The J.M. Smucker (SJM) to Buy Hostess Brands: Things to Know

The J. M. Smucker Co. SJM inked a deal to acquire Hostess Brands, Inc. TWNK, a premier snacking company. Management expects to conclude the transaction in the third quarter of fiscal 2024.

The move will enhance SJM’s ability to meet consumer needs with more convenience and selection. The acquisition is in synch with the company’s long-term growth goals and efforts to drive shareholder value.

Inside the Headlines

The deal includes TWNK’s sweet baked goods brands like Hostess Donettes, Twinkies and DingDongs and the Voortman cookie brand. SJM will also acquire production facilities in Emporia, Kansas; Burlington, Ontario; Chicago, Illinois; Columbus, Georgia; Indianapolis, Indiana and Arkadelphia, Arkansas. In addition, it will take over a distribution facility in Edgerton, Kansas.

The transaction is priced at $34.25 per share in a cash and stock transaction, representing a total enterprise value of nearly $5.6 billion, including almost $900 million of net debt. The deal represents an adjusted EBITDA multiple of nearly 17.2x based on its projection of Hostess Brands 2023 results. Including potential run-rate synergies of $100 million, the multiple stands at about 13.2x.

The buyout will add Hostess Brands’ popular snacks and innovation in the sweet baked goods category to The J. M. Smucker’s brand offerings.

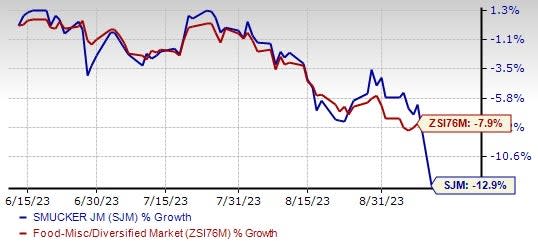

Image Source: Zacks Investment Research

The J. M. Smucker expects the buyout to contribute nearly $1.5 billion in net sales, with a projected mid-single digit percentage annual growth rate. Management anticipates adjusted earnings per share (EPS) to be accretive during the first fiscal year. The company envisions generating solid cash flow from the combined business, enabling increased deleveraging and continued reinvestment in the business.

The TWNK acquisition will likely drive The J. M. Smucker’s growth and innovation story.

Wrapping Up

The J. M. Smucker is dealing with rising costs. The ongoing cost inflation, supply-chain bottlenecks and the broader macroeconomic landscape continue to affect the company’s results and cause risks for fiscal 2024. In addition, the company is grappling with higher selling, distribution and administrative costs, which are likely to persist in fiscal 2024.

Shares of the Zacks Rank #4 (Sell) company have dropped 12.9% in the past three months compared with the industry’s decline of 7.9%.

Some Solid Food Picks

MGP Ingredients MGPI, which produces and markets ingredients and distillery products, currently sports a Zacks Rank #1 (Strong Buy). MGPI has a trailing four-quarter earnings surprise of 18% on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for MGP Ingredients’ current financial-year sales and earnings per share suggests growth of 5.8% and 10.4%, respectively, from the corresponding year-ago reported figures.

Flowers Foods FLO emphasizes providing high-quality baked items. The company currently carries a Zacks Rank #2 (Buy). The expected EPS growth rate for three to five years is 2.3%.

The Zacks Consensus Estimate for Flowers Foods’ current financial-year sales suggests growth of 6.7% from the year-ago period’s actuals. FLO has a trailing four-quarter earnings surprise of 7.6% on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The J. M. Smucker Company (SJM) : Free Stock Analysis Report

Flowers Foods, Inc. (FLO) : Free Stock Analysis Report

MGP Ingredients, Inc. (MGPI) : Free Stock Analysis Report

Hostess Brands (TWNK) : Free Stock Analysis Report