J. B. Hunt (JBHT) Continues to Grapple With Segmental Weakness

J.B. Hunt Transport Services, Inc. JBHT third-quarter 2023 revenues of $3,163.8 million lagged the Zacks Consensus Estimate of $3,224 million and fell 18% year over year. Total operating revenues, excluding fuel surcharges, decreased 15% year over year. The downfall was due to a decline in revenue per load of 14% in Intermodal, 22% in Truckload, a 38% decline in volume in Integrated Capacity Solutions, a 20% decrease in stops in Final Miles Services, and a 1% decline in average revenue producing trucks in Dedicated Contract Services.

Higher net interest expense is likely to mar J.B. Hunt’s bottom line. JBHT continues to incur higher interest expenses owing to higher interest rates and debt issuance costs. Net interest expense for the first nine months of 2023 increased 7.7% year over year due to higher effective interest rates.

J.B. Hunt’s weak cash position is also worrisome. JBHT's cash and cash equivalents were $75.19 million at the third quarter of 2023-end, much lower than the long-term debt of $1,195.70 million.

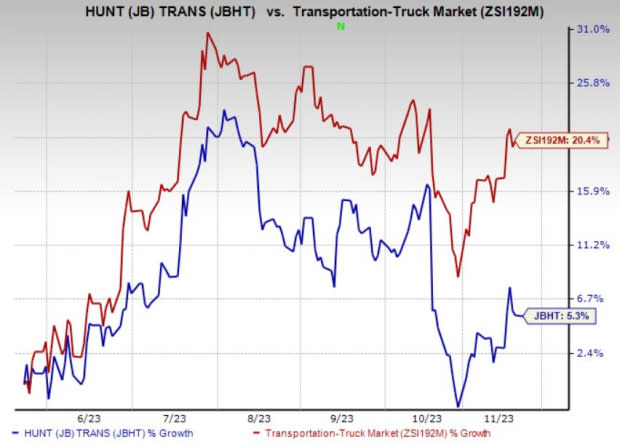

Partly due to these headwinds, shares of JBHT, despite gaining 5.3%, have underperformed its industry’s growth of 20.4% in the past six months.

Image Source: Zacks Investment Research

On the flip side, we are impressed by the company’s efforts to reward its shareholders through dividend payments and share repurchases. During the first nine months of 2023, JBHT purchased almost 765,000 shares for $135.0 million and paid dividends worth $130.54 million. As of Sep 30, 2023, JBHT had approximately $416 million remaining under its share repurchase authorization.

Declining operating expenses due to lower fuel costs, purchased transportation costs, and salaries, wages and benefits expenses, have the potential to boost J.B. Hunt's bottom line. During the first nine months of 2023, operating expenses fell 13.6% year over year.

Zacks Rank and Stocks to Consider

J.B. Hunt currently carries a Zacks Rank #5 (Strong Sell).

Some better-ranked stocks from the Zacks Transportation sector are Westinghouse Air Brake Technologies Corporation, operating as Wabtec Corporation WAB and SkyWest, Inc. SKYW. Each stock presently carries a Zacks Rank of 2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Wabtec has an expected earnings growth rate of 20.99% for the current year. WAB delivered a trailing four-quarter earnings surprise of 7.11%, on average.

The Zacks Consensus Estimate for WAB’s current-year earnings has improved 4.9% over the past 90 days. Shares of WAB have gained 11.6% year to date.

SkyWest's fleet-modernization efforts are commendable. The Zacks Consensus Estimate for WAB’s current-year earnings has improved 18.4% over the past 90 days. Shares of SKYW have surged 160% year to date.

SKYW delivered a trailing four-quarter earnings surprise of 32.57%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

J.B. Hunt Transport Services, Inc. (JBHT) : Free Stock Analysis Report

SkyWest, Inc. (SKYW) : Free Stock Analysis Report

Westinghouse Air Brake Technologies Corporation (WAB) : Free Stock Analysis Report