J.B. Hunt (JBHT) Q3 Earnings & Revenues Beat Estimates, Up Y/Y

J.B. Hunt Transport Services, Inc. JBHT reported better-than-expected third-quarter 2022 results, wherein both earnings and revenues outperformed the Zacks Consensus Estimate.

Quarterly earnings of $2.57 per share surpassed the Zacks Consensus Estimate of $2.45 and improved 36.7% year over year.

Total operating revenues of $3,838.3 million also outperformed the Zacks Consensus Estimate of $3803.4 million. The top line jumped 22.1% year over year on the back of strength across — Dedicated Contract Services (DCS), Intermodal (JBI), Truckload (JBT) and Final Mile Services (FMS) segments. Total operating revenues, excluding fuel surcharges, rose 12.4% year over year.

The quarterly operating income (on a reported basis) climbed 32.3% to $362.23 million due to customer rate, cost-recovery efforts and higher volumes related to the company’s DCS, JBI and JBT business units. These were partially offset by higher rail and truck purchased transportation costs, increased investments related to attracting and retaining professional drivers, office personnel, and maintenance technicians, higher equipment-related and maintenance expenses, and costs associated with inefficiencies in container utilization in JBI and the onboarding of newly awarded business in both DCS and FMS.

Operating expenses escalated 21.1% to $3.48 billion.

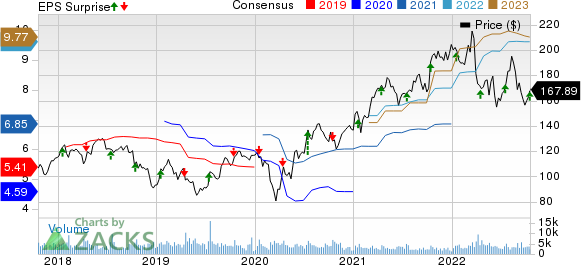

J.B. Hunt Transport Services, Inc. Price, Consensus and EPS Surprise

J.B. Hunt Transport Services, Inc. price-consensus-eps-surprise-chart | J.B. Hunt Transport Services, Inc. Quote

Segmental Highlights

Intermodal division generated quarterly revenues of $1.84 billion, up 30% year over year. Revenue per load climbed 26% in the quarter under discussion. Volumes increased 4% year over year. While Eastern network loads increased 7%, transcontinental loads rose 1%.

Despite strong demand, volumes were affected by network inefficiencies and container utilization challenges due to rail velocity and customer behavior. Operating income soared 31% year over year to $217 million, driven by an increase in volume, customer rate and cost-recovery efforts.

Dedicated Contract Services segment revenues rose 34% from the year-ago period to $894 million, owing to fleet productivity improvement and an increase in average revenue-producing trucks. The company’s fleet, at the end of the quarter, had 1,836 more revenue-producing trucks (on a net basis) versus a year ago. Operating income increased 32% to $103.1 million.

Integrated Capacity Solutions revenues decreased 11% year over year to $591 million. While segmental volumes decreased 8% and truckload volumes declined 1%. Revenue per load fell 4%, as lower revenue per load in the company’s transactional business has partially offset higher contractual rates in the truckload business and changes in the customer freight mix. Operating income decreased 8% to $13.5 million.

Final Mile Services revenues ascended 21% year over year to $249 million due to the addition of multiple customer contracts over the last year and benefits from the acquisition of Zenith Freight Lines, which closed in February-end. The segment’s operating income was $9.6 million in the reported quarter compared with $1.3 million in the third quarter of 2021.

Truckload revenues soared 34% to $274 million. Excluding fuel surcharge revenues, segmental revenues rose 24% year over year due to increased load volume and higher revenue per load excluding fuel surcharge revenue. At the end of the second quarter, total tractors and trailers were 2,684 and 13,751, respectively, compared with the year-ago quarter’s figures of 1,965 and 9,906. The Truckload operating income grew 30% to $19 million on increased load counts and revenue per load.

Liquidity & Buyback

J.B. Hunt exited the third quarter with cash and cash equivalents of $84.33 million compared with $123.84 million at the end of June 2022. Long-term debt was $1,243.81 million compared with $945.99 million at June-end.

Net capital expenditures for the first quarter were $419.93 million compared with $250.36 million in the year-ago period.

During the reported quarter, J.B. Hunt repurchased around 349,000 shares for approximately $61 million. The trucking company had approximately $551 million remaining under its share repurchase authorization at the end of the third quarter.

Currently, J.B. Hunt carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Transportation Companies

Delta AirLines’ DAL third-quarter 2022 earnings (excluding 42 cents from non-recurring items) of $1.51 per share fell short of the Zacks Consensus Estimate of $1.56. Escalated operating expenses induced the earnings miss.

Multiple flight cancelations and booking weaknesses due to Hurricane Ian also hurt results. DAL reported earnings of 30 cents per share a year ago, dull in comparison to the current scenario, as air-travel demand was not so buoyant then.

DAL reported revenues of $13,975 million, which lagged the Zacks Consensus Estimate of $14,157.2 million. Driven by the high air-travel demand, total revenues increased more than 52% on a year-over-year basis.

United Airlines’ UAL third-quarter 2022 earnings (excluding 5 cents from non-recurring items) of $2.81 per share beat the Zacks Consensus Estimate of $2.21 and our estimate of $2.17. An upbeat in air-travel demand aided results.

In the year-ago quarter, UAL incurred a loss of $1.02 per share when air-travel demand was not as buoyant as in the current scenario. The third quarter of 2022 was the second consecutive profitable quarter at UAL since the onset of the pandemic.

Operating revenues of $12,877 million beat the Zacks Consensus Estimate of $12,709.5 million and our estimate of $12, 631.6 million. UAL’s revenues increased more than 66% year over year owing to an upbeat in air-travel demand. The optimistic air-travel demand scenario is also evident from the fact that total operating revenues increased 13.2% from third-quarter 2019 (pre-coronavirus) levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Delta Air Lines, Inc. (DAL) : Free Stock Analysis Report

United Airlines Holdings Inc (UAL) : Free Stock Analysis Report

J.B. Hunt Transport Services, Inc. (JBHT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research