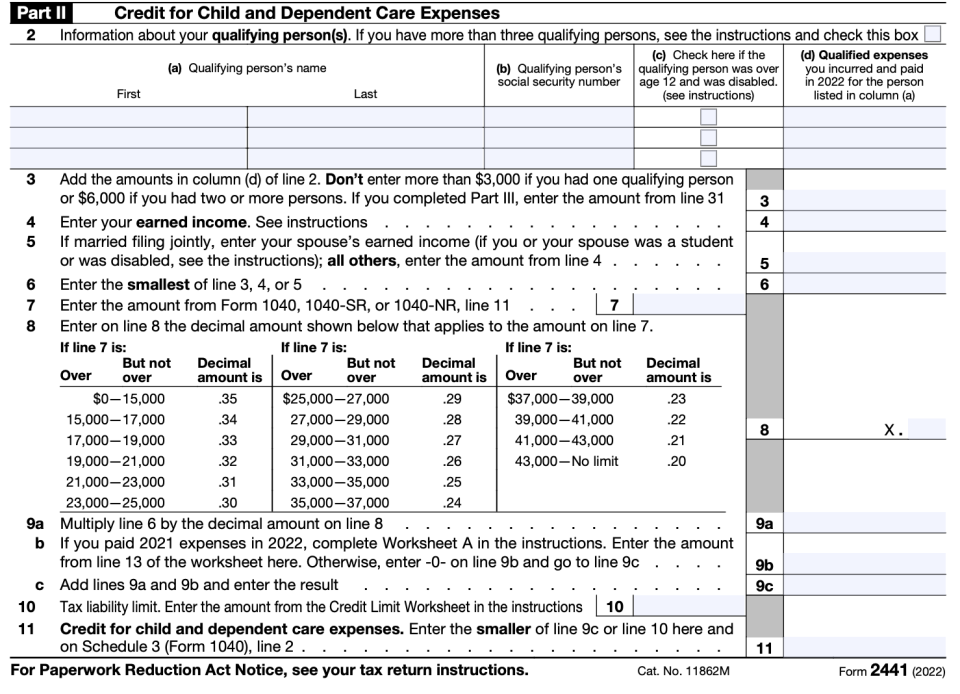

Part II

Part II concerns the credit itself and it’s where you calculate the tax credit you’re eligible to claim. First, you’ll write the name(s), Social Security Number(s) and “qualified expenses” for each person or people whose care you’ve paid for. Add up those amounts paid (if you’re claiming for more than one person) and enter the sum in Line 3 – unless you went straight to Part III, in which case you’ll write the amount from Line 31 in Part II.

Lines 4 and 5 are where you enter your own earned income and your spouse’s earned income (if applicable). Then, on Line 6, enter the smallest of Lines 3, 4 or 5. On Line 7, enter the amount from Form 1040, line 7 or Form 1040NR, line 36, depending on which form you’re using to declare your income. On Line 8, use the chart to find the decimal amount that corresponds to what you wrote in Line 7. On Line 9, multiply Line 6 by the decimal from Line 8. This is where you reduce your tax credit by a certain percentage that varies based on your income. People with lower incomes get to keep more of their credit. On Line 10, enter your tax liability limit from the attached worksheet. On Line 11, enter the smaller of Line 9 or Line 10. You should also write your Line 11 result (the credit itself) on line 49 of Schedule 3 (Form 1040) or on line 47 of Form 1040NR. And that’s Part II finished. Line 11 shows you your credit.

