Jabil (JBL) Closes Mobility Business Divestiture, Revises View

Jabil Inc. JBL recently completed the divestiture of its Mobility business to China-based BYD Electronic (International) Company Limited for $2.2 billion cash. The transaction was earlier expected to close on Jan 31, 2024. The preponement of the deal closure forced Jabil to revise its guidance for the second quarter of fiscal 2024.

For second-quarter fiscal 2024, revenues are currently expected to be in the range of $6.6-$7.2 billion, down from $7.0-$7.6 billion estimated earlier owing to lower revenue recognition from the divested business. Non-GAAP operating income is projected within $291-$351 million compared with the previous range of $339-$399 million. Management estimates non-GAAP earnings within the band of $1.43-$1.83 per share, down from $1.73-$2.13.

For fiscal 2024, Jabil expects net revenues to be in the vicinity of $30.6 billion with more than $9.00 in core earnings per share. The core operating margin is expected to be in the range of 5.3-5.5%.

The divestment is likely to enhance Jabil’s financial flexibility to help reward its shareholders with risk-adjusted returns in the form of incremental share repurchases. In addition, it is expected to facilitate the company to invest more in electric vehicles (EVs), renewable energy, healthcare, AI cloud data centers and other end markets to strengthen its position as one of the largest global suppliers of electronic manufacturing services.

Jabil is witnessing solid momentum in industrial business driven by growth in clean and smart energy infrastructure adoption. Strength in solar inverters, smart meters, energy storage & power and building management solutions is boosting the top line. The company has an established global presence and a worldwide connected factory network, which enables it to scale up production per the evolving market dynamics.

Management’s focus on improving working capital management and integrating sophisticated AI and ML capabilities to enhance the efficiency of its internal process acts as major tailwinds. The company is witnessing a resilient demand trend and anticipates substantial secular growth in EVs, healthcare, renewable energy infrastructure, 5G and cloud. Its automotive industry is poised to benefit as the transformation to EV accelerates.

Jabil is likely to benefit from secular growth drivers with strong margin and cash flow dynamics. Moreover, solid end-market experience, proven technical and design capabilities, manufacturing know-how, supply chain insights and global product management expertise have put it in good stead. An extensive global footprint is further strengthened by a centralized procurement process, which, coupled with a single Enterprise Resource Planning system, aids customers with end-to-end supply chain visibility.

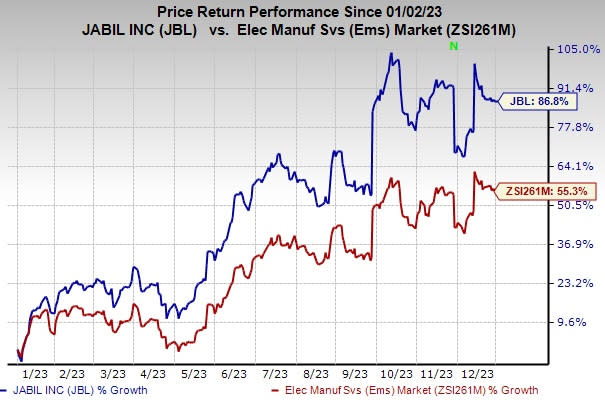

The stock has gained 86.8% in the past year compared with the industry’s growth of 55.3%.

Image Source: Zacks Investment Research

Jabil presently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Key Picks

United States Cellular Corporation USM, sporting a Zacks Rank #1, is the fourth largest full-service wireless carrier in the United States. The company provides a range of wireless products and services, and a high-quality network to increase the competitiveness of local businesses and improve the efficiency of government operations.

U.S. Cellular has taken concrete steps to accelerate subscriber additions and improve churn management. The company aims to offer the best wireless experience to customers by providing superior quality network and national coverage. It is well-positioned to support the investment required for network enhancements, including the deployment of 5G technology. The company is well-positioned for continued demand for broadband.

InterDigital, Inc. IDCC: Headquartered in Wilmington, DE, InterDigital is a pioneer in advanced mobile technologies that enable wireless communications and capabilities. The company engages in designing and developing a wide range of advanced technology solutions, which are used in digital cellular as well as wireless 3G, 4G and IEEE 802-related products and networks.

This Zacks Rank #2 (Buy) stock has a long-term earnings growth expectation of 17.4% and has surged 122.6% over the past year. A well-established global footprint, diversified product portfolio and ability to penetrate different markets are key growth drivers for InterDigital. Apart from a strong portfolio of wireless technology solutions, the addition of technologies related to sensors, user interface and video to its offerings is likely to drive considerable value, given the massive size of the market it offers licensing technologies to.

Qualcomm Incorporated QCOM, carrying a Zacks Rank #2, delivered an earnings surprise of 2.2%, on average, in the trailing four quarters. It has long-term earnings growth expectation of 12.5%.

Qualcomm is one of the largest manufacturers of wireless chipset based on baseband technology. The company is focusing to retain its leadership in 5G, chipset market and mobile connectivity with several technological achievements and innovative product launches. It is facilitating the seamless transition to super-fast 5G networks, delivering low-power resilient multi-gigabit connectivity with unprecedented range and Qualcomm's best-in-class security. This, in turn, is offering the flexibility and scalability needed for broad and fast 5G adoption through accelerated commercialization by OEMs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

QUALCOMM Incorporated (QCOM) : Free Stock Analysis Report

United States Cellular Corporation (USM) : Free Stock Analysis Report

Jabil, Inc. (JBL) : Free Stock Analysis Report

InterDigital, Inc. (IDCC) : Free Stock Analysis Report