Jacobs (J) Wins National Grid Management Consultancy Framework

Jacobs Solutions Inc. J has been awarded the general management consultancy framework with energy utility National Grid to support its business service operations needs in the United Kingdom and the United States.

Per the contract, Jacobs has been enlisted to offer comprehensive service operations support throughout the National Grid. This is for enhancing key aspects of the organization's operations, encompassing strategic development, business planning, process refinement and implementation assistance.

Jacobs is actively assisting clients in navigating the future of clean, secure, and affordable energy supply, as well as addressing the challenges of decarbonization and electrification demand. In the United Kingdom, Jacobs has played a crucial role in supporting National Grid in various capacities. For instance, the company has been integral to the Design & Project Services Framework within National Grid's Transmission portfolio.

Additionally, Jacobs’s partnership with Morrison Energy Services (under the Joint Venture known as J1M) offers a wide spectrum of services as part of National Grid's Electricity Transmission Engineering Procurement Construction Framework, specifically in the Substations Lot.

Moreover, Jacobs' Consulting and Advisory team has provided essential support to National Grid's U.K. distribution team. They have been instrumental in preparing a five-year regulatory submission aimed at securing investment for network operations and the development of new infrastructure, particularly in the context of the critical transition to a net-zero emissions environment.

Robust Backlog

Jacobs has been witnessing a surge in demand for its consulting services across diverse sectors, encompassing infrastructure, water management, environmental solutions, space exploration, broadband, cybersecurity, and life sciences. The company's recent impressive performance owes much to its effective project execution, underscored by a consistent stream of contract wins. A testament to this success is the robust backlog level, which stood at $28.9 billion by the close of the third quarter of fiscal 2023, reflecting a 2.9% increase compared to the previous year. This growth can be largely attributed to the People and Places Solutions (P&PS) segment, which achieved an impressive 13% year-over-year operating profit growth.

Within this backlog, the Critical Mission Solutions segment contributed $8.097 billion, providing substantial visibility into the core business, while P&PS accounted for $17.5 billion during the third quarter of fiscal 2023.

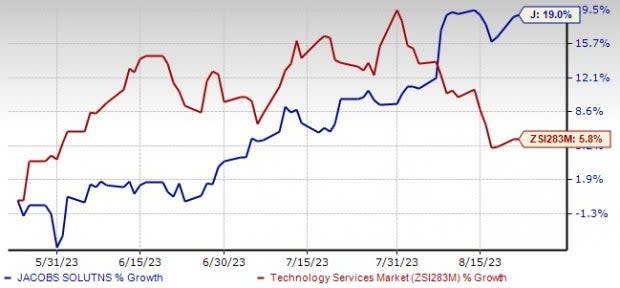

Image Source: Zacks Investment Research

Shares of Jacobs inched up 0.2% on Aug 22 during the trading session and 1.4% in the after-hour trading session on the same day. Also, the stock has risen 19% in the past three months versus the Zacks Technology Services industry’s growth of 5.8%.

Despite the prevailing concerns related to foreign exchange rate fluctuations and elevated costs and expenses, Jacobs anticipates benefiting from robust global trends. These encompass infrastructure modernization, the shift toward sustainable energy, national security imperatives, and the potential for a super-cycle in global supply-chain investments in the foreseeable future. These factors are expected to sustain the company's positive momentum in the short term.

Zacks Rank & Key Picks

Jacobs currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the Zacks Business Services sector are TriNet Group, Inc. TNET, Parsons Corporation PSN and DocuSign, Inc. DOCU.

TriNet currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

TNET delivered a four-quarter average earnings surprise of 84%. The company’s shares have risen 20.7% in the past year. The Zacks Consensus Estimate for TNET’s 2023 sales and earnings per share (EPS) indicates a decline of 4.7% and 2.7%, respectively, from the prior-year reported figures.

Parsons currently flaunts a Zacks Rank of 1. PSN has a four-quarter average earnings surprise of 5.2%. The stock has risen 30.4% in the past year.

The Zacks Consensus Estimate for PSN’s 2023 sales and EPS indicates growth of 18.5% and 23.2%, respectively, from the prior-year reported figures.

DocuSign currently sports a Zacks Rank of 1. DocuSign has a trailing four-quarter earnings surprise of 25.6%, on average. Shares of the company have declined 21.5% in the past year.

The Zacks Consensus Estimate for DocuSign’s fiscal 2024 sales and EPS indicates a decline of 8.1% and 23.7%, respectively, from the year-ago reported levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

TriNet Group, Inc. (TNET) : Free Stock Analysis Report

DocuSign (DOCU) : Free Stock Analysis Report

Parsons Corporation (PSN) : Free Stock Analysis Report

Jacobs Solutions Inc. (J) : Free Stock Analysis Report