Jack In The Box Inc (JACK) Reports Modest Sales Growth Amidst Strategic Expansions

Same-Store Sales Growth: Jack in the Box and Del Taco report same-store sales increases of 0.8% and 2.2%, respectively.

Systemwide Sales Growth: Jack in the Box sees a 1.8% increase, while Del Taco experiences a marginal 0.1% uptick.

Earnings Per Share: Diluted EPS stands at $1.93 with Operating EPS at $1.95.

Restaurant-Level Margin: Jack in the Box's margin improves to 23.1%, a 3.3% increase from the previous year.

Expansion: New development agreements signed to expand in Florida and Michigan.

Stock Repurchase: $25.2 million worth of shares repurchased, with $225.0 million remaining under the buyback program.

Dividend: A cash dividend of $0.44 per share declared, payable on March 27, 2024.

On February 21, 2024, Jack In The Box Inc (NASDAQ:JACK) released its 8-K filing, announcing its financial results for the first quarter of 2024. The company, which operates quick-service and fast-casual restaurants under the Jack in the Box and Del Taco brands, reported a modest increase in same-store sales and systemwide sales growth. Despite facing challenges such as weather impacts and transaction declines, the company's strategic initiatives and focus on franchise profitability have led to improved margins and expansion opportunities.

Financial Performance and Challenges

Jack In The Box Inc (NASDAQ:JACK) experienced a slight uptick in same-store sales, with a 0.8% increase, while Del Taco outperformed with a 2.2% rise. The company's systemwide sales growth was 1.8% for Jack in the Box and a marginal 0.1% for Del Taco. The restaurant-level margin for Jack in the Box improved significantly to 23.1%, reflecting a 3.3% increase from the previous year, primarily driven by commodity deflation and sales leverage.

However, the company faced challenges, including transaction declines and a negative weather impact towards the end of the quarter. Additionally, the franchise-level margin decreased due to the lap of a prior year royalty buyout, which positively impacted the previous year's margins. These challenges underscore the importance of the company's strategic growth plan and the need to adapt to changing market conditions.

Strategic Growth and Expansion

The company's strategic growth initiatives have led to the signing of development agreements with new franchisees, aiming to expand in Florida and enter Michigan. The successful soft launch of the new Smashed Jack burger, which sold out in less than three weeks, also highlights the company's ability to innovate and attract customers. The expansion and product innovation are crucial for maintaining competitiveness in the restaurant industry and driving long-term growth.

Key Financial Metrics

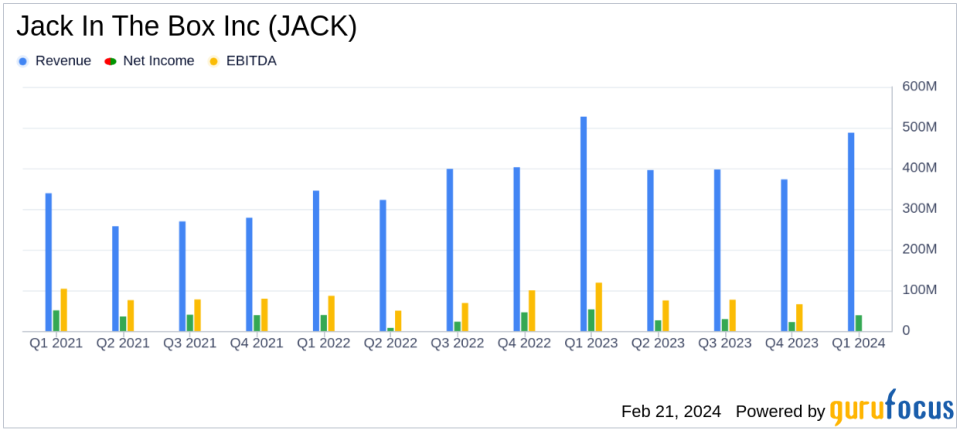

Jack In The Box Inc (NASDAQ:JACK) reported a diluted earnings per share (EPS) of $1.93 and an operating EPS of $1.95. Total revenues decreased by 7.5% to $487.5 million, compared to $527.1 million in the prior year, largely due to Del Taco's refranchising efforts. Net earnings decreased to $38.7 million, compared with $53.3 million in the first quarter of the previous fiscal year. Adjusted EBITDA was $101.8 million, a decrease from the prior year's $108.6 million.

The company's capital allocation strategy included repurchasing 0.3 million shares for $25.2 million, with $225.0 million remaining under the stock buyback program. A cash dividend of $0.44 per share was declared, emphasizing the company's commitment to returning value to shareholders.

Analysis of Performance

While Jack In The Box Inc (NASDAQ:JACK) has demonstrated resilience in a challenging market, the modest growth in same-store sales and the decrease in net earnings highlight the need for continued strategic focus. The company's expansion efforts and improved margins are positive indicators, but it must navigate market volatility and competition to sustain growth. The performance of new products and the execution of expansion plans will be critical in determining the company's success in the upcoming quarters.

For a more detailed analysis and insights into Jack In The Box Inc (NASDAQ:JACK)'s financial performance, investors and interested parties are encouraged to review the full earnings report and join the upcoming conference call.

Explore the complete 8-K earnings release (here) from Jack In The Box Inc for further details.

This article first appeared on GuruFocus.