Jacobs (J) to Lead Design for NEOM's Port Transformation

Jacobs Solutions Inc. J, a global leader in design and consulting services, has secured a pivotal role in the redevelopment of the Port of NEOM in Saudi Arabia. NEOM Company (“NEOM”) has entrusted Jacobs as the lead design consultant for this project, set to revolutionize the existing facility into a cutting-edge, net-zero global logistics hub.

Shares of Jacobs gained 0.8% during the trading session on Sep 18 but declined 0.4% in the after-hour trading session on the same day.

Notably, NEOM's Port of Oxagon, located in northwest Saudi Arabia, aims to become the world's first fully automated, 100% renewable energy-powered integrated port and supply chain system.

For Jacobs, this venture marks another significant involvement in the Saudi giga project, NEOM, and adds to its ever-growing portfolio of global port and maritime projects. Leveraging its expertise, Jacobs is poised to offer a comprehensive solution that aligns with NEOM's vision, fosters regional growth, and steers the facility toward a more connected and sustainable future.

Situated on the northern Red Sea coast, the Port of NEOM holds a strategic position at the intersection of major trade routes, offering direct access to international markets in Asia, Europe, North America, and Africa. The development of this primary seaport is set to catalyze economic growth in northwest Saudi Arabia, boosting connectivity and attracting new businesses and industries to the region.

Jacobs will collaborate with sub-consultants Moffatt & Nichol, IGO Solutions, and Trent to bring this transformative project to life. NEOM's Terminal 1, the first container terminal, is expected to be operational by 2025.

As the Port of NEOM transforms into a global logistics powerhouse, Jacobs is set to make its mark on the future of trade and connectivity.

Strong Backlog Reflects Diverse Services

Jacobs is experiencing a surge in demand for its consulting services across a wide range of sectors, including infrastructure, water management, environmental solutions, space exploration, broadband, cybersecurity, and life sciences.

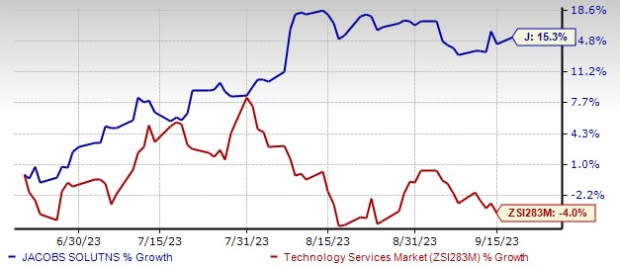

Image Source: Zacks Investment Research

In the past three months, shares of Jacobs have gained 15.3% against the industry’s 4% decline. The company's recent stellar performance can be attributed to its effective project execution, characterized by a consistent stream of contract wins.

A clear indicator of this success is the robust backlog, which stood at $28.9 billion at the close of the third quarter of fiscal 2023, marking a 2.9% increase compared to the previous year. The primary driver of this growth is the People and Places Solutions (P&PS) segment, which achieved an impressive 13% year-over-year operating profit increase.

Breaking down the backlog, the Critical Mission Solutions segment contributed $8.097 billion, offering significant visibility into the company's core operations. Meanwhile, the P&PS segment accounted for $17.5 billion during the third quarter of fiscal 2023.

Jacobs' ability to secure and execute contracts across diverse sectors underscores its strength in the consulting industry. The healthy backlog not only reflects the company's past achievements but also sets the stage for continued growth and success in the future.

Zacks Rank & Key Picks

Jacobs currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the Zacks Business Services sector are TriNet Group, Inc. TNET, Parsons Corporation PSN and Payoneer Global Inc. PAYO.

TriNet currently sports a Zacks Rank #1 (Strong Buy).TNET delivered a four-quarter average earnings surprise of 84%. The company’s shares have risen 49% in the past year. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for TNET’s 2023 sales and earnings per share (EPS) indicates a decline of 4.7% and 2.7%, respectively, from the prior-year reported figures.

Parsons currently flaunts a Zacks Rank of #1. PSN has a four-quarter average earnings surprise of 5.2%. The stock has risen 34.7% in the past year.

The Zacks Consensus Estimate for PSN’s 2023 sales and EPS indicates growth of 18.7% and 23.2%, respectively, from the prior-year reported figures.

Payoneer currently sports a Zacks Rank of #1. Payoneer has a trailing four-quarter earnings surprise of 65.4% on average. Shares of the company have gained 0.3% in the past year.

The Zacks Consensus Estimate for Payoneer’s 2023 sales and EPS indicates growth of 31.5% and 833.3%, respectively, from the year-ago reported levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

TriNet Group, Inc. (TNET) : Free Stock Analysis Report

Parsons Corporation (PSN) : Free Stock Analysis Report

Jacobs Solutions Inc. (J) : Free Stock Analysis Report

Payoneer Global Inc. (PAYO) : Free Stock Analysis Report