Itron (ITRI) Benefits From Steady Momentum Across Segments

Itron’s ITRI top-line performance is benefiting from strength in momentum across all business segments — Device Solutions, Networked Solutions and Outcomes.

In the last reported quarter, revenues from Device Solutions were $111 million (19.8% of total revenues), up 18% from the year-ago quarter due to higher demand for water meter sales.

Networked Solutions revenues totaled $385 million (68.7%), up 43% year over year, driven by the easing of supply-chain issues. Outcomes segment’s revenues of $65 million (11.6%) increased 14% on a year-over-year basis due to higher recurring services revenues.

The company’s overall top line improved 33% year over year to $561 million. Itron’s bookings were $413 million and its backlog amounted to $4.3 billion at the end of the last reported quarter.

On the back of strong third-quarter results, the company made upward revisions to its 2023 guidance. It now projects revenues to be between $2.16 billion and $2.17 billion. Non-GAAP earnings per share (EPS) are estimated in the band of $2.83-$2.93.

Earlier, ITRI predicted revenues in the range of $2.11-$2.14 billion. Non-GAAP EPS were envisioned to be between $2.03 and $2.28.

Growth Catalysts

Continued momentum in software license sales driven by Distributed Intelligence offerings bodes well. It expects increased demand for electric vehicles and distributed energy resource management to drive customer bookings in the future. Management suggests bookings to be $2 billion for 2023.

Accelerating trends in electrification, gas safety, energy transition, grid-edge digitalization and water efficiency are likely to drive demand for the company’s solutions going forward. Management noted that utilities across the Asia-Pacific region are working on improving grid stability and reliability. This represents a solid opportunity for Itron.

ITRI’s extensive restructuring efforts to cut down on overhead expenses, and streamline its supply chain and manufacturing operations augur well. Strategic collaboration and frequent product launches are added positives.

However, rising operating expenses coupled with a leveraged balance sheet remain major headwinds. As of Sep 30, 2023, cash and cash equivalents totaled $254.8 million, while net long-term debt was $454.3 million.

Uncertainty prevailing over global macroeconomic conditions, as well as volatile supply-chain dynamics, remain concerning.

A Look at Estimates

Revenues for 2023 and 2024 are forecast to rise 20.6% and 5.8% to $2.17 billion and $2.29 billion, respectively.

Itron’s EPS are expected to climb 155% and 9.2% to $2.88 and $3.14 in 2023 and 2024, respectively. The Zacks Consensus Estimate for 2023 and 2024 EPS has improved by 7.1% and 5.7%, respectively, in the past 60 days.

ITRI’s long-term earnings growth rate is pegged at 23%.

The company’s PE ratio is pegged at 23.04, below the industry’s ratio of 36.80.

Zacks Rank & Share Price Movement

Currently, Itron carries a Zacks Rank #2 (Buy).

Apart from a favorable rank, ITRI has a VGM Score of A. Per Zacks proprietary methodology, stocks with a combination of a Zacks Rank #1 (Strong Buy) or 2 and a VGM Score of A or B offer solid investment opportunities.

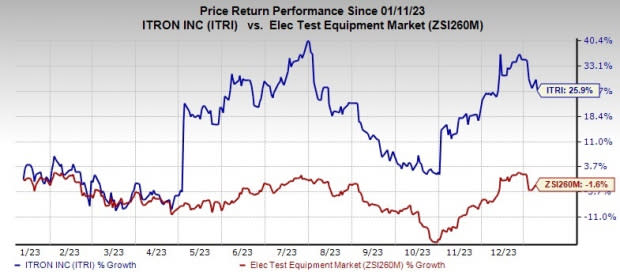

Itron’s shares have rallied 25.9% in the past year compared with 1.6% decline of the sub-industry.

Moreover, it is trading 11.7% below its 52-week high price of $79.99, reflecting upside potential.

Image Source: Zacks Investment Research

Other Stocks to Consider

Some other top-ranked stocks worth consideration in the broader technology space are Watts Water Technologies WTS, NETGEAR NTGR and Blackbaud BLKB. While NETGEAR and Blackbaud currently sport a Zacks Rank #1 each, Watts Water carries a Zacks Rank of 2. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Watts Water Technologies’ 2023 EPS has improved by 1% in the past 60 days to $8.08.

WTS’ earnings surpassed the Zacks Consensus Estimate in each of the last four quarters, the average surprise being 11.8%. Shares of WTS have jumped 25.5% in the past year.

The Zacks Consensus Estimate for 2023 is pegged at a loss of 9 cents per share for NETGEAR, which remained unchanged in the past 30 days. NTGR’s earnings outpaced the Zacks Consensus Estimate in three of the last four quarters while missing once. The average surprise was 127.5%. Shares of NTGR were down 27.3% in the past year.

The Zacks Consensus Estimate for Blackbaud’s 2023 EPS has improved by 1% in the past 60 days to $3.86.

BLKB’s earnings surpassed the Zacks Consensus Estimate in each of the last four quarters, the average surprise being 10.6%. Shares of BLKB have gained 32.4% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Itron, Inc. (ITRI) : Free Stock Analysis Report

NETGEAR, Inc. (NTGR) : Free Stock Analysis Report

Blackbaud, Inc. (BLKB) : Free Stock Analysis Report

Watts Water Technologies, Inc. (WTS) : Free Stock Analysis Report