Ituran Location and Control (NASDAQ:ITRN) Has A Rock Solid Balance Sheet

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. As with many other companies Ituran Location and Control Ltd. (NASDAQ:ITRN) makes use of debt. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for Ituran Location and Control

How Much Debt Does Ituran Location and Control Carry?

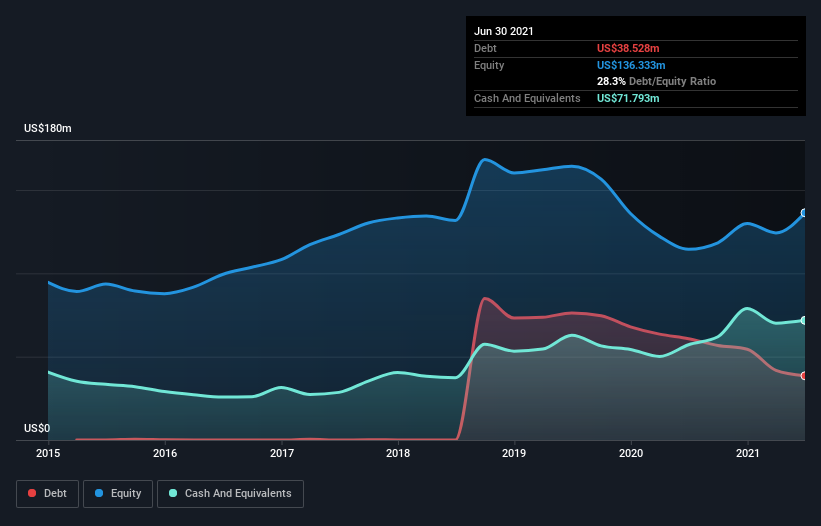

You can click the graphic below for the historical numbers, but it shows that Ituran Location and Control had US$38.5m of debt in June 2021, down from US$60.8m, one year before. However, its balance sheet shows it holds US$71.8m in cash, so it actually has US$33.3m net cash.

How Strong Is Ituran Location and Control's Balance Sheet?

We can see from the most recent balance sheet that Ituran Location and Control had liabilities of US$117.2m falling due within a year, and liabilities of US$56.5m due beyond that. Offsetting these obligations, it had cash of US$71.8m as well as receivables valued at US$45.9m due within 12 months. So it has liabilities totalling US$56.1m more than its cash and near-term receivables, combined.

Of course, Ituran Location and Control has a market capitalization of US$546.1m, so these liabilities are probably manageable. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time. While it does have liabilities worth noting, Ituran Location and Control also has more cash than debt, so we're pretty confident it can manage its debt safely.

And we also note warmly that Ituran Location and Control grew its EBIT by 20% last year, making its debt load easier to handle. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Ituran Location and Control's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. While Ituran Location and Control has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Over the last three years, Ituran Location and Control recorded free cash flow worth a fulsome 90% of its EBIT, which is stronger than we'd usually expect. That positions it well to pay down debt if desirable to do so.

Summing up

While Ituran Location and Control does have more liabilities than liquid assets, it also has net cash of US$33.3m. The cherry on top was that in converted 90% of that EBIT to free cash flow, bringing in US$47m. So we don't think Ituran Location and Control's use of debt is risky. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. Be aware that Ituran Location and Control is showing 1 warning sign in our investment analysis , you should know about...

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.