J.Jill Inc (JILL) Reports Mixed Fiscal Year 2023 Results with Strong Gross Margin Performance

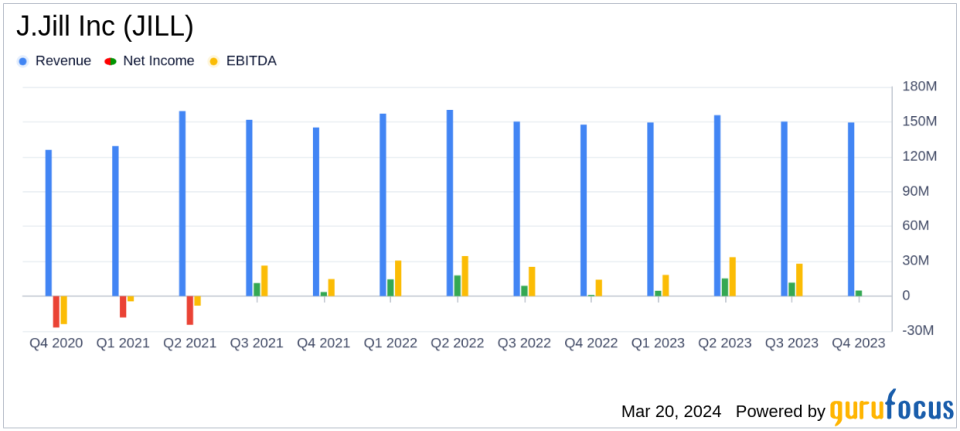

Net Sales: Q4 net sales increased by 1.2% to $149.4 million, while FY23 net sales decreased by 1.7% to $604.7 million.

Gross Margin: Achieved a strong gross margin of 67.3% in Q4 and 70.7% for the full year.

Operating Income Margin: Expanded by 170 basis points in Q4 and 140 basis points for FY23.

Net Income: Q4 net income rose to $4.8 million, with full-year net income at $36.2 million.

Adjusted EBITDA: Increased to $17.6 million in Q4 and $112.2 million for the full year.

Store Count: Ended the year with 244 stores after opening 2 new stores and closing 1.

Free Cash Flow: Generated $46.4 million in free cash flow for FY23.

On March 20, 2024, J.Jill Inc (NYSE:JILL) released its 8-K filing, announcing its financial results for the fourth quarter and full fiscal year ended February 3, 2024. The national lifestyle brand, known for its women's apparel, footwear, and accessories, reported a slight increase in Q4 net sales but a decrease in annual net sales compared to the previous year. Despite the sales dip, J.Jill Inc (NYSE:JILL) delivered a robust gross margin performance, reflecting the strength of its operating model.

Financial Performance and Challenges

J.Jill Inc (NYSE:JILL) faced a challenging macroeconomic environment in 2023, which impacted consumer spending and the broader retail sector. Despite these headwinds, the company managed to end the year with a strong gross margin, a testament to its disciplined operating model and strategic initiatives. The company's focus on omni-channel capabilities and assortment expansion contributed to its financial resilience. However, the slight decline in annual net sales and comparable company sales, which includes both store and direct-to-consumer channels, indicates that J.Jill Inc (NYSE:JILL) is not immune to the challenges facing the retail industry.

Key Financial Achievements

The company's financial achievements, particularly the expansion of its operating income margin and strong gross margin, are significant in the competitive retail sector. These metrics demonstrate J.Jill Inc (NYSE:JILL)'s ability to manage costs effectively and maintain profitability in a cyclical industry. The increase in adjusted EBITDA and net income per diluted share also highlights the company's operational efficiency and profitability on a per-share basis, which is crucial for investor confidence.

Financial Metrics and Importance

Key financial metrics from the income statement, such as the gross profit of $100.6 million in Q4 and $427.4 million for the full year, underscore the company's ability to generate earnings above the cost of goods sold. The balance sheet reflects a solid cash position of $62.2 million, providing liquidity to support ongoing operations and strategic investments. The cash flow statement reveals a free cash flow of $46.4 million, indicating the company's capacity to generate cash after accounting for capital expenditures, which is vital for sustaining growth and shareholder returns.

Management Commentary

"We are pleased with our strong end to 2023 which delivered fourth quarter and full year results above our expectations. This performance is once again a testament to the execution of our disciplined operating model which has continued to support the healthy margin profile and strong cash generation of the business," said Claire Spofford, President and CEO of J.Jill Inc (NYSE:JILL).

Analysis of Performance

J.Jill Inc (NYSE:JILL)'s performance in the fourth quarter shows resilience in a tough retail environment, with the company leveraging its operating model to expand margins and control costs. The full-year results, however, reflect the broader challenges in the retail sector, with a slight decline in net sales and direct-to-consumer sales. The company's strategic focus on omni-channel capabilities and new store openings positions it for potential growth, but it remains cautious about the macroeconomic outlook for 2024.

The company expects net sales for fiscal 2024 to be flat to up in the low-single digits and Adjusted EBITDA to be down in the mid-single digits compared to fiscal 2023. This guidance takes into account the loss of the 53rd week in fiscal 2023, which contributed $7.9 million to net sales and $2.2 million to Adjusted EBITDA.

For value investors and potential GuruFocus.com members, J.Jill Inc (NYSE:JILL)'s ability to maintain a strong gross margin and generate significant free cash flow in a challenging environment is noteworthy. The company's cautious yet strategic approach to growth and its disciplined operating model may offer a stable investment opportunity in the cyclical retail sector.

For more detailed information on J.Jill Inc (NYSE:JILL)'s financial results, please refer to the full 8-K filing.

Explore the complete 8-K earnings release (here) from J.Jill Inc for further details.

This article first appeared on GuruFocus.