J&J Snack Foods (NASDAQ:JJSF) Reports Sales Below Analyst Estimates In Q1 Earnings

Snack food company J&J Snack Foods (NASDAQ:JJSF) fell short of analysts' expectations in Q1 FY2024, with revenue flat year on year at $348.3 million. It made a non-GAAP profit of $0.52 per share, improving from its profit of $0.42 per share in the same quarter last year.

Is now the time to buy J&J Snack Foods? Find out by accessing our full research report, it's free.

J&J Snack Foods (JJSF) Q1 FY2024 Highlights:

Revenue: $348.3 million vs analyst estimates of $362.9 million (4% miss)

EPS (non-GAAP): $0.52 vs analyst expectations of $0.78 (33.3% miss)

Free Cash Flow of $29.02 million, down 23.8% from the previous quarter

Gross Margin (GAAP): 27.2%, up from 25.9% in the same quarter last year

Market Capitalization: $3.1 billion

Dan Fachner, J&J Snack Foods Chairman, President and CEO, commented, “J&J Snack Foods continues to execute on our long-term strategy while managing through a softer consumer environment. Fiscal first quarter net sales declined approximately 1%, in line with trends in the overall industry. Declines in consumer traffic and consumption at many of our customers impacted our sales in the quarter compared to a strong quarter last year. While we experienced softness across Food Service, we saw resilience in Retail and continued strong growth in Frozen Beverages with sales growing 1.6% and 8.5%, respectively. Despite overall softer sales, our ongoing focus on gross margin expansion resulted in a 130-basis point improvement, reflecting the positive impact of our strategy to grow higher margin core products, as well as continued gains in overall productivity. This resulted in healthy bottom-line growth, including a 20.6% increase in adjusted operating income and a 19.4% increase in adjusted EBITDA.

Best known for its SuperPretzel soft pretzels and ICEE frozen drinks, J&J Snack Foods (NASDAQ:JJSF) produces a range of snacks and beverages and distributes them primarily to supermarket and food service customers.

Packaged Food

As America industrialized and moved away from an agricultural economy, people faced more demands on their time. Packaged foods emerged as a solution offering convenience to the evolving American family, whether it be canned goods, prepared meals, or snacks. Today, Americans seek brands that are high in quality, reliable, and reasonably priced. Furthermore, there's a growing emphasis on health-conscious and sustainable food options. Packaged food stocks are considered resilient investments. People always need to eat, so these companies can enjoy consistent demand as long as they stay on top of changing consumer preferences.The industry spans from multinational corporations to smaller specialized firms and is subject to food safety and labeling regulations.

Sales Growth

J&J Snack Foods is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefitting from better brand awareness and economies of scale. On the other hand, one advantage is that its growth rates can be higher because it's growing off a small base.

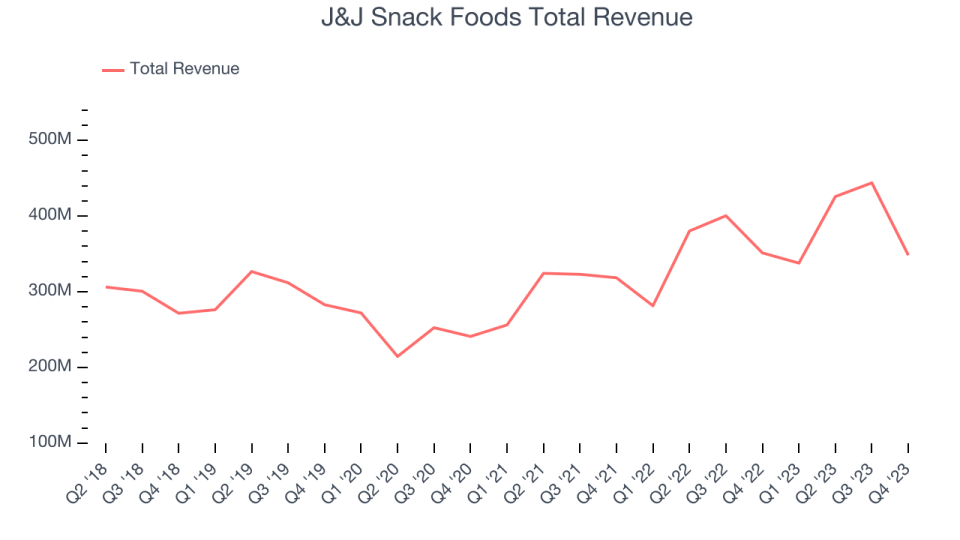

As you can see below, the company's annualized revenue growth rate of 16.7% over the last three years was impressive for a consumer staples business.

This quarter, J&J Snack Foods missed Wall Street's estimates and reported a rather uninspiring 0.9% year-on-year revenue decline, generating $348.3 million in revenue.

Today’s young investors likely haven’t read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Key Takeaways from J&J Snack Foods's Q1 Results

We struggled to find many strong positives in these results. Its revenue, operating margin, and EPS all missed analysts' estimates. This weakness was driven by a 4.1% year-on-year decline in its Food Service segment, which includes pies and cookies. Two bright spots (but not enough to move the needle) were its Churros and Frozen Beverages categories, which grew 8.9% and 8.5%, respectively. Overall, the results could have been better. The stock is flat after reporting and currently trades at $155 per share.

J&J Snack Foods may not have had the best quarter, but does that create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.