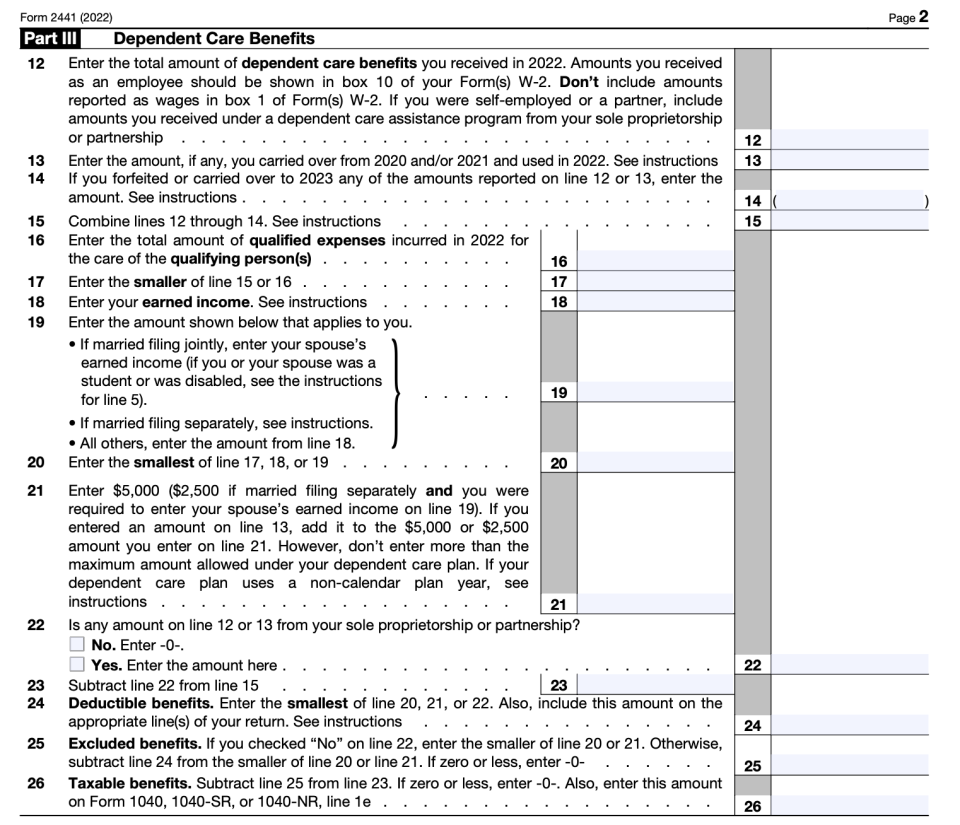

Part III

If you received dependent care benefits, you will have skipped to Part III. What are dependent care benefits, you ask? They’re the benefits an employee gets from an employer to cover child or other other dependent care expenses. Those benefits can take the form of a stipend, the fair market value of employer-provided daycare or even the money that you put into your flexible spending account (FSA) to cover care expenses.

If you received dependent care benefits, they’ll appear in box 10 of the W-2 form your employer gives you before tax time. Enter those benefits on Line 12 of Form 2441. On Line 13, enter the amount of benefits you carried over from a previous year, if applicable. On Line 14, enter the amount you’re forfeiting or carrying over, if applicable.

On Lines 15 – 26 you’ll adjust those benefits according to the instructions on Form 2441. Adjustments will be based on your income, your spouse’s income (if applicable), the type of benefits you received and your filing status. There will be instructions to help you reconcile Form 2441 with your 1040 or 1040NR.

The point of this process is to prevent you from getting a double tax break. If you received tax-free benefits to cover care, you’ll reduce your credit-eligible expenses accordingly so you’re not claiming a tax credit on expenses you paid for in part with tax-free money.

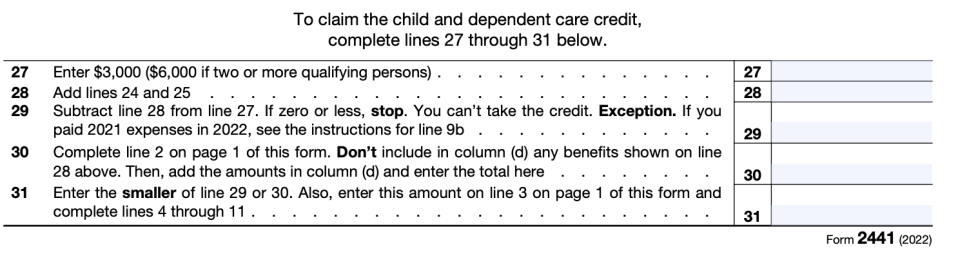

OK, so you’ve declared and adjusted the dependent care benefits you received. Lines 27 – 31 are where you start claiming the Child and Dependent Care Tax Credit that was the whole reason you started Form 2441 in the first place. Take the number from Line 31 of Part III and enter it on Line 3 of Part II. Then follow the instructions for Lines 4 – 11 to calculate your credit. And you’re done!

Bottom Line

Providing care is a part of life and the IRS wants to give a tax break to people who pay for care so that they can stay in the workforce. If you qualify for the Child and Dependent Care Tax Credit, it’s a great way to cut your tax bill, even if the credit falls short of what many people pay in care costs. While the American Rescue Plan Act made the Child and Dependent Care Tax Credit was worth $8,000 for one qualifying dependent and $16,000 for two or more, it has reverted back in 2022 to $3,000 (a maximum credit of $1,050) for one child or dependent and $6,000 (for a maximum credit of $2,100) for the care of two or more.

Tips for Calculating Your Taxes

Whether you need help tax planning, investing or retirement planning, a financial advisor can help you create a financial plan for you and your family. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three vetted financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

If you don’t know whether you’re better off with the standard deduction versus itemizing your deductions, you might want to read up on it and do some math. Educating yourself before the tax return deadline could help you reduce your tax liability.

A financial advisor who specializes in tax planning could help you lower your capital gains taxes with a tax-loss harvesting strategy that allows you to offset stock gains with your stock losses.

Photo credit: ©iStock.com/goldenKB, images of Form 2441 come from IRS.gov, ©iStock.com/kdshutterman

The post All About IRS Form 2441 appeared first on SmartAsset Blog.