Itau Unibanco (ITUB) Q2 Earnings & Revenues Increase Y/Y

Itau Unibanco Holding S.A. ITUB posted recurring managerial results of R$8.74 billion ($1.78 billion) for second-quarter 2023, up 13.8% year over year.

The results were supported by higher revenues and an increase in managerial financial margin. Rising total deposits and assets reflected a strong balance sheet position. However, an escalation in non-interest expenses was an offsetting factor.

Revenues & Costs Increase

Operating revenues were R$38.83 billion ($7.93 billion) in the reported quarter, up 10.2% on a year-over-year basis.

Managerial financial margin jumped 14.8% year over year to R$26 billion ($5.31 billion). However, commissions and fees were down 1.3% to R$10.36 billion ($2.11 billion).

Non-interest expenses totaled R$14.27 billion ($2.91 billion), up 7.2% year over year.

In the second quarter, efficiency ratio was 39.6%, down from 40.8% in the year-earlier quarter. A decrease in this ratio indicates increased profitability.

Credit Quality Weak

The cost of credit charges climbed 25.3% on a year-over-year basis to R$9.44 billion ($1.93 billion).

Non-performing loan ratio (loan transactions overdue more than 90 days) was 3% in the second quarter, up from the prior-year quarter’s 2.7%.

Balance Sheet Position Strong

As of Jun 30, 2023, Itau Unibanco’s total assets rose 1.5% to R$2.59 trillion ($0.53 trillion) from the last reported quarter. Liabilities, including deposits, debentures, securities, borrowings and on lending totaled R$1.31 trillion ($0.27 trillion), inching up 1% on a sequential basis.

Itau Unibanco’s credit portfolio, including corporate securities and financial guarantees provided, declined marginally from the last quarter’s reported figure to R$1.15 trillion ($0.24 trillion) as of Jun 30, 2023.

Capital & Profitability Ratios Rise

As of Jun 30, 2023, the Common Equity Tier 1 ratio was 12.2%, up from 11.1% as of Jun 30, 2022.

Annualized recurring managerial return on average equity was 20.9% in the second quarter, up from 20.8% in the year-earlier quarter.

Our Viewpoint

Itau Unibanco’s second-quarter results were driven by a rise in managerial financial margin. The declining efficiency ratio indicates a rise in profitability, which is a positive factor. However, weak credit quality was concerning.

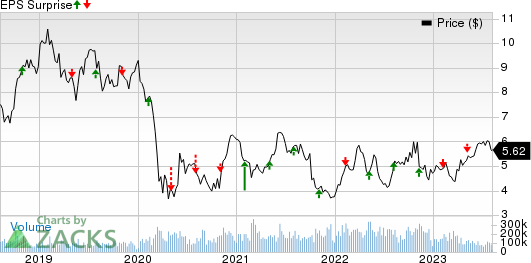

Itau Unibanco Holding S.A. Price and EPS Surprise

Itau Unibanco Holding S.A. price-eps-surprise | Itau Unibanco Holding S.A. Quote

Itau Unibanco currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Foreign Banks

Deutsche Bank DB reported second-quarter 2023 profits attributable to shareholders of €763 million ($831 million), down 27% from the year-ago quarter. The Germany-based lender reported profit before tax of €1.41 billion ($1.53 billion), down 9% year over year.

Results of DB were largely driven by higher net revenues and strong capital position. However, higher provisions for credit losses and a rise in operating expenses were offsetting factors.

Barclays BCS reported second-quarter 2023 net income attributable to ordinary equity holders of £1.33 billion ($1.66 billion), up 24% from the prior-year quarter.

BCS recorded an increase in expenses and lower revenues in the reported quarter. Also, higher credit impairment charges hurt results to some extent.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Barclays PLC (BCS) : Free Stock Analysis Report

Deutsche Bank Aktiengesellschaft (DB) : Free Stock Analysis Report

Itau Unibanco Holding S.A. (ITUB) : Free Stock Analysis Report