J&J Snack Foods Corp's Dividend Analysis

Assessing the Sustainability and Growth of JJSF's Dividends

J&J Snack Foods Corp(NASDAQ:JJSF) recently announced a dividend of $0.74 per share, payable on 2024-01-09, with the ex-dividend date set for 2023-12-18. As investors look forward to this upcoming payment, the spotlight also shines on the company's dividend history, yield, and growth rates. Using the data from GuruFocus, let's delve into J&J Snack Foods Corp's dividend performance and evaluate its sustainability.

What Does J&J Snack Foods Corp Do?

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

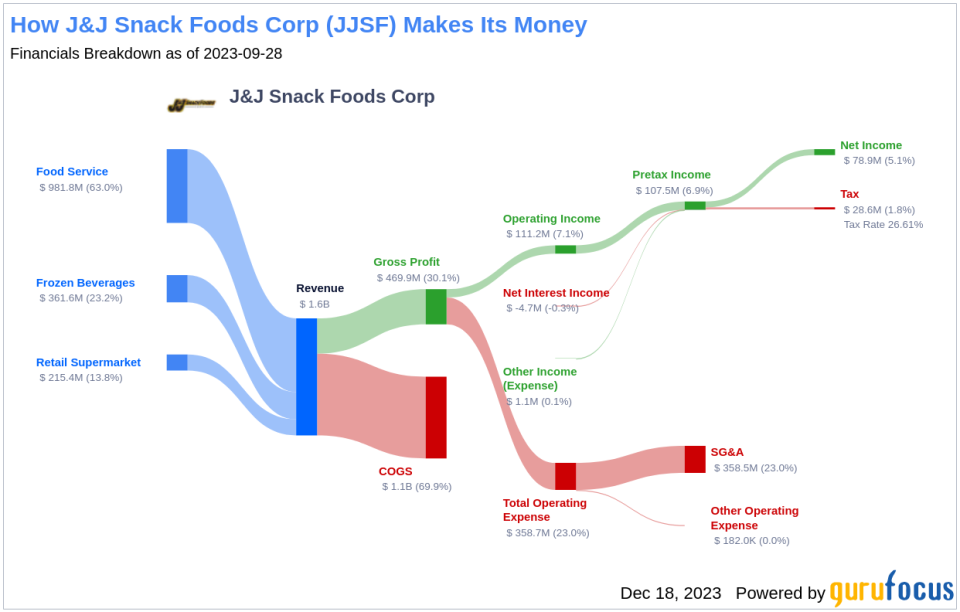

J&J Snack Foods Corp manufactures, markets, and distributes snack foods and beverages to foodservice and retail supermarket outlets. The company's products include frozen beverages, juice, fruit bars, sorbet, cakes, and cookies that are distributed to various consumers, including restaurants, supermarkets, convenience stores, universities, theaters, and theme parks. J&J Snack Foods Corp operates in three business segments: food service, which sells snacks, desserts, and baked goods at the point-of-sale; retail supermarkets, which sells frozen and prepackaged products to supermarkets; and frozen beverages, which sells frozen beverages under brands Icee, Slush puppie, and Parrot ice in the United States, Mexico, and Canada.

A Glimpse at J&J Snack Foods Corp's Dividend History

J&J Snack Foods Corp has maintained a consistent dividend payment record since 2004, with dividends currently distributed on a quarterly basis. Since 2005, J&J Snack Foods Corp has increased its dividend each year, earning it the title of a dividend achiever for its 18-year streak of dividend increases. Below is a chart showing the annual Dividends Per Share to track historical trends.

Breaking Down J&J Snack Foods Corp's Dividend Yield and Growth

As of today, J&J Snack Foods Corp has a trailing dividend yield of 1.67% and a forward dividend yield of 1.73%, indicating expectations of increased dividend payments over the next 12 months. Over the past three years, the annual dividend growth rate was 7.20%, which expanded to 9.30% over a five-year period. Over the past decade, the annual dividends per share growth rate stands at an impressive 12.30%. Based on these figures, the 5-year yield on cost for J&J Snack Foods Corp stock is approximately 2.61%.

The Sustainability Question: Payout Ratio and Profitability

To gauge the sustainability of dividends, examining the dividend payout ratio is crucial. As of 2023-09-30, J&J Snack Foods Corp's dividend payout ratio is 0.69, suggesting a healthy balance between dividend distribution and earnings retention for growth and stability. The company's profitability rank is 8 out of 10, indicating strong profitability compared to its peers. Consistent positive net income over the past decade bolsters J&J Snack Foods Corp's financial robustness.

Growth Metrics: The Future Outlook

Strong growth metrics are essential for the continuation of dividend payments. J&J Snack Foods Corp's growth rank of 8 out of 10 signals a promising growth trajectory. The company's revenue per share and 3-year revenue growth rate, averaging 14.50% per year, outperforms approximately 72.93% of global competitors. Additionally, J&J Snack Foods Corp's 3-year EPS growth rate, averaging 63.00% per year, outperforms approximately 88.99% of global competitors. However, the 5-year EBITDA growth rate of -4.80% is an area that requires attention, although it still outperforms about 26.62% of global competitors.

Concluding Thoughts on J&J Snack Foods Corp's Dividends

In conclusion, J&J Snack Foods Corp's consistent dividend payments, robust dividend growth rate, prudent payout ratio, and strong profitability and growth metrics paint a promising picture for the company's dividend sustainability. While the EBITDA growth rate presents some concerns, the overall financial health of J&J Snack Foods Corp suggests that it remains a potentially attractive option for value investors focused on dividend income. For those seeking high-dividend yield stocks, GuruFocus Premium offers a High Dividend Yield Screener to discover similar investment opportunities.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.