Jana Partners Adds Mercury Systems Inc to Its Portfolio

On August 18, 2023, Jana Partners (Trades, Portfolio), a renowned investment management firm, made a significant addition to its portfolio by acquiring 4711386 shares in Mercury Systems Inc. This article provides an in-depth analysis of this transaction, the profiles of both Jana Partners (Trades, Portfolio) and Mercury Systems Inc, and the potential implications of this acquisition.

Details of the Transaction

The transaction took place on August 18, 2023, with Jana Partners (Trades, Portfolio) adding 316745 shares of Mercury Systems Inc to its portfolio. This addition had a 0.89% impact on Jana Partners (Trades, Portfolio)' portfolio. The shares were traded at a price of $38.05 each, bringing Jana Partners (Trades, Portfolio)' total holdings in Mercury Systems Inc to 4711386 shares. This represents 13.28% of Jana Partners (Trades, Portfolio)' portfolio and 8.10% of Mercury Systems Inc's total shares.

Profile of Jana Partners (Trades, Portfolio)

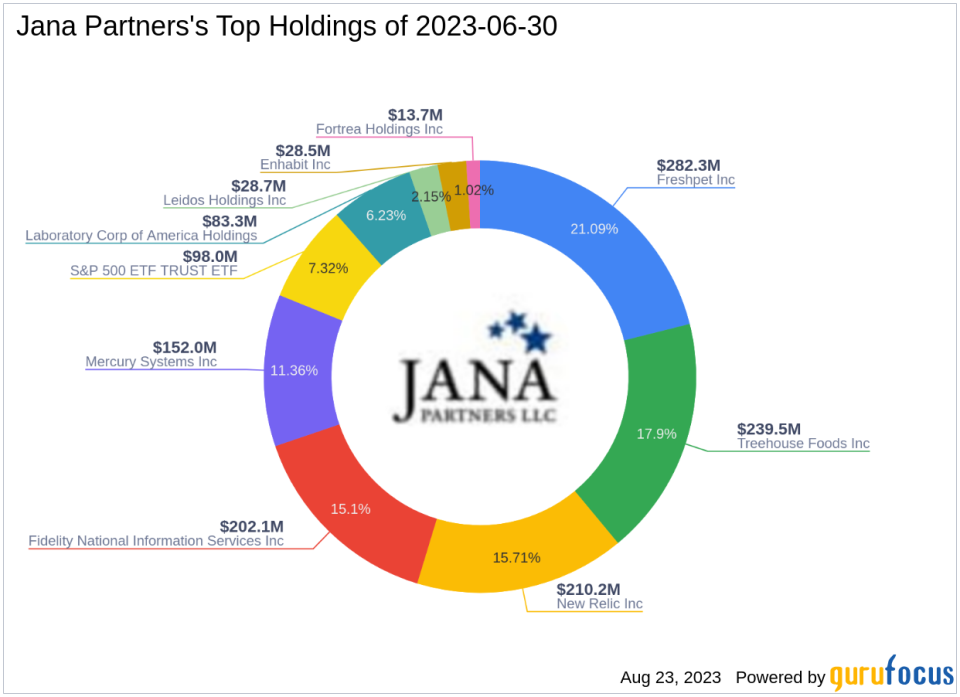

Jana Partners (Trades, Portfolio) LLC is an investment management firm founded in 2001 by Barry Rosenstein, Janas Managing Partner and Co-Portfolio Manager. The firm, headquartered in New York, follows a value-oriented, event-driven strategy. It identifies undervalued companies with specific catalysts to unlock value and, in certain cases, becomes an actively engaged shareholder to create value. Jana invests both long and short and across the capital structure, including equity and debt. The firm's top holdings include Freshpet Inc(NASDAQ:FRPT), Mercury Systems Inc(NASDAQ:MRCY), Fidelity National Information Services Inc(NYSE:FIS), New Relic Inc(NYSE:NEWR), and Treehouse Foods Inc(NYSE:THS). The firm's equity stands at $1.34 billion, with a strong focus on the Consumer Defensive and Technology sectors.

Overview of Mercury Systems Inc

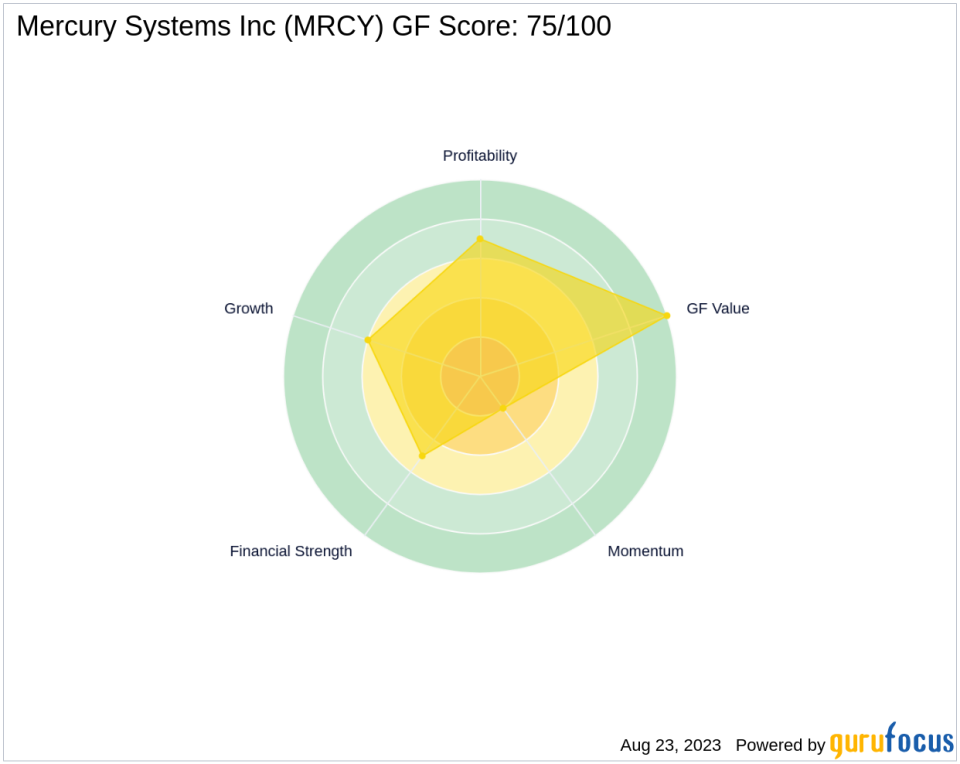

Mercury Systems Inc is a commercial technology company serving the aerospace and defense industry. The company, which went public on January 30, 1998, creates and delivers secure open architecture solutions for a broad range of mission-critical applications in challenging and demanding environments. The company's market capitalization stands at $2.21 billion, with a current stock price of $37.96. Despite a PE percentage of 0.00, indicating a loss, the company's GF Value is 56.15, suggesting a possible value trap. The company's GF Score is 75/100, indicating a likely average performance.

Analysis of the Transaction

The addition of Mercury Systems Inc to Jana Partners (Trades, Portfolio)' portfolio aligns with the firm's value-oriented, event-driven strategy. Despite Mercury Systems Inc's current loss, as indicated by a PE percentage of 0.00, the company's GF Value of 56.15 suggests potential for value unlocking. This acquisition could potentially enhance Jana Partners (Trades, Portfolio)' portfolio performance, given Mercury Systems Inc's GF Score of 75/100.

Comparison with Other Gurus

Other gurus, such as Ken Fisher (Trades, Portfolio), also hold shares in Mercury Systems Inc. However, Baron Funds holds the most shares in the company. The acquisition by Jana Partners (Trades, Portfolio) further underscores the potential value in Mercury Systems Inc, as perceived by these investment gurus.

Conclusion

In conclusion, Jana Partners (Trades, Portfolio)' acquisition of Mercury Systems Inc shares is a strategic move that aligns with the firm's investment philosophy. Despite Mercury Systems Inc's current loss, the company's GF Value suggests potential for value unlocking. This transaction could potentially enhance Jana Partners (Trades, Portfolio)' portfolio performance and contribute to the firm's overall investment strategy.

This article first appeared on GuruFocus.