Jana Partners' Q2 2023 13F Filing Update: Key Trades and Portfolio Overview

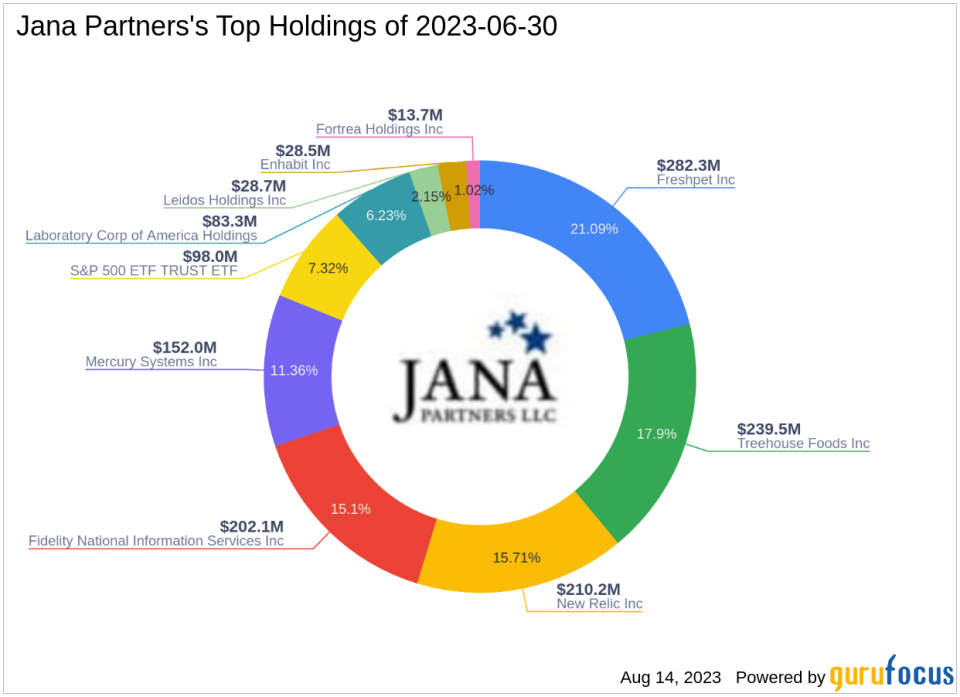

Jana Partners (Trades, Portfolio), a renowned investment firm, recently submitted their 13F report for the second quarter of 2023, which concluded on June 30, 2023. The firm's portfolio comprised of 10 stocks with a total value of $1.34 billion. The top holdings for the quarter were Freshpet Inc. (21.09%), Treehouse Foods Inc. (17.90%), and New Relic Inc. (15.71%).

Profile of Jana Partners (Trades, Portfolio)

Jana Partners is a value-oriented investment firm that focuses on event-driven investing. The firm seeks to generate compelling risk-adjusted returns by focusing on companies with value-creating opportunities and working constructively with management and boards to realize this value.

Top Three Trades of the Quarter

The following were the firm's top three trades of the quarter:

1. Treehouse Foods Inc (NYSE:THS)

Jana Partners (Trades, Portfolio) purchased 41,500 shares of Treehouse Foods Inc, bringing their total holding to 4,795,414 shares. This trade had a 0.14% impact on the equity portfolio. The stock traded for an average price of $46.11 during the quarter. As of August 14, 2023, THS had a price of $47.86 and a market cap of $2.70 billion. The stock has returned 0.42% over the past year. GuruFocus gives the company a financial strength rating of 4 out of 10 and a profitability rating of 5 out of 10. In terms of valuation, THS has a price-book ratio of 1.56, a EV-to-Ebitda ratio of 14.12, and a price-sales ratio of 0.75.

2. Freshpet Inc (NAS:FRPT)

Jana Partners (Trades, Portfolio) reduced their investment in Freshpet Inc by 669,073 shares. This trade had a 4.11% impact on the equity portfolio. The stock traded for an average price of $82.25 during the quarter. As of August 14, 2023, FRPT had a price of $79.65 and a market cap of $3.84 billion. The stock has returned 66.75% over the past year. GuruFocus gives the company a financial strength rating of 7 out of 10 and a profitability rating of 3 out of 10. In terms of valuation, FRPT has a price-book ratio of 4.09, a EV-to-Ebitda ratio of -1835.49, and a price-sales ratio of 5.71.

3. Mercury Systems Inc (NAS:MRCY)

Jana Partners (Trades, Portfolio) purchased 2,401,242 shares of Mercury Systems Inc, bringing their total holding to 4,394,641 shares. This trade had a 6.21% impact on the equity portfolio. The stock traded for an average price of $42.85 during the quarter. As of August 14, 2023, MRCY had a price of $35.12 and a market cap of $2.04 billion. The stock has returned -31.54% over the past year. GuruFocus gives the company a financial strength rating of 6 out of 10 and a profitability rating of 7 out of 10. In terms of valuation, MRCY has a price-book ratio of 1.31, a EV-to-Ebitda ratio of 23.85, and a price-sales ratio of 1.95.

In conclusion, Jana Partners (Trades, Portfolio)' Q2 2023 13F filing reveals a strategic approach to value investing, with a focus on companies that present value-creating opportunities. The firm's top trades for the quarter reflect this investment philosophy.

This article first appeared on GuruFocus.