JAKKS Pacific (JAKK) Gains 53% in a Year: What's Driving It?

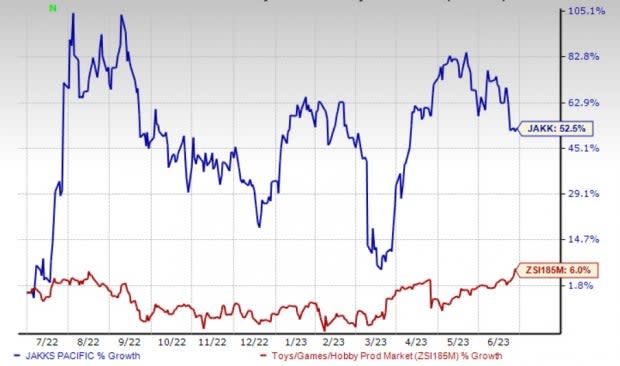

Shares of JAKKS Pacific, Inc. JAKK have gained 52.5% in the past year compared with the industry’s growth of 6%. Solid international expansion, strategic acquisitions, focus on innovation, and collaborations with popular brands and movie franchisees are aiding the company’s performance.

Growth Catalysts

JAKKS Pacific is committed toward diversifying its footprint outside the United States. Consistent with its endeavors, the company has opened sales offices and expanded distribution agreements for its products.

Meanwhile, after launching Tsum Tsum in the key international markets like Latin America and Asia, JAKK plans to expand its distribution in new territories going forward. The expansion initiatives are likely to strengthen its international presence and customer base. The initiatives are also expected to boost sales and profit margins as well as enable the company to attract licenses.

JAKKS Pacific has regularly brought in novelty in its products to cope with the changing play pattern of children and boost demand. Recently, the demand for physical toys has been declining due to younger children’s preference for digital games and other electronic learning tools. Consistent with this trend, JAKK has introduced a number of mobile gaming apps and digital games along with the physical toys which would help the company cash in on the demand for smartphone gaming.

Image Source: Zacks Investment Research

JAKKS Pacific is also connecting with customers through digital videos, display banners and social ads which would improve customer experience.

The company is also focusing on licensing agreement to drive growth. JAKKS Pacific’s licensing partners are responsible for some of the most popular intellectual properties in the world, including The Walt Disney Company, Marvel, Pixar, DC Comics, Warner Bros., NBC Universal and so many others.

The Zacks Rank #2 (Buy) company’s outlook for 2023 and beyond is promising. JAKK’s strategic expansion into new categories and acquisition of licenses to enhance its products has led to thriving evergreen businesses. The introduction of skateboard and roller skate products, with and without licenses, in its seasonal business garnered positive customer response. To maximize this success, JAKKS Pacific is expanding its distribution channels.

Other Key Picks

Some other top-ranked stocks in the Zacks Consumer Discretionary sector are Royal Caribbean Cruises Ltd. RCL, Trip.com Group Limited TCOM and Bluegreen Vacations Holding Corporation BVH, presently sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Royal Caribbean Cruises has a trailing four-quarter earnings surprise of 26.4%, on average. Shares of RCL have surged 187.4% in the past year.

The Zacks Consensus Estimate for Royal Caribbean Cruises’ 2023 sales and EPS indicates rises of 48.5% and 162.9%, respectively, from the year-ago period’s levels.

Trip.com Group has a trailing four-quarter earnings surprise of 147.9%, on average. Shares of TCOM have increased 24.8% in the past year.

The Zacks Consensus Estimate for Trip.com Group’s 2023 sales and EPS implies surges of 102.2% and 334.5%, respectively, from the year-ago period’s levels.

Bluegreen Vacations has a trailing four-quarter earnings surprise of 24.7%, on average. Shares of BVH have gained 36.8% in the past year.

The Zacks Consensus Estimate for Bluegreen Vacations’ 2023 sales and EPS suggests improvements of 3.6% and 17.6%, respectively, from the year-ago period’s levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Royal Caribbean Cruises Ltd. (RCL) : Free Stock Analysis Report

JAKKS Pacific, Inc. (JAKK) : Free Stock Analysis Report

Trip.com Group Limited Sponsored ADR (TCOM) : Free Stock Analysis Report

Bluegreen Vacations Holding Corporation (BVH) : Free Stock Analysis Report