Jamf Holding Corp (JAMF) Reports Solid Growth Amidst Economic Headwinds

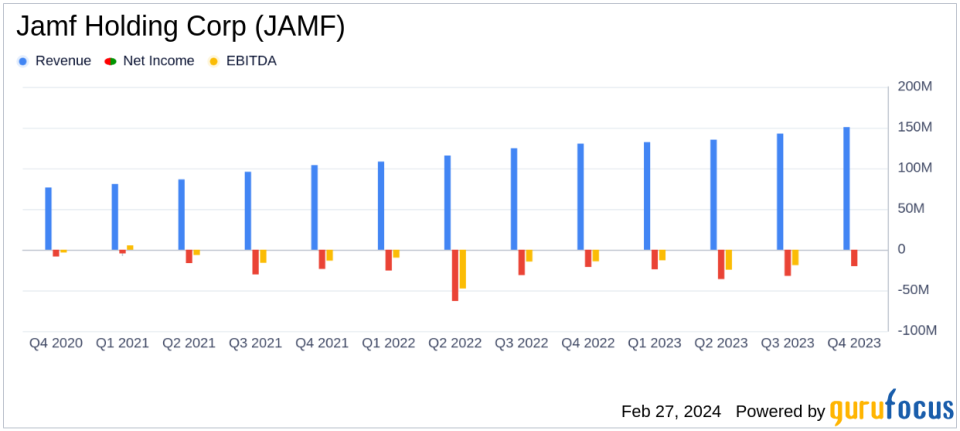

Annual Revenue Growth: Jamf Holding Corp (NASDAQ:JAMF) achieved a 17% increase in total revenue, reaching $560.6 million for the fiscal year 2023.

ARR Expansion: Annual Recurring Revenue (ARR) grew by 15% year-over-year, totaling $588.6 million as of December 31, 2023.

Operating Income and Loss: Non-GAAP operating income improved to $45.4 million, while GAAP operating loss decreased to $115.2 million for the fiscal year.

Gross Profit Margin: GAAP gross profit margin remained strong at 78%, with non-GAAP gross profit margin at 82% for the fiscal year.

Cash Flow: Cash flow from operations was reported at $36.0 million, with unlevered free cash flow of $55.4 million for fiscal year 2023.

On February 27, 2024, Jamf Holding Corp (NASDAQ:JAMF), a leader in Apple Enterprise Management, released its 8-K filing, detailing the financial results for the fourth quarter and fiscal year ended December 31, 2023. The company, known for its cloud software platform that manages and secures Apple products, reported a year-over-year revenue growth of 17%, signaling robust performance despite economic challenges.

Jamf's cloud-based Software-as-a-Service (SaaS) solutions are sold through a subscription model, catering to a diverse clientele that includes businesses, educational institutions, hospitals, and government agencies. The company's direct sales force, online presence, and channel partners, including Apple, facilitate its global reach across The Americas, EMEA, and Asia Pacific regions.

Financial Performance and Strategic Initiatives

Jamf's fiscal year 2023 was marked by a significant 17% increase in total revenue, amounting to $560.6 million. The company's Annual Recurring Revenue (ARR) also saw a 15% rise, reaching $588.6 million. This growth is indicative of Jamf's strong market position and the increasing demand for its Apple-first enterprise solutions.

Despite the positive revenue growth, Jamf reported a GAAP operating loss of $115.2 million, which is an improvement from the previous year's $138.9 million loss. The reduction in operating loss, coupled with a non-GAAP operating income of $45.4 million, reflects the company's strategic efforts in cost management and operational efficiency.

Jamf's gross profit margins remained robust, with a GAAP gross profit of $434.5 million, or 78% of total revenue, and a non-GAAP gross profit of $460.1 million, or 82% of total revenue. These figures underscore the company's ability to maintain profitability in its core operations.

The company's cash flow from operations stood at $36.0 million, representing 6% of total revenue, while unlevered free cash flow was reported at $55.4 million, or 10% of total revenue. These cash flow metrics are crucial for Jamf's ability to invest in growth initiatives and navigate economic uncertainties.

"We achieved significant margin improvement on both on a GAAP and non-GAAP basis in 2023 as a result of revenue outperformance and diligent cost management," said Ian Goodkind, Jamf CFO. "As we look to the next three years, well ramp up our efforts to increase profitability to align our cost structure with the current revenue growth profile of Jamf, with the goal of exceeding the Rule of 40 in 2026."

Jamf's balance sheet remains solid, with cash and cash equivalents totaling $243.6 million as of December 31, 2023. The company's commitment to strategic investments and cost management is expected to drive further financial improvements and shareholder value.

Looking Ahead

As Jamf looks forward to the fiscal year 2024, it anticipates total revenue to be between $614.5 and $619.5 million, with non-GAAP operating income projected to be between $89.0 and $93.0 million. These forward-looking statements reflect the company's confidence in its business model and the continued demand for its solutions.

Jamf's emphasis on security and innovation is evident in its recent business highlights, including a 33% year-over-year growth in security ARR and the launch of support for Apple Vision Pro. The company's participation in the Microsoft Security Copilot Partner Private Preview and the release of its annual Security 360: Annual Trends Report further demonstrate its commitment to staying at the forefront of enterprise security.

Value investors and potential GuruFocus.com members interested in the software industry and cloud-based SaaS solutions will find Jamf Holding Corp (NASDAQ:JAMF)'s financial results and strategic direction indicative of a company poised for continued growth and profitability. For a more detailed analysis and insights into Jamf's financials, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Jamf Holding Corp for further details.

This article first appeared on GuruFocus.