JAKKS Pacific (JAKK) Q3 Earnings Beat Estimates, Stock Up

JAKKS Pacific, Inc. JAKK reported third-quarter 2023 results, with earnings and revenues surpassing the Zacks Consensus Estimate. While revenues outpaced the consensus estimate for the eighth straight quarter, earnings beat the same for the third consecutive quarter.

Following the announcement, shares of the company increased 22% during the after-hours trading session on Nov 1. The company’s product margins have seen a notable boost this year, thanks to a more stable supply chain and reduced promotional activities compared with the previous year.

Q3 Earnings and Revenues

During the quarter, the company reported adjusted earnings per share (EPS) of $4.75, beating the Zacks Consensus Estimate of $3.46. In the prior-year quarter, JAKK reported adjusted EPS of $3.80.

Quarterly revenues of $309.7 million surpassed the consensus mark of $284 million. However, the top line declined 4% on a year-over-year basis. During the quarter, it reported solid contributions from Costumes. Yet, dismal Toys/Consumer Products sales hurt its top line.

Net sales in the Toys/Consumer Products segment decreased 9% year over year to $246 million. Our estimate was $236.6 million.

Costumes net sales rose 19% year over year to $63.7 million. Our projection was $46.4 million.

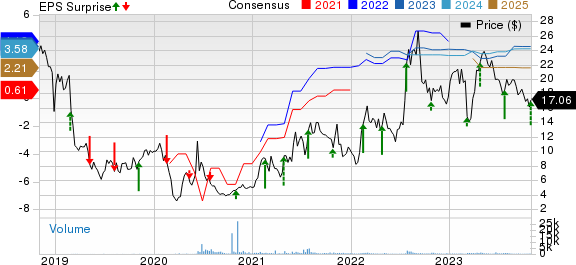

JAKKS Pacific, Inc. Price, Consensus and EPS Surprise

JAKKS Pacific, Inc. price-consensus-eps-surprise-chart | JAKKS Pacific, Inc. Quote

Operating Highlights

In the reported quarter, gross margin reached 34.5%, up 600 basis points from the prior-year levels. We predicted the metric to be 26.9%.

Adjusted EBITDA amounted to $67.1 million compared with $59.4 million a year ago.

Balance Sheet

As of Sep 30, the company’s cash and cash equivalents (including restricted cash) were $96.4 million compared with $76.6 million as of Sep 30, 2022.

As of Sep 30, 2023, total debt was zero, in contrast to $67.7 million as of Sep 30, 2022, and $67.2 million as of Dec 31, 2022.

Zacks Rank

JAKKS Pacific carries a Zacks Rank #2 (Buy).

Other Key Picks

Live Nation Entertainment, Inc. LYV sports a Zacks Rank #1 (Strong Buy). It has a trailing four-quarter earnings surprise of 34.6%, on average. Shares of LYV have declined 3.8% in the past year. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for LYV’s 2023 sales and EPS indicates 21.6% and 59.4% growth, respectively, from a year ago.

AMC Entertainment Holdings, Inc. AMC flaunts a Zacks Rank #1. AMC has a trailing four-quarter earnings surprise of 44.2% on average. The stock has fallen 32.9% in the past year.

The Zacks Consensus Estimate for AMC’s 2024 sales and EPS implies improvements of 19.5% and 72.8%, respectively, from the prior-year levels.

OneSpaWorld Holdings Limited OSW sports a Zacks Rank #1. OSW has a trailing four-quarter earnings surprise of 42.6% on average. Shares of OSW have increased by 10.1% in the past year.

The Zacks Consensus Estimate for OSW’s 2023 sales and EPS suggests advancements of 44.5% and 117.9%, respectively, from the year-earlier levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

JAKKS Pacific, Inc. (JAKK) : Free Stock Analysis Report

Live Nation Entertainment, Inc. (LYV) : Free Stock Analysis Report

AMC Entertainment Holdings, Inc. (AMC) : Free Stock Analysis Report

OneSpaWorld Holdings Limited (OSW) : Free Stock Analysis Report