J&J (JNJ) Seeks EU Nod for Rybrevant for First-Line NSCLC

Johnson & Johnson JNJ filed an application to the European Medicines Agency (EMA) seeking approval for the expanded use of its cancer drug, Rybrevant (amivantamab).

The Type II indication application extension seeks Rybrevant's approval in combination with chemotherapy (carboplatin and pemetrexed) for the first-line treatment of patients with advanced non-small cell lung cancer (NSCLC) with EGFR exon 20 insertion mutations. The application is based on data from the phase III PAPILLON study.

The EMA had granted conditional marketing authorization to Rybrevant in December 2021 for patients with locally advanced or metastatic NSCLC with EGFR exon 20 insertion mutations whose disease progressed after platinum-based chemotherapy.

A supplemental biologics license application (sBLA) seeking approval from the FDA for a similar first-line use of Rybrevant in NSCLC is also under review in the United States. Currently, Rybrevant is approved for patients with locally advanced or metastatic NSCLC with EGFR exon 20 insertion mutations whose disease progressed on or after platinum-based chemotherapy in the United States.

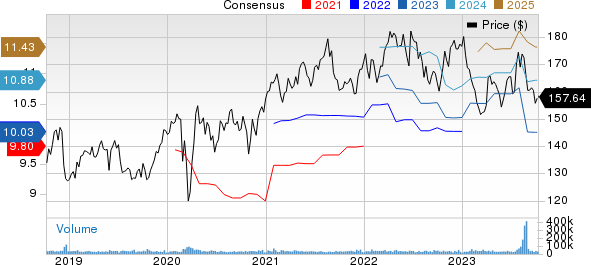

J&J’s stock has declined 10.8% so far this year against an increase of 5.3% for the industry.

Image Source: Zacks Investment Research

In July, J&J had announced positive top-line data from the PAPILLON study, which evaluated Rybrevant in combination with chemotherapy in patients with newly diagnosed advanced or metastatic NSCLC with EGFR exon 20 insertion mutations. The study met its primary endpoint. It showed a statistically significant and clinically meaningful improvement in progression-free survival (PFS) in the Rybrevant plus chemotherapy arm versus chemotherapy alone.

Last month, J&J announced positive top-line data from another study, MARIPOSA-2, evaluating Rybrevant plus chemotherapy with and without lazertinib versus chemotherapy alone in patients with EGFR-mutated NSCLC after disease progression on osimertinib. The study met its dual primary endpoint, resulting in statistically significant and clinically meaningful improvement in PFE versus chemotherapy alone in both experimental treatment arms. Regarding overall survival data, a planned interim analysis showed a trend favoring the Rybrevant and lazertinib combination compared to osimertinib.

Zacks Rank & Stocks to Consider

J&J currently has a Zacks Rank #4 (Sell).

Johnson & Johnson Price and Consensus

Johnson & Johnson price-consensus-chart | Johnson & Johnson Quote

Some top-ranked drug/biotech companies worth considering are Alpine Immune Sciences ALPN, Aurinia Pharmaceuticals AUPH and Corcept Therapeutics CORT, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 90 days, the consensus estimate for Alpine Immune Sciences’ 2023 loss has narrowed from $1.43 per share to $1.18 per share, while the same for 2024 has narrowed from $1.73 per share to $1.47 per share. Year to date, shares of Alpine Immune Sciences have rallied 65.8%.

ALPN’s earnings beat estimates in two of the trailing four quarters and missed the mark in the other two, delivering an average negative earnings surprise of 79.65%.

In the past 90 days, the loss per share estimate for Aurinia Pharmaceuticals for 2023 has narrowed from 71 cents per share to 58 cents per share, while that for 2024 has narrowed from 44 cents to 27 cents. Year to date, shares of Aurinia Pharmaceuticals have gained 68.9%.

Earnings of Aurinia Pharmaceuticals beat estimates in all the last four quarters, delivering an earnings surprise of 45.61% on average.

In the past 90 days, the Zacks Consensus Estimate for Corcept’s earnings has increased from 62 cents per share to 78 cents for 2023. The bottom-line estimate has also improved from 61 cents to 83 cents for 2024 during the same time frame. Shares of the company have rallied 30.0% year to date.

CORT’s earnings beat estimates in two of the trailing four quarters and missed the mark in the other two, delivering an average earnings surprise of 6.99%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Johnson & Johnson (JNJ) : Free Stock Analysis Report

Corcept Therapeutics Incorporated (CORT) : Free Stock Analysis Report

Aurinia Pharmaceuticals Inc (AUPH) : Free Stock Analysis Report

Alpine Immune Sciences, Inc. (ALPN) : Free Stock Analysis Report