J&J (JNJ) Gets FDA Panel Vote for Carvykti's Expanded Use

Johnson & Johnson JNJ announced that an FDA committee has unanimously recommended expanded use of its multiple myeloma drug Carvykti for earlier lines of treatment.

J&J is looking for expansion of Carvykti’s label to include treatment of adult patients with relapsed or refractory multiple myeloma who have received at least one prior line of therapy, including a proteasome inhibitor (PI) and an immunomodulatory agent (IMiD) and who are refractory to Bristol-Myers Squibb’s Revlimid (lenalidomide).

The FDA’s Oncologic Drugs Advisory Committee voted 11-0 after reviewing survival and safety data from the phase III CARTITUDE-4 study, which was the basis for the supplemental biologics license application (sBLA) filing. The committee found the risk-benefit assessment of Carvykti for the proposed expanded use favorable.

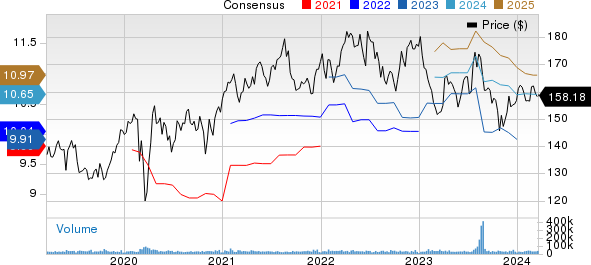

In the past year, J&J’s shares have risen 2.8% compared with the industry’s 30.5% increase.

Image Source: Zacks Investment Research

The CARTITUDE-4 study achieved its primary endpoint of progression-free survival with statistical significance. Treatment with the therapy reduced the risk of disease progression by 74% when compared to the current standard of care treatments. The FDA’s decision on the sBLA is expected on Apr 5.

At present, Carvykti is approved for the treatment of adults with relapsed or refractory multiple myeloma after four or more prior lines of therapy, including a PI, an IMiD agent and an anti-CD38 monoclonal antibody.

J&J has also submitted a Type II variation application to the European Medicines Agency seeking label expansion for Carvykti for the treatment of adult patients with relapsed and lenalidomide-refractory multiple myeloma. Last month, the Committee for Medicinal Products for Human Use gave a positive opinion recommending approval of Carvykti for the above-mentioned expanded use.

Zacks Rank and Stocks to Consider

J&J currently has a Zacks Rank #3 (Hold).

Johnson & Johnson Price and Consensus

Johnson & Johnson price-consensus-chart | Johnson & Johnson Quote

Some better-ranked stocks in the healthcare sector are Vanda Pharmaceuticals VNDA, ADMA Biologics ADMA and GSK, plc GSK, all with a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, 2024 estimates for Vanda Pharmaceuticals have improved from a loss of 46 cents to earnings of 1 cent. For 2025, loss estimates have narrowed from 94 cents to 48 cents per share in the past 60 days. In the past year, shares of VNDA have declined 42.3%.

Vanda Pharmaceuticals delivered a three-quarter average earnings surprise of 92.88%.

In the past 60 days, estimates for ADMA Biologics’ 2024 earnings per share have improved from 22 cents to 30 cents, while that for 2025 has increased from 32 cents to 50 cents. In the past year, shares of ADMA Biologics have risen 94.5%.

Earnings of ADMA Biologics beat estimates in three of the last four quarters while meeting the same once. ADMA delivered a four-quarter average earnings surprise of 85.0%.

In the past 60 days, estimates for GSK’s 2024 earnings per share have improved from $3.87 to $4.03, while that for 2025 has increased from $4.20 per share to $4.39. In the past year, shares of GSK have risen 20.8%.

Earnings of GSK beat estimates in three of the last four quarters while missing the same once. GSK delivered a four-quarter average earnings surprise of 7.59%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

GSK PLC Sponsored ADR (GSK) : Free Stock Analysis Report

Johnson & Johnson (JNJ) : Free Stock Analysis Report

Vanda Pharmaceuticals Inc. (VNDA) : Free Stock Analysis Report

ADMA Biologics Inc (ADMA) : Free Stock Analysis Report