J&J (JNJ) Secures Full FDA Nod for Rybrevant in Lung Cancer

Johnson & Johnson JNJ announced that the FDA granted full approval to its EFGR/MET inhibitor Rybrevant (amivantamab) in non-small cell lung cancer (NSCLC) indication.

Following the FDA decision, Rybrevant, in combination with chemotherapy (carboplatin-pemetrexed), is approved for the first-line treatment of patients with locally advanced or metastatic NSCLC with EGFR exon 20 insertion mutations. The drug was initially granted accelerated approval for a similar indication in May 2021.

Alongside the FDA approval, J&J announced that the National Comprehensive Cancer Network (NCCN) updated its guidelines recommending the Rybrevant-chemotherapy as a preferred first-line regimen for patients with NSCLC with EGFR exon 20 insertion mutations.

Both the approval and recommendation are based on positive top-line data from the phase III PAPILLON study, which evaluated Rybrevant plus chemotherapy in patients with newly-diagnosed advanced or metastatic NSCLC with EGFR exon 20 insertion mutations. Patients who received the Rybrevant-chemotherapy combination achieved a 61% reduction in the risk of disease progression or death compared to chemotherapy alone.

A regulatory filing is currently under review in the European Union seeking marketing approval/authorization for a similar indication, supported by data from the PAPILLON study. A final decision is expected in the coming months.

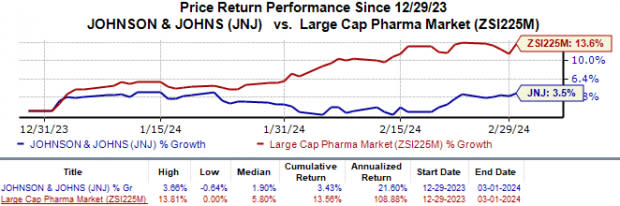

Shares of J&J have gained 3.4% year to date compared with the industry’s 13.6% growth.

Image Source: Zacks Investment Research

During fourth-quarter 2023, J&J submitted two other supplemental biologics license application (sBLA) filings with the FDA seeking approval for combination therapies with Rybrevant in patients as first-line and second-line treatments for locally advanced or metastatic NSCLC with EGFR exon 19 deletions (ex19del) or L858R substitution mutations.

The first sBLA, filed in November, seeks the FDA’s approval for Rybrevant in combination with chemotherapy (carboplatin-pemetrexed) as a treatment for patients with locally advanced or metastatic NSCLC with EGFR ex19del or L858R substitution mutations whose disease has progressed on or after receiving AstraZeneca’s Tagrisso (osimertinib). This filing is supported by data from the late-stage MARIPOSA-2 study. A similar filing was submitted in the EU last November.

The second sBLA, filed in December, seeks the agency’s approval for Rybrevant plus oral EGFR-TKI inhibitor lazertinib for the first-line treatment of adult patients with locally advanced or metastatic NSCLC with EGFR ex19del or L858R substitution mutations. This submission is based on data from the phase III MARIPOSA study. A similar filing was also submitted in the EU last month.

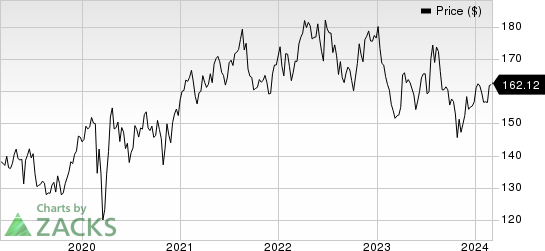

Johnson & Johnson Price

Johnson & Johnson price | Johnson & Johnson Quote

Zacks Rank & Key Picks

J&J currently carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the overall healthcare sector include Adicet Bio ACET, ADMA Biologics ADMA and Puma Biotechnology PBYI. While ADMA each sports a Zacks Rank #1 (Strong Buy) at present, Adicet and Puma carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, estimates for ADMA Biologics’ 2024 earnings per share (EPS) have risen from 18 cents to 25 cents. Meanwhile, during the same period, EPS estimates for 2025 have improved from 32 cents to 42 cents. Year to date, shares of ADMA have risen 22.1%.

Earnings of ADMA Biologicsbeat estimates in three of the last four quarters while meeting the same on one occasion. ADMA delivered a four-quarter average earnings surprise of 85.00%.

In the past 60 days, estimates for Adicet Bio’s 2024 loss per share have improved from $2.11 to $1.81. Year to date, shares of ACET have rallied 27.0%.

Earnings of Adicet Bio beat estimates in two of the trailing four quarters while missing the mark on the other two occasions. On average, Adicet came up with a four-quarter negative earnings surprise of 8.36%.

In the past 60 days, estimates for Puma Biotechnology’s 2024 EPS have risen from 69 cents to 71 cents. During the same period, earnings per share estimates for 2024 have improved from 80 cents to 81 cents. Year to date, shares of PBYI have rallied 36.0%.

Earnings of Puma Biotechnology beat estimates in three of the last four quarters while missing the same on one occasion. Puma delivered a four-quarter average earnings surprise of 147.49%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Johnson & Johnson (JNJ) : Free Stock Analysis Report

Adicet Bio, Inc. (ACET) : Free Stock Analysis Report

Puma Biotechnology, Inc. (PBYI) : Free Stock Analysis Report

ADMA Biologics Inc (ADMA) : Free Stock Analysis Report