Jabil, Fabrinet Lead Breakout Stocks: Relief Rally Underway?

The stock market rebounded on Wednesday, led by the Nasdaq as bond yields finally took a breather from 16-year highs. Despite the pullback over the last two months, the market’s price action remains relatively normal, and the uptrend off last year’s bear market lows remains intact.

From a seasonal perspective, the broad declines over the last two months weren’t entirely unexpected, as the August-September timeframe is historically the weakest two-month stretch of the year. But the outlook appears more bullish as we have now entered the fourth quarter. Dating back to 1950, Q4 is the strongest quarter of the year, up nearly 80% of the time with an average return north of 4% (twice as much as the next best quarter).

Wednesday marked the first day of a rally attempt for both the S&P 500 and Dow Jones Industrial Average. Several individual stocks have broken out, with numerous others flashing aggressive entry points.

Electronic Manufacturers Stage Early Breakouts

Jabil JBL, one of the largest global suppliers of electronic manufacturing services, broke out in late September after beating earnings estimates for the 14th consecutive quarter. JBL stock is a market leader and has advanced more than 90% year-to-date. The company is currently a Zacks Rank #3 (Hold) and is ranked favorably by our Zacks Style Scores, with top marks in our Value and Growth categories.

Image Source: StockCharts

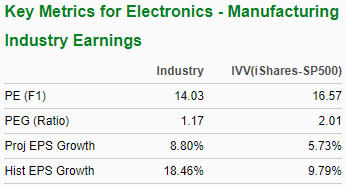

Jabil is part of the Zacks Electronics – Manufacturing Services industry group, which ranks in the top 42% out of approximately 250 Zacks Ranked Industries. Because it is ranked in the top half of all Zacks Ranked Industries, we expect this group to outperform the market over the next 3 to 6 months.

Historical research studies suggest that approximately half of a stock’s price appreciation is due to its industry grouping. In fact, the top 50% of Zacks Ranked Industries outperforms the bottom 50% by a factor of more than 2 to 1. By focusing on leading stocks within the top 50% of Zacks Ranked Industries, we can dramatically improve our stock-picking success.

Note the favorable traits for this industry below:

Image Source: Zacks Investment Research

Another electronic manufacturer in Fabrinet FN has also been outperforming as of late. Fabrinet, a Zacks Rank #2 (Buy), has exceeded the earnings mark in each of the past five quarters. FN stock is breaking out here in early October ahead of the major indexes, and is up more than 85% over the past five months.

Image Source: StockCharts

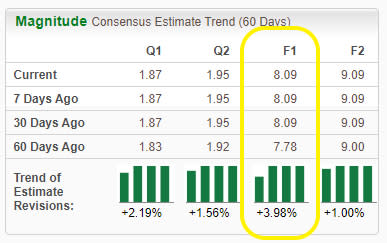

Analysts covering Fabrinet are in agreement and have been raising earnings estimates across the board. Estimates for the current fiscal year have increased by 3.98% in the past 60 days. The Zacks Consensus Estimate now stands at $8.09/share, reflecting growth of 5.48% relative to the prior year.

Image Source: Zacks Investment Research

Economic Data Helps the Fed’s Case

Yesterday’s ADP report showed that private job growth totaled just 89,000 in September, down from an upwardly revised 180k in August. The figure was well below the 160k median estimate. The gains came almost exclusively from services, which contributed 81,000 to the total number. The more widely-followed U.S. employment report is due out on Friday morning.

A weakening labor market bolsters the case for a continued rate pause. But Fed officials aren’t convinced just yet that the worst of inflation is behind us. Earlier this week, Cleveland Fed President Loretta Mester stated that she is likely to favor a rate hike at the next meeting if the current economic situation holds.

Treasury yields have clearly been acting as a headwind for stocks. Yields finally took a breather yesterday, with the yield on the benchmark 10-year treasury note falling 6.7 basis points to 4.735%. Energy prices have also plunged over the past few sessions, with WTI crude oil futures falling below $84/barrel.

Relief Rally Underway?

It is not unusual for an existing uptrend to give back a substantial portion of a previous bullish move before resuming the larger trend. The major indexes appear to be finding support at key levels, a necessary ingredient for this bull market to continue.

Image Source: StockCharts

A batch of support areas are in play including an upward-sloping 200-day moving average, the trendline off the October lows (green solid line), and the 4,200-level that served as resistance earlier this year before a break above it in June. As the saying goes, what once acted as resistance may now become support.

Bottom Line

Markets are trying to draw a line in the sand near a pivotal point. The major indices will need more time to establish a meaningful bottom, and we’ll also need to see more in the way of stronger participation and follow-through to get there.

Seasonal statistics point to a high probability of an end-of-year rally. Make sure you’re taking advantage of all that Zacks has to offer to uncover leading stocks like JBL and FN.

Disclosure: Jabil is a current holding within the Zacks Headline Trader portfolio.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Jabil, Inc. (JBL) : Free Stock Analysis Report

Fabrinet (FN) : Free Stock Analysis Report