Jamf (NASDAQ:JAMF) Surprises With Q4 Sales But Stock Drops 10.2% On Weak Guidance

Apple device management company, Jamf (NASDAQ:JAMF) reported results ahead of analysts' expectations in Q4 FY2023, with revenue up 15.6% year on year to $150.6 million. On the other hand, next quarter's revenue guidance of $149 million was less impressive, coming in 1.2% below analysts' estimates. It made a non-GAAP profit of $0.13 per share, improving from its profit of $0.06 per share in the same quarter last year.

Is now the time to buy Jamf? Find out by accessing our full research report, it's free.

Jamf (JAMF) Q4 FY2023 Highlights:

Revenue: $150.6 million vs analyst estimates of $148.5 million (1.4% beat)

EPS (non-GAAP): $0.13 vs analyst estimates of $0.12 (9.4% beat)

Revenue Guidance for Q1 2024 is $149 million at the midpoint, below analyst estimates of $150.8 million

Management's revenue guidance for the upcoming financial year 2024 is $617 million at the midpoint, missing analyst estimates by 3.8% and implying 10.1% growth (vs 17.3% in FY2023)

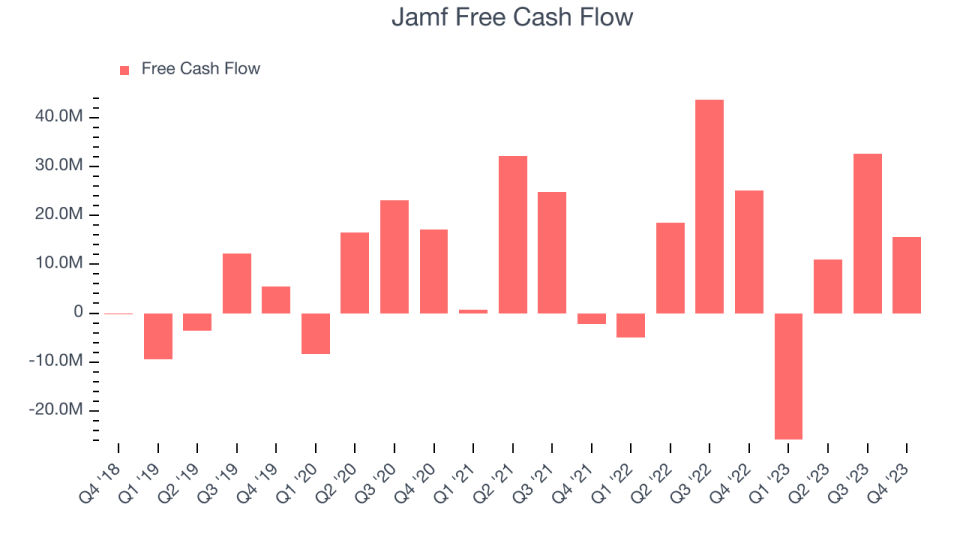

Free Cash Flow of $15.51 million, down 52.3% from the previous quarter

Gross Margin (GAAP): 78%, down from 80% in the same quarter last year

Market Capitalization: $2.50 billion

“Jamf completed 2023 with solid results as organizations choose Jamf to enable an Apple-first, modern approach to managing and securing employee devices,” said John Strosahl, Jamf CEO.

Founded in 2002 by Zach Halmstad and Chip Pearson, right around the time when Apple began to dominate the personal computing market, Jamf (NASDAQ:JAMF) provides software for companies to manage Apple devices such as Macs, iPads, and iPhones.

Automation Software

The whole purpose of software is to automate tasks to increase productivity. Today, innovative new software techniques, often involving AI and machine learning, are finally allowing automation that has graduated from simple one- or two-step workflows to more complex processes integral to enterprises. The result is surging demand for modern automation software.

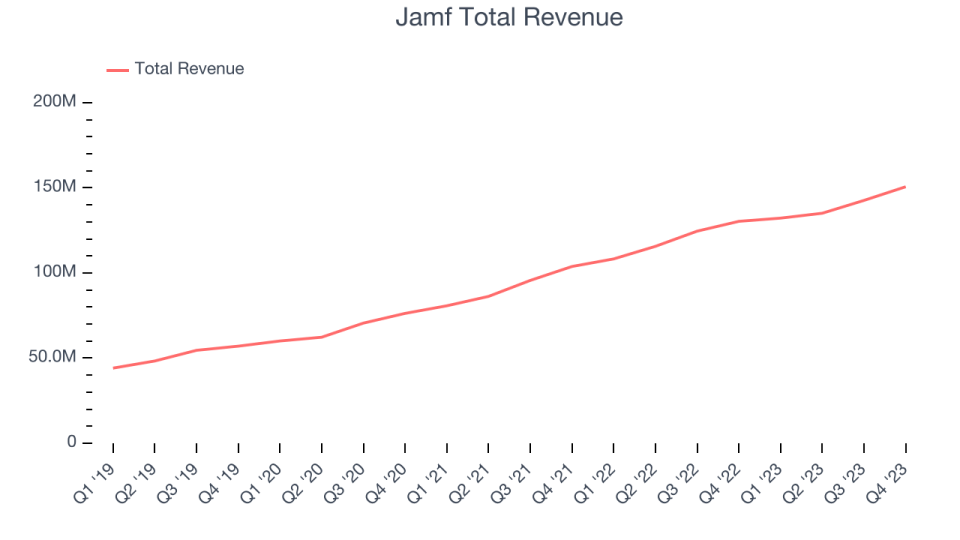

Sales Growth

As you can see below, Jamf's revenue growth has been strong over the last two years, growing from $103.8 million in Q4 FY2021 to $150.6 million this quarter.

This quarter, Jamf's quarterly revenue was once again up 15.6% year on year. We can see that Jamf's revenue increased by $8.02 million in Q4, up from $7.54 million in Q3 2023. While we've no doubt some investors were looking for higher growth, it's good to see that quarterly revenue is re-accelerating.

Next quarter's guidance suggests that Jamf is expecting revenue to grow 12.7% year on year to $149 million, slowing down from the 22.1% year-on-year increase it recorded in the same quarter last year. For the upcoming financial year, management expects revenue to be $617 million at the midpoint, growing 10.1% year on year compared to the 17.1% increase in FY2023.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Cash Is King

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Jamf's free cash flow came in at $15.51 million in Q4, down 38.2% year on year.

Jamf has generated $33.03 million in free cash flow over the last 12 months, or 5.9% of revenue. This FCF margin enables it to reinvest in its business without depending on the capital markets.

Key Takeaways from Jamf's Q4 Results

It was encouraging to see Jamf narrowly top analysts' revenue expectations this quarter. On the other hand, free cash flow was weaker and its full-year revenue guidance was below estimates and suggests a slowdown in demand. Overall, the results could have been better. The company is down 10.2% on the results and currently trades at $17.9 per share.

Jamf may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.