The J.M. Smucker (SJM) to Potentially Buy Hostess Brands

The J. M. Smucker Company SJM is apparently in talks to acquire the owner of Twinkies snack cakes, Hostess Brands, Inc. TWNK, per media reports. Sources revealed that the deal is priced at nearly $5 billion. According to reports, the acquisition price excludes Hostess Brands’ net debt of approximately $900 million.

TWNK owns popular household brands like Ho-Hos, Ding Dongs, Zingers and Voortman cookies and wafers. Hostess Brands recently raised prices for some of its products to boost revenues. We believe that the potential acquisition of TWNK will likely further strengthen The J. M. Smucker’s brand portfolio.

What’s More?

The J. M. Smucker is progressing well with core priorities, which include driving commercial excellence; reshaping its portfolio; streamlining cost structure and unleashing its organization to win. Strength in such strategies is helping The J. M. Smucker navigate complex supply chain challenges. These are also helping SJM improve in-store fundamentals and stock performance for the brands.

The company is committed to increasing its focus and resources to reshape its portfolio to achieve sustainable growth across pet food and snacks, coffee, and snacking categories. SJM concluded the divestiture of certain pet food brands in the fourth quarter of fiscal 2023 to reshape the portfolio. The pet business structure includes 60% pet snacks and 40% cat food. This move, which will help the company direct more resources toward the fast-growing and higher-margin dog snacks category, will enhance the product mix and profit over time.

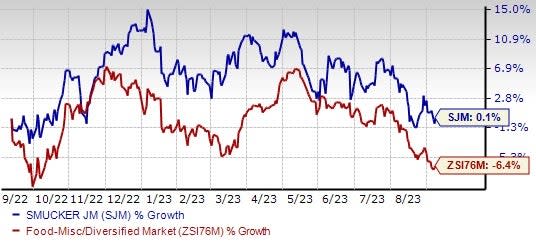

Image Source: Zacks Investment Research

Wrapping Up

The Zacks Rank #4 (Sell) company is dealing with rising costs. The ongoing cost inflation, supply-chain bottlenecks and the broader macroeconomic landscape continue to affect the company’s results and cause risks for fiscal 2024. That being said, SJM is implementing inflation-justified pricing actions across all businesses. Management is optimizing its supply chain and lowering costs to aid growth.

SJM’s stock has increased 0.1% in the past year against the industry’s decline of 6.4%.

Some Solid Food Picks

MGP Ingredients MGPI, which produces and markets ingredients and distillery products, currently sports a Zacks Rank #1 (Strong Buy). MGPI has a trailing four-quarter earnings surprise of 18% on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for MGP Ingredients’ current financial-year sales and earnings per share suggests growth of 5.8% and 10.4%, respectively, from the corresponding year-ago reported figures.

Flowers Foods FLO emphasizes providing high-quality baked items. The company currently carries a Zacks Rank #2 (Buy). The expected EPS growth rate for three to five years is 2.3%.

The Zacks Consensus Estimate for Flowers Foods’ current financial-year sales suggests growth of 6.7% from the year-ago period’s actuals. FLO has a trailing four-quarter earnings surprise of 7.6% on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The J. M. Smucker Company (SJM) : Free Stock Analysis Report

Flowers Foods, Inc. (FLO) : Free Stock Analysis Report

MGP Ingredients, Inc. (MGPI) : Free Stock Analysis Report

Hostess Brands (TWNK) : Free Stock Analysis Report