Jacobs (J) to Compete for US Army Corps of Engineers Deals

Jacobs Engineering Group Inc. J, along with five other companies, will compete for multiple firm-fixed-price contracts, each worth $700 million, to provide architecture-engineering design services. The contracts received by Jacobs Government Services Co., Washington, D.C., were given by the U.S. Army Corps of Engineers, Middle East District, Winchester, VA and are likely to be completed by Jun 29, 2028.

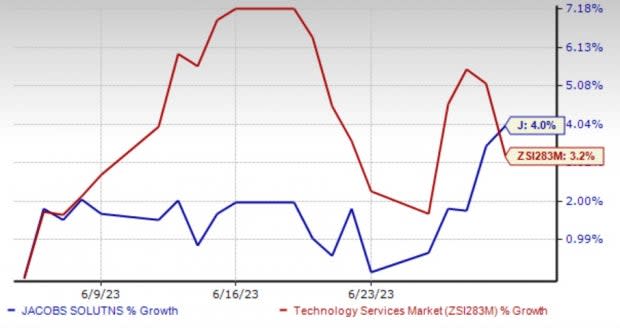

J’s shares gained 4% in the past month compared with the Zacks Technology Services industry’s 3.2% growth. Nonetheless, earnings estimates for fiscal 2023 suggest 6.1% year-over-year growth on 7.6% higher revenues.

Although foreign exchange risks and high costs and expenses are major concerns for the company, solid performance across the portfolios and a robust backlog are likely to further boost investors’ sentiment in the near future.

Image Source: Zacks Investment Research

Solid Project Execution to Drive Growth

Jacobs is witnessing a rising demand for infrastructure, water, environment, space, broadband, cybersecurity and life sciences consulting services. It has also been creating smart and connected spaces and places to support diverse regeneration and development projects, like a feasibility study for Rikers Island and The Ellinikon development in Greece.

Efficient project execution has been a key factor driving Jacobs’ performance over the last few quarters. The company’s solid backlog level is a testimony to this fact. Jacobs’ backlog at the end of second-quarter fiscal 2023 amounted to $29 billion, up 4% from a year ago.

Jacobs’ Focus 2023 initiative entails more than $200 million in benefits versus fiscal 2020. Through this initiative, the company has been accelerating the adoption of digital technology across all facets of operations. This move will reduce the physical real estate footprint by more than 30% as it significantly shifts to a more flexible and virtual workforce.

Jacobs expects that by 2023, this transformative initiative will drive growth through technology-enabled solutions, providing it with the flexibility to materially invest in the business.

Zacks Rank & Key Picks

Currently, Jacobs carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the Business Services sector are Inspired Entertainment, Inc. INSE, Trane Technologies plc TT and Healthcare Services Group, Inc. HCSG. Inspired Entertainment sports a Zacks Rank #1 (Strong Buy). Trane Technologies and Healthcare Services Group each carry a Zacks Rank #2 (Buy) at present.

You can see the complete list of today’s Zacks #1 Rank stocks here.

The bottom line of Inspired Entertainment outpaced estimates in three of the last four quarters and missed the mark once, the average beat being 30%.

The Zacks Consensus Estimate for INSE’s 2023 earnings suggests an improvement of 42.9% from the year-ago reported figure. The same for revenues suggests growth of 20.4% from the year-ago reported number. The consensus mark for INSE’s 2023 earnings has moved 14.6% north in the past 60 days.

Trane Technologies’ earnings outpaced estimates in each of the trailing four quarters, the average surprise being 6.7%.

The Zacks Consensus Estimate for TT’s 2023 earnings suggests an improvement of 14.7% from the year-ago reported figure. The same for revenues suggests growth of 9% from the year-ago reported number. The consensus mark for TT’s 2023 earnings has moved 1.3% north in the past 60 days.

The bottom line of Healthcare Services Group outpaced estimates in two of the last four quarters and missed the mark twice, the average beat being 1.4%.

The Zacks Consensus Estimate for HCSG’s 2023 earnings suggests an improvement of 55.3% from the year-ago reported figure. The consensus mark for HCSG’s 2023 earnings has moved 5.8% north in the past 60 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Healthcare Services Group, Inc. (HCSG) : Free Stock Analysis Report

Trane Technologies plc (TT) : Free Stock Analysis Report

Inspired Entertainment, Inc. (INSE) : Free Stock Analysis Report

Jacobs Solutions Inc. (J) : Free Stock Analysis Report