Jacobs Solutions Inc (J) Posts Robust Q1 2024 Earnings with Revenue and EPS Surge

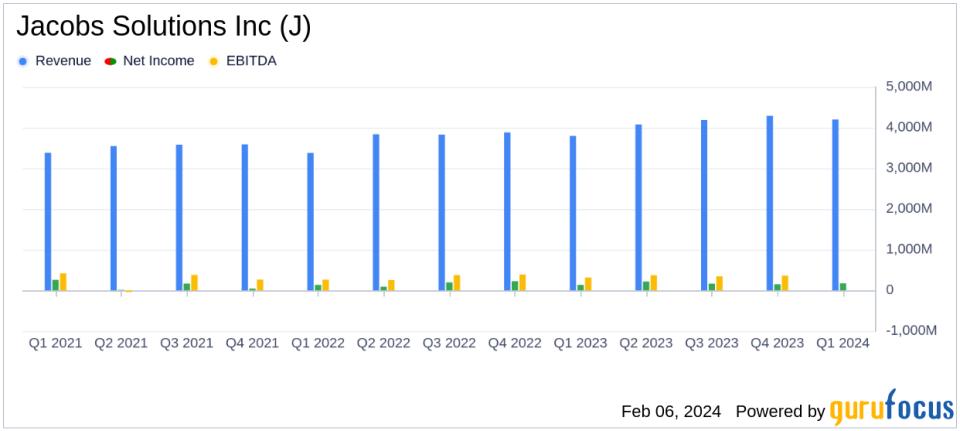

Revenue: Q1 revenue increased by 9.5% year-over-year to $4.2 billion.

Earnings Per Share (EPS): Reported EPS rose by 28% year-over-year to $1.37; Adjusted EPS also up 28% to $2.02.

Cash Flow: Strong cash flow from operations reported at $418 million.

Dividend: Announced an 11.5% increase in quarterly dividend.

Backlog: Backlog grew by 4.7% year-over-year to $29.6 billion, with gross profit in backlog up 6.1%.

Financial Outlook: Fiscal 2024 adjusted EBITDA and adjusted EPS outlook reiterated, with midpoints up by 9% and 10%, respectively.

On February 6, 2024, Jacobs Solutions Inc (NYSE:J) released its 8-K filing, detailing a strong start to the fiscal year with significant year-over-year growth in revenue and earnings per share. Jacobs Solutions, a global leader in delivering engineering, design, procurement, construction, and maintenance services, as well as cyber engineering and security solutions, continues to leverage its expansive portfolio to meet the growing demands of various sectors including water, transportation, healthcare, technology, and chemicals.

Performance Highlights and Challenges

Jacobs Solutions Inc (NYSE:J) reported a 9.5% increase in revenue for the first quarter of fiscal 2024, reaching $4.2 billion, driven by a 10.9% increase in its People and Places Solutions segment. This growth reflects the company's strategic focus on global infrastructure and sustainability investments. The reported earnings per share (EPS) saw a significant 28% increase year-over-year, standing at $1.37, while the adjusted EPS from continuing operations also rose by 28% to $2.02. This performance underscores the importance of Jacobs' lean operating model and disciplined execution in delivering value to stakeholders.

Despite these achievements, Jacobs Solutions Inc (NYSE:J) faces challenges inherent in the construction industry, such as the need for continuous innovation, managing complex projects, and navigating regulatory environments. These challenges could lead to problems if not managed effectively, but the company's robust backlog growth and strategic initiatives indicate a strong capacity to address these issues.

Financial Achievements and Industry Significance

The company's financial achievements, including a strong cash flow from operations of $418 million and a commitment to returning capital to shareholders through share repurchases and an increased dividend, are particularly important in the construction industry. These actions demonstrate financial stability and confidence in the company's future, which is critical for sustaining long-term growth and competitiveness in the market.

Financial Metrics and Analysis

Key financial details from the income statement show that Jacobs Solutions Inc (NYSE:J) has managed to increase its gross profit from $814.713 million in Q1 2023 to $850.538 million in Q1 2024. Selling, general, and administrative expenses also rose from $576.908 million to $646.475 million, reflecting the company's investment in growth and operational excellence. The balance sheet remains solid, with the company maintaining a disciplined approach to capital allocation and investment.

Important metrics such as cash flow from operations and free cash flow are crucial for Jacobs Solutions Inc (NYSE:J) as they provide insights into the company's operational efficiency and liquidity. The strong cash flow performance supports the company's strategic investments and shareholder returns, showcasing its robust financial health.

Executive Commentary

"We kicked off fiscal 2024 with strong performance, underpinned by robust organic revenue growth in our People and Places Solutions (P&PS) business, reflecting the broad-based strength that we see in global infrastructure and sustainability investment," said Jacobs' CEO Bob Pragada.

"Jacobs delivered $418M in cash flow from operations and $401M in free cash flow while repurchasing $100M in shares and increasing our dividend. We remain committed to the consistent return of capital to shareholders, and will look to increase return of capital while maintaining discipline and an investment grade credit profile," added Jacobs CFO Claudia Jaramillo.

The company's reiteration of its fiscal 2024 adjusted EBITDA and adjusted EPS outlook, with midpoints up by 9% and 10% respectively, reflects confidence in its strategic direction and operational capabilities. The planned separation transaction with Amentum, expected to close in the second half of fiscal year 2024, is also a significant move that could further streamline operations and unlock shareholder value.

Overall, Jacobs Solutions Inc (NYSE:J)'s Q1 2024 earnings report presents a picture of a company that is successfully navigating the complexities of the construction industry, leveraging its strengths in infrastructure and sustainability, and delivering value to its stakeholders.

For more detailed information and to view the full earnings release, please visit the official 8-K filing.

Explore the complete 8-K earnings release (here) from Jacobs Solutions Inc for further details.

This article first appeared on GuruFocus.