J&J Snack Foods Corp Reports Growth in Net Earnings Despite Sales Dip

Net Sales: Slight decrease to $348.3M, down 0.9% year-over-year.

Operating Income: Increased to $9.7M, up 3.8% from the previous year.

Net Earnings: Grew by 9.8% to $7.3M compared to the same quarter last year.

Earnings per Diluted Share: Rose to $0.37, marking an 8.8% increase.

Adjusted Operating Income: Jumped 20.6% to $13.5M, reflecting improved gross margins and supply chain efficiencies.

Adjusted EBITDA: Climbed 19.4% to $30.2M, driven by strategic focus on higher margin products.

Gross Profit Margin: Improved to 27.2% from 25.9% in the prior year's quarter.

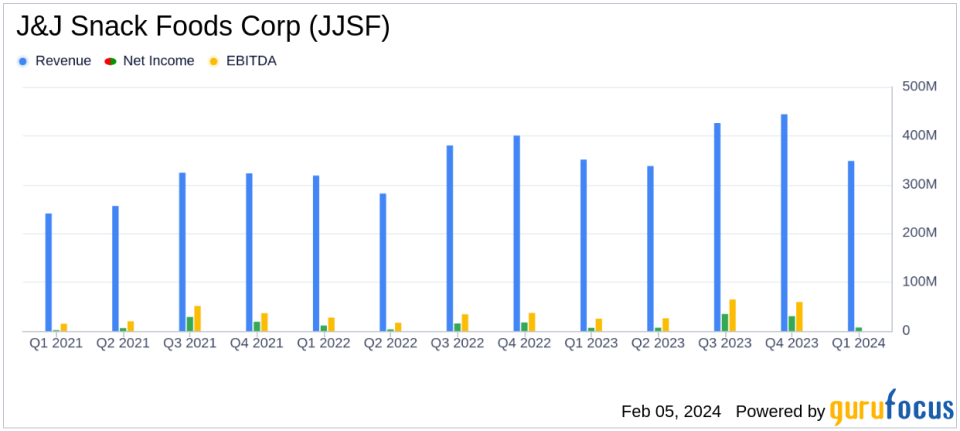

On February 5, 2024, J&J Snack Foods Corp (NASDAQ:JJSF) released its 8-K filing, announcing its financial results for the first quarter ended December 30, 2023. Despite a slight decrease in net sales by 0.9% to $348.3 million, the company reported a notable increase in net earnings by 9.8% to $7.3 million, compared to the same period last year. This performance demonstrates the company's resilience in a challenging consumer environment.

J&J Snack Foods Corp, a leading manufacturer and distributor of snack foods and beverages, operates in three business segments: Food Service, Retail Supermarkets, and Frozen Beverages. The company's diverse product portfolio includes frozen beverages, juice, fruit bars, sorbet, cakes, and cookies, catering to a variety of outlets such as restaurants, supermarkets, convenience stores, universities, theaters, and theme parks.

Financial Performance and Strategic Focus

The company's financial achievements, particularly in net earnings growth and adjusted EBITDA, are significant in the Consumer Packaged Goods industry, where margins are often tight and competition is intense. J&J Snack Foods Corp's strategic focus on gross margin expansion, through growing higher margin core products and productivity gains, has paid off with a 130-basis point improvement in gross profit margin. This strategic direction is crucial for maintaining profitability and competitiveness in the market.

Despite the overall sales softness, J&J Snack Foods Corp experienced growth in its Frozen Beverages segment, with an 8.5% increase in sales, and resilience in its Retail segment, with a 1.6% increase. The Food Service segment, however, saw a decrease of 4.1%, primarily due to reduced inventories among certain customers and a decline in Handhelds sales.

Operational Highlights and Future Outlook

During the quarter, J&J Snack Foods Corp incurred $2.2 million in one-time expenses related to the opening of a new regional distribution center in New Jersey. This investment is expected to drive future productivity improvements in the company's supply chain.

"Looking ahead, we expect to build momentum through the balance of the fiscal year as we execute our strategy to grow our core brands, cross-sell the portfolio and expand our customer footprint," said Dan Fachner, Chairman, President, and CEO of J&J Snack Foods Corp. "The diverse nature of our business, along with the power of our brands and the channel diversity of our products is something that we are confident will continue to serve us well in fiscal 2024 and beyond."

With a clear vision and strategic investments in place, J&J Snack Foods Corp is poised to navigate the evolving market landscape and continue delivering value to its stakeholders.

Financial Statements Overview

Key details from the financial statements include a gross profit of $94.6 million, up from $90.9 million in the same quarter last year. Total operating expenses increased to $84.9 million, representing 24.4% of sales, compared to 23.2% in the previous year. The company's balance sheet remains strong with total assets of $1.29 billion and total stockholders' equity of $912.5 million.

For value investors and potential GuruFocus.com members, J&J Snack Foods Corp's latest earnings report underscores the company's ability to grow earnings and improve operational efficiency even in a softer consumer environment. The company's strategic focus on high-margin products and supply chain productivity, coupled with its diverse product portfolio and brand strength, suggest a robust foundation for continued financial health and shareholder value creation.

For more detailed financial analysis and insights into J&J Snack Foods Corp and other investment opportunities, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from J&J Snack Foods Corp for further details.

This article first appeared on GuruFocus.