Jana Partners Adds to Its Stake in Treehouse Foods Inc

On September 7, 2023, Jana Partners (Trades, Portfolio), a renowned investment management firm, increased its stake in Treehouse Foods Inc. (NYSE:THS), a leading private label manufacturer in the U.S. This article provides an in-depth analysis of the transaction, the profiles of Jana Partners (Trades, Portfolio) and Treehouse Foods Inc, and the potential implications for value investors.

Details of the Transaction

Jana Partners (Trades, Portfolio) added 112,275 shares of Treehouse Foods Inc to its portfolio on September 7, 2023, at a trade price of $44.53 per share. This transaction increased Jana Partners (Trades, Portfolio)' total holdings in Treehouse Foods Inc to 4,907,689 shares, representing 16.27% of its portfolio. The transaction had a 0.37% impact on Jana Partners (Trades, Portfolio)' portfolio and increased its stake in Treehouse Foods Inc to 8.70%.

Profile of Jana Partners (Trades, Portfolio)

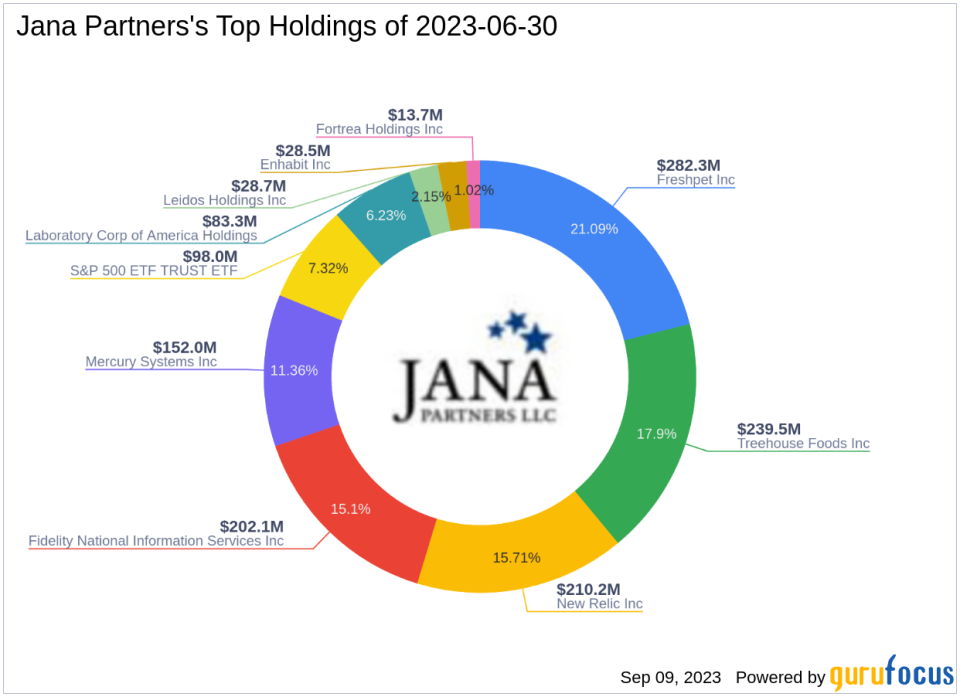

Jana Partners (Trades, Portfolio) LLC is an investment management firm founded in 2001 by Barry Rosenstein. The firm is headquartered in New York and follows a value-oriented, event-driven strategy. Jana Partners (Trades, Portfolio) identifies undervalued companies with specific catalysts to unlock value and, in some cases, becomes an actively engaged shareholder. The firm's top holdings include Freshpet Inc (NASDAQ:FRPT), Mercury Systems Inc (NASDAQ:MRCY), Fidelity National Information Services Inc (NYSE:FIS), New Relic Inc (NYSE:NEWR), and Treehouse Foods Inc (NYSE:THS). The firm's equity is valued at $1.34 billion, with the Consumer Defensive and Technology sectors being its top sectors.

Overview of Treehouse Foods Inc

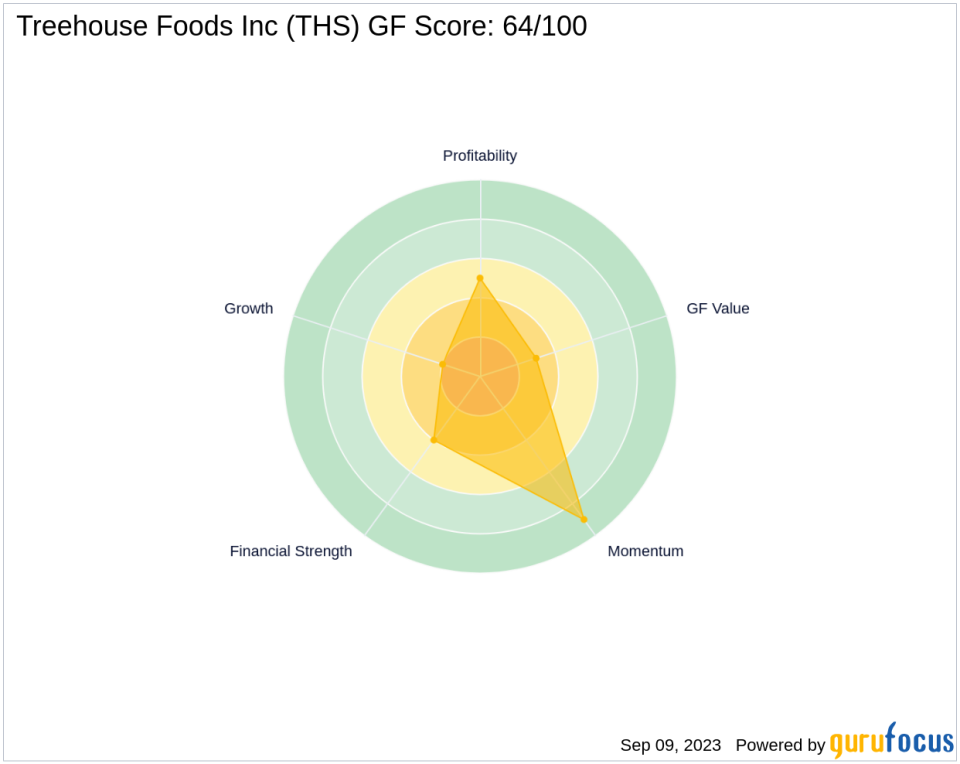

Treehouse Foods Inc, the largest private label manufacturer in the U.S, operates in over 25 categories, including snacks, meals, and single-serve beverages. The company's market capitalization stands at $2.56 billion, with a current stock price of $45.42. Despite a PE percentage of 0.00, indicating a loss, the company is considered fairly valued based on the GF Value of 41.87. The stock has gained 2% since the transaction and has seen a 67.91% increase since its IPO on June 15, 2005. However, the stock has declined by 7.04% year-to-date. The company's GF Score stands at 64/100, indicating a poor future performance potential.

Analysis of Treehouse Foods Inc's Financial Health

Treehouse Foods Inc's financial health is evaluated based on several factors. The company's balance sheet, profitability, and growth ranks are 4/10, 5/10, and 2/10, respectively. The company's Piotroski F-Score is 4, and its Altman Z score is 1.48, indicating potential financial distress. The company's cash to debt ratio is 0.01, and its interest coverage is 2.60. These figures suggest that the company may face challenges in meeting its financial obligations.

Other Gurus' Investment in Treehouse Foods Inc

Other notable gurus who hold Treehouse Foods Inc's stock include Mario Gabelli (Trades, Portfolio) and Joel Greenblatt (Trades, Portfolio). The guru with the most shares in Treehouse Foods Inc is FPA Queens Road Small Cap Value Fund.

Conclusion

In conclusion, Jana Partners (Trades, Portfolio)' recent acquisition of additional shares in Treehouse Foods Inc is a significant move that increases its stake in the company. However, given Treehouse Foods Inc's financial health and stock performance, value investors should exercise caution. As always, investors are advised to conduct their own comprehensive analysis before making investment decisions.

This article first appeared on GuruFocus.