Jana Partners Increases Mercury Systems Stake Following Board Shake-Up

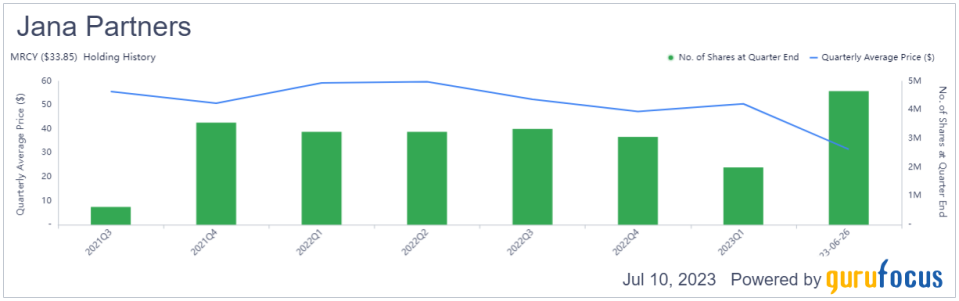

After curbing its investment in Mercury Systems Inc. (NASDAQ:MRCY) during the first quarter, Jana Partners (Trades, Portfolio) disclosed last week it boosted the stake by 133.53%.

Taking a value-oriented, event-driven approach to picking stocks, the New York-based firm founded in 2001 by Barry Rosenstein often enters activist positions in order to help unlock value for shareholders.

The investment

In the case of Mercury Systems, Jana disclosed an investment in the company in the third quarter of 2021. The firm said it planned to push the aerospace and defense company to consider options for improving its business, including a potential sale.

GuruFocus Real-Time Picks, a Premium feature based on 13D, 13G and Form 4 filings, showed the activist firm picked up 2.66 million shares of the Andover, Massachusetts-based company on June 26, impacting the equity portfolio by 5.97%. The stock traded for an average price of $31.50 per share on the day of the transaction.

Jana now holds 4.65 million shares total, which represent 10.44% of the equity portfolio. It was the sixth-largest holding as of the end of the first quarter according to the 13F report. GuruFocus estimates the firm has lost 10.67% on the investment so far.

Investors should be aware that 13F filings do not give a complete picture of a firms holdings as the reports only include its positions in U.S. stocks and American depository receipts, but they can still provide valuable information. Further, the reports only reflect trades and holdings as of the most-recent portfolio filing date, which may or may not be held by the reporting firm today or even when this article was published.

Strategic alternatives

In January, Mercury Systems revealed it was exploring a potential sale of the company, among other strategic alternatives.

On June 23, it announced it had not been successful in finding a buyer, so would instead pursue growth under a refreshed leadership team.

As part of the initiative, Mark Aslett stepped down as chief executive. Bill Ballhaus, a board member, was appointed interim president and CEO until a new leader is found. Mercury also said it would bring on new independent directors and find a permanent chief financial officer.

In a statement, Chairman William OBrien said the decisions were the result of deliberate and thoughtful planning to best deliver maximum value to shareholders.

Although the process has now concluded, the board remains open to and will consider all opportunities to enhance shareholder value, he added.

Leadership changes

In the following weeks, the company announced additional changes to its leadership team.

First, on June 29, the company announced it had named David Farnsworth as its new CFO and Roger Krone as one of its new board members.

Then, on July 6, Mercury Systems said that ahead of its annual shareholder meeting, Ballhaus will also assume the role of chairman as OBrien is retiring. Board member Mary Louise Krakauer has also decided to retire.

In a statement, OBrien said, the changes reflect the natural evolution of the Mercury board to guide the companys next chapter.

Along with Gerard Jerry DeMuro, Mercury Systems also revealed it appointed Scott Ostfeld, a managing partner at Jana, as a class II director on the board. In addition to helping with the search for a new CEO, he will serve as a member of two committees.

I commend the board for the actions it has taken to set Mercury on the right path and install a refreshed board and leadership team, Ostfeld said. Jana believes Jerry DeMuro and Roger Krone are excellent additions to the board and will support both nominees at the upcoming annual meeting. I look forward to working with the Board and management to significantly improve execution and deliver tangible results for all shareholders.

Based on these changes, the board decided to reduce its size by two seats. As of the annual meeting, it will be comprised of nine directors.

Valuation

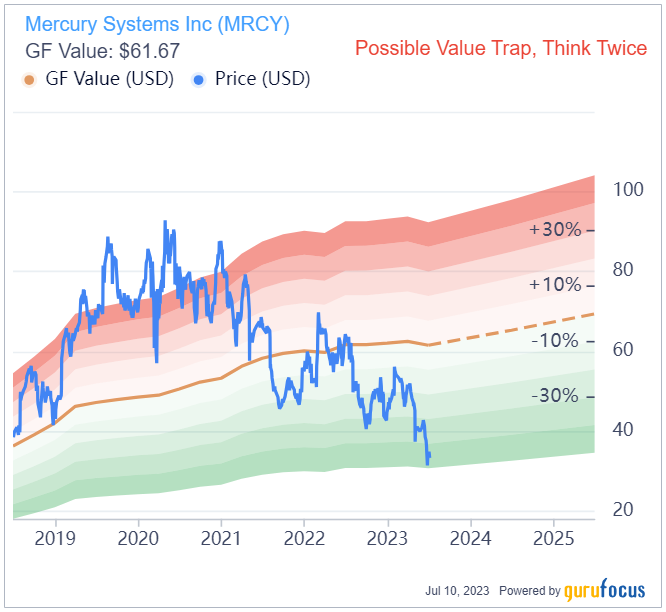

The company, which develops open architecture computer hardware and software for the aerospace and defense industry, has a $1.97 billion market cap; its shares were trading around $33.81 on Monday with a price-book ratio of 1.26 and a price-sales ratio of 1.90.

Due to its historical ratios, past performance and analysts future earnings projections, the GF Value Line suggests the stock is a possible value trap currently. As such, potential investors should do thorough research before making a decision.

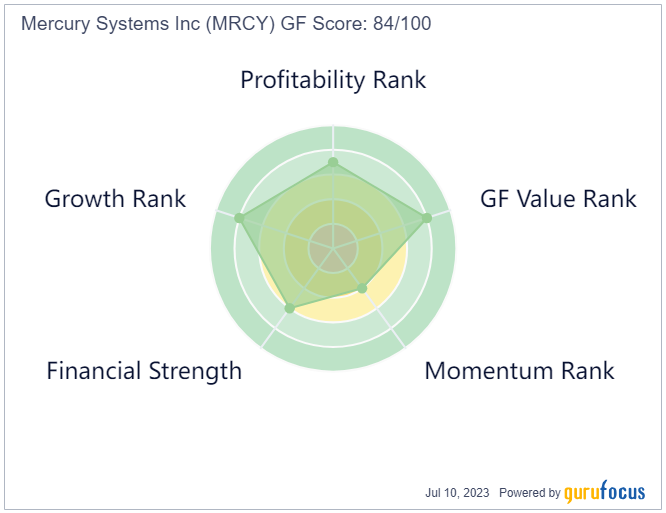

At 84 out of 100, however, the GF Score indicates the company has good outperformance potential. While it received high ratings for profitability, growth and value, the financial strength and momentum ranks are more moderate.

The company also has a predictability rank of one out of five stars. According to GuruFocus research, companies with this rank return an average of 1.1% annually over a 10-year period. It is on watch, however, due to a combination of slowing revenue per share growth, a low Piotroski F-Score of 2 out of 9 and a moderate Altman Z-Score of 2.45, among other factors.

Guru interest

Of the gurus invested in Mercury Systems, Jana has the largest stake with 8% of its outstanding shares.

As of the end of the first quarter, Ron Baron (Trades, Portfolio), Chuck Royce (Trades, Portfolio), First Eagle Investment (Trades, Portfolio) and Ken Fisher (Trades, Portfolio) also had positions in the stock.

Portfolio composition

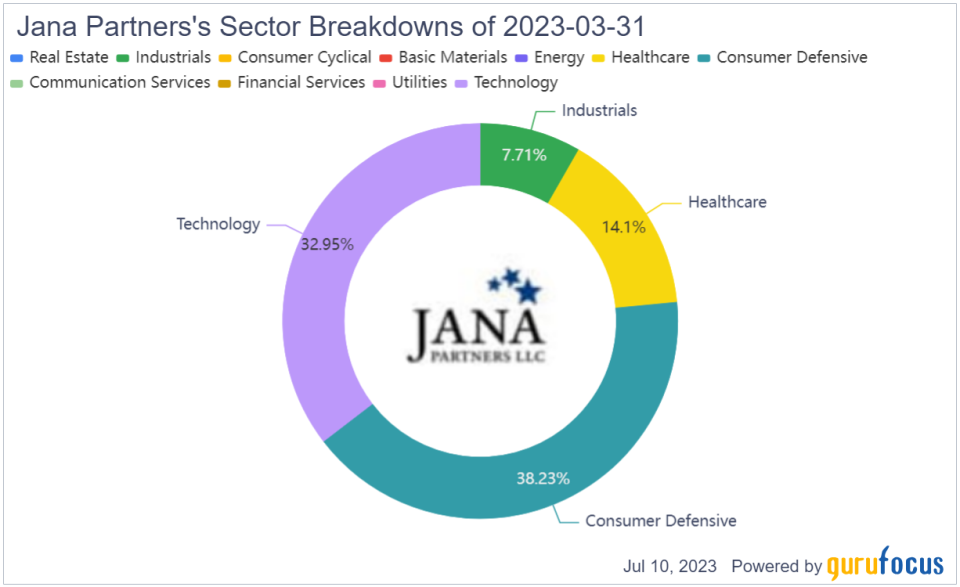

As of the three months ended March 31, 13F filings show Janas $1.32 billion equity portfolio, which consisted of nine stocks, was most heavily invested in the consumer defensive and technology sectors. Industrials stocks represented 7.71%.

This article first appeared on GuruFocus.