ITT's Board Approves New $1B Share Buyback Authorization

ITT Inc.’s ITT board has approved a $1 billion share repurchase program for an indefinite time. The program will be effective upon expiration of the current $500 million authorization.

ITT has been committed to rewarding its shareholders through dividends and share buybacks. In the first six months of 2023, dividend payments totaled $48.1 million and share repurchases were $60 million. In February, the company hiked its dividend by 10%. In 2022, ITT bought back shares worth $245.3 million and paid out dividends of $87.9 million.

Apart from announcing a new share buyback program, ITT has elected Nazzic Keene and Kevin Berryman to its board of directors.

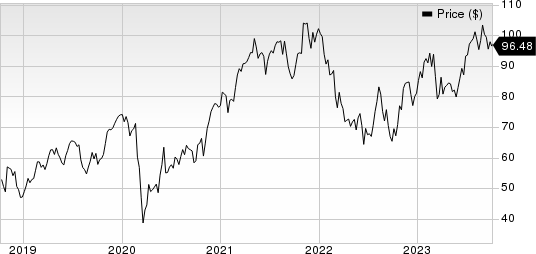

ITT Inc. Price

ITT Inc. price | ITT Inc. Quote

ITT focuses on strengthening and expanding its business through acquisitions. In May 2023, the company acquired Micro-Mode Products, Inc, enhancing its product portfolio and customer base for long-term defense programs. The buyout has expanded ITT’s existing North American connectors platform.

Last August, ITT acquired Clippard Instrument Laboratories’ product lines, expanding its Compact Automation product offering in the robotics, packaging and automation end markets. In June 2022, ITT acquired CRP Technology and CRP USA (jointly CRP), expanding its additive manufacturing technology capabilities and strengthening its position in the material science space.

Zacks Rank & Other Stocks to Consider

ITT presently carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks are as follows:

Griffon Corporation GFF currently carries a Zacks Rank #2. The company pulled off a trailing four-quarter earnings surprise of 30.4%, on average. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks.

Griffon has an estimated earnings growth rate of 7.6% for the current fiscal year. The stock has gained 9.3% in the year-to-date period.

Markel Group Inc. MKL is also a Zacks Rank #2 player. The company delivered a trailing four-quarter earnings surprise of 10%, on average.

Markel Group has an estimated earnings growth rate of 26% for the current year. The stock has gained 11% so far this year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ITT Inc. (ITT) : Free Stock Analysis Report

Markel Group Inc. (MKL) : Free Stock Analysis Report

Griffon Corporation (GFF) : Free Stock Analysis Report