ITT Boosts Brake Pad Offerings Via Investment in Italy Plant

ITT Inc. ITT is making an initial investment of €50 million ($54.49 million) to expand a Friction manufacturing facility in Termoli, Italy, and enhance the research and development competence in Barge, Italy. With this investment, the company aims to boost its position in the brake pad market for luxury and sporting vehicles.

Friction is a unit of ITT’s Motion Technologies segment. The segment specializes in manufacturing highly engineered and durable components, such as brake pads, shock absorbers and damping technologies for the transportation industry.

ITT started building the Termoli facility this month. The investment expands the plant’s covered surface by 75%. The plant’s features like fast prototyping, amplified testing machinery and automated production module will handle the challenging specifications of the high-performance brake pads. Also, the company-installed solar panels will cater to 20% of the plant’s electricity demand, bolstering ITT’s carbon reduction goals.

ITT expects that the high-performance brake pads market to grow to approximately 11 million by 2026. Friction’s leading position in material science and its long-established relationships with premium auto original equipment producers are likely to benefit the company’s high-performance brake pad product line.

ITT aims to serve customers who are in need of high-quality, high-performance and reliable brake pads by expanding its capacity in the high-performance brake pad market. The recent investment in Termoli and Barge as well as Friction’s testing and research and development proficiency is likely to boost ITT’s competitive edge.

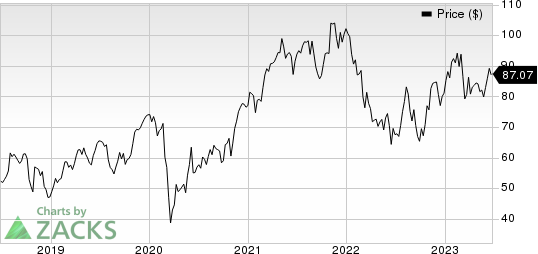

ITT Inc. Price

ITT Inc. price | ITT Inc. Quote

The Termoli facility is likely to become operational by mid-2024 and the production of the new brake pad lines will commence in the fourth quarter of 2024.

Zacks Rank & Stocks to Consider

ITT currently carries Zacks Rank #3 (Hold). Some better-ranked stocks are discussed below:

Griffon Corporation GFF sports a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks.

GFF delivered a trailing four-quarter earnings surprise of 12.5%, on average. In the past 60 days, Griffon’s earnings estimates have increased 2.4% for fiscal 2023. The stock has gained 4.6% in the year-to-date period.

Ingersoll Rand Inc. IR presently sports a Zacks Rank of 1. IR delivered a trailing four-quarter earnings surprise of 12.6%, on average.

In the past 60 days, estimates for Ingersoll Rand’s 2023 earnings have increased 6.7%. The stock has risen 21.2% in the year-to-date period.

Alamo Group Inc. ALG currently sports a Zacks Rank of 1. ALG delivered a trailing four-quarter earnings surprise of 17.7%, on average.

In the past 60 days, estimates for Alamo’s 2023 earnings have increased 12.7%. The stock has gained 28.1% in the year-to-date period.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ITT Inc. (ITT) : Free Stock Analysis Report

Ingersoll Rand Inc. (IR) : Free Stock Analysis Report

Alamo Group, Inc. (ALG) : Free Stock Analysis Report

Griffon Corporation (GFF) : Free Stock Analysis Report