Jana Partners Cuts Ties with New Relic Inc, Impacting Portfolio by -19.64%

Insight into Jana Partners (Trades, Portfolio)' Latest 13F Filing for Q4 2023

Jana Partners (Trades, Portfolio) LLC, the New York-based investment management firm known for its value-oriented, event-driven investment strategy, has revealed its 13F holdings for the fourth quarter of 2023. Founded in 2001 by Barry Rosenstein, Jana Partners (Trades, Portfolio) focuses on identifying undervalued companies poised for a value unlock, often taking an active role to catalyze change. The firm's approach spans long and short investments across equity and debt, reflecting a flexible yet disciplined investment philosophy.

Summary of New Buys

Jana Partners (Trades, Portfolio) introduced a new position in the following stock:

Trimble Inc (NASDAQ:TRMB) was the standout new addition with 3,760,371 shares, making up 12.91% of the portfolio and valued at $200.05 million.

Key Position Increases

The firm also bolstered its stakes in several companies:

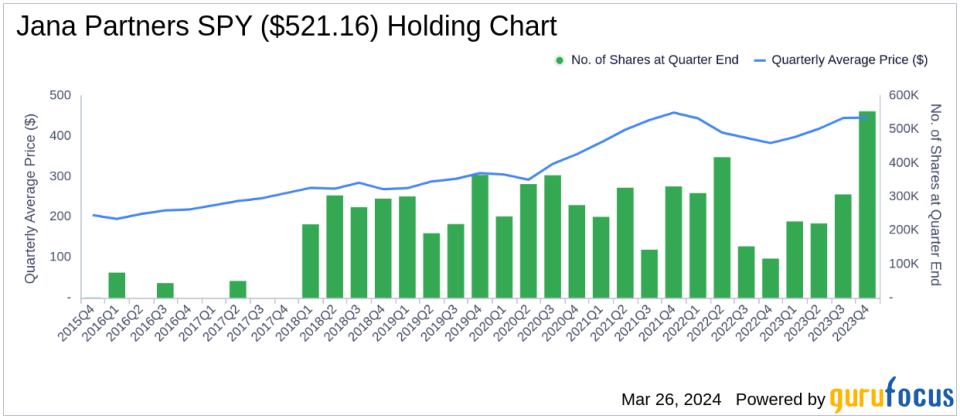

A significant boost was seen in S&P 500 ETF TRUST ETF (SPY), with an additional 246,900 shares, bringing the total to 553,933 shares. This represents an 80.41% increase in share count and a 7.58% impact on the current portfolio, valued at $263.29 million.

Frontier Communications Parent Inc (NASDAQ:FYBR) also saw a notable hike with an additional 744,300 shares, resulting in a total of 9,023,476 shares. This adjustment marks an 8.99% increase in share count, with a total value of $228.65 million.

Summary of Sold Out Positions

Jana Partners (Trades, Portfolio) exited positions in two companies during the quarter:

New Relic Inc (NEWR) saw a complete sell-off of 3,215,426 shares, leading to a -19.64% impact on the portfolio.

Wolfspeed Inc (NYSE:WOLF) was also liquidated with all 936,000 shares sold, causing a -2.54% impact on the portfolio.

Key Position Reductions

Reductions were made in the following stocks:

Freshpet Inc (NASDAQ:FRPT) was trimmed by 460,526 shares, resulting in a -14.15% decrease in shares and a -2.17% impact on the portfolio. The stock traded at an average price of $68.5 during the quarter and has returned 33.84% over the past three months and 32.61% year-to-date.

Fidelity National Information Services Inc (NYSE:FIS) saw a reduction of 421,912 shares, a -11.29% decrease in shares, and a -1.66% impact on the portfolio. The stock's average trading price was $54.86 during the quarter, with returns of 19.56% over the past three months and 19.95% year-to-date.

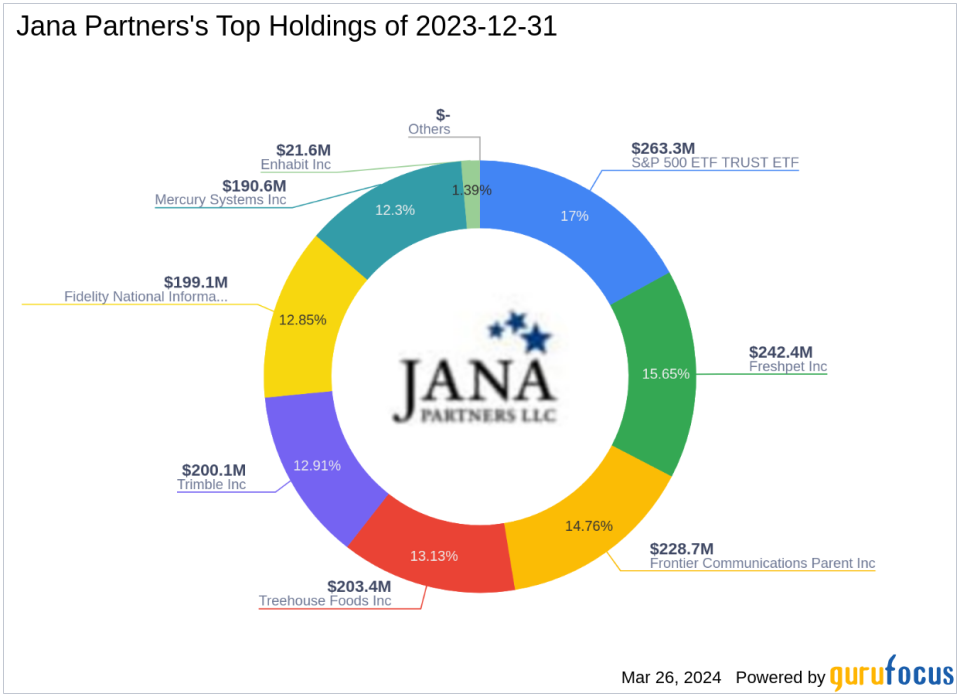

Portfolio Overview

As of the fourth quarter of 2023, Jana Partners (Trades, Portfolio)' portfolio consisted of 8 stocks. The top holdings were 17% in S&P 500 ETF TRUST ETF (SPY), 15.65% in Freshpet Inc (NASDAQ:FRPT), 14.76% in Frontier Communications Parent Inc (NASDAQ:FYBR), 13.13% in Treehouse Foods Inc (NYSE:THS), and 12.91% in Trimble Inc (NASDAQ:TRMB). The investments are primarily concentrated in five industries: Consumer Defensive, Technology, Communication Services, Industrials, and Healthcare.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